On 4/12, the World Gold Council released its Gold Outlook 2026 report. In this report, the organization predicts that prolonged geopolitical tensions and safe-haven sentiment will continue to drive up gold demand. Consequently, global gold prices could increase by an additional 15-30% from current levels.

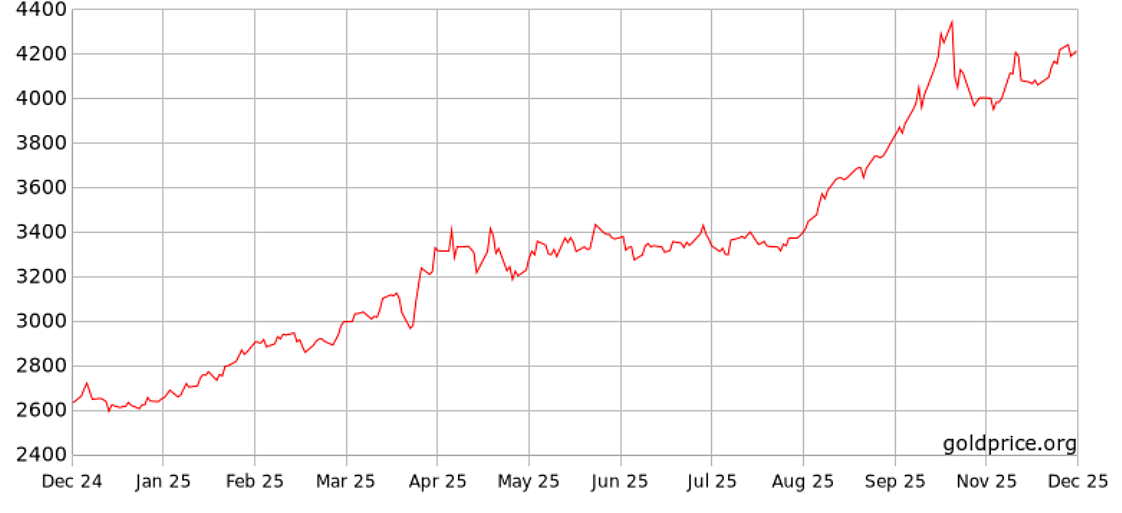

This forecast comes as the precious metal has seen an impressive gain this year, rising 60% and hitting new peaks 50 times. Key factors include US import tariffs, global geopolitical instability, and substantial purchases by central banks. In October, prices briefly set a record at 4,381 USD per ounce. Currently, gold is trading around 4,200 USD.

The WGC emphasizes that declining government bond yields, heightened geopolitical tensions, and investors' demand for safe-haven assets will create "exceptionally favorable conditions" for gold in 2026. Given this situation, the precious metal's price could continue to experience one of its strongest years of growth in history.

|

Global gold price movements over the past year. Chart: Goldprice

This year, investors have aggressively bought gold. Global markets reacted to tensions between the US and major economies, rising import tariffs, and prolonged geopolitical instability. Central banks also played a pivotal role, rapidly acquiring gold as major economies adjusted their interest rate strategies.

Investment demand through gold ETFs has also surged. WGC data shows global gold ETFs attracted 77 billion USD in investment in 2025, adding over 700 tons of gold to their portfolios. Since 5/2024, this figure has increased by an additional 850 tons. This level is only half of previous bull cycles, and according to the WGC, "there is still significant room for growth."

As risk hedging remains a priority for global investors, gold's upward momentum is likely to be further reinforced. The WGC expects gold ETFs and other investment channels to continue as the largest sources of demand in 2026. However, demand for jewelry or gold-related technology products may decline due to high prices.

While leaning towards a positive scenario, the WGC also outlines possibilities that could lead to a 5-20% decrease in gold prices next year. For example, a turning point would occur if US President Donald Trump's economic policies succeed, leading to stronger-than-forecast US growth. If inflation accelerates and the US Federal Reserve (Fed) maintains or raises interest rates next year, US government bond yields would increase, the US dollar would strengthen, and global investors would once again seek risk assets.

A shift of capital towards stocks and high-yield assets could lead to significant outflows from gold ETFs, the WGC forecasts. Much of gold's appreciation since 2022 has stemmed from geopolitical risk hedging sentiment, especially after the Russia-Ukraine conflict erupted. Therefore, de-escalating tensions would reduce gold demand.

Nevertheless, the WGC states that even if prices fall, buying activity from long-term investors and consumers could still limit a deep decline. Investors will therefore closely monitor central bank policies, geopolitical developments, and capital flows into ETFs next year.

By Ha Thu (According to WGC, Business Standard)