Military Commercial Joint Stock Bank (MB) pursues a multi-layered ecosystem development strategy to create sustainable value for customers. Originating as a bank serving the military, MB inherits values of discipline, dedication, and reliability, transforming these core principles into its operational DNA across the entire system.

This foundation enables MB to maintain depth and identity when expanding into new market segments, strengthening customer trust.

**Diversifying products and customer segments**

Over the past 30 years, the bank has developed product packages that closely align with the specific needs of each user group, addressing unique challenges.

For the armed forces, MB designed the "product combo for military personnel", a financial solution system that provides officers and soldiers with easy access to services ranging from preferential savings and overdraft loans to multi-purpose military cards and digital banking. This solution reflects a strategy of not just selling a single product, but designing a complete financial component for their entire life journey.

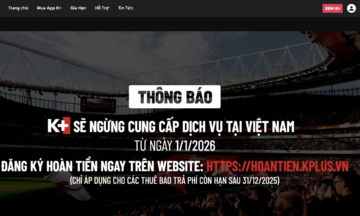

|

The product combo for military personnel, custom-designed by MB for customers in the armed forces. *Photo: MB*

Beyond its traditional customer base, MB has built an extensive financial ecosystem to meet society's diverse needs. The MBBank App currently has nearly 35 million accounts. For its priority customer group, MB offers MB Priland, a financial solution for real estate funding needs, featuring preferential loan policies and specialized consultation. This solution is one of MB's services that helps customers upgrade the quality of their family assets, a growing demand in new urban societies.

|

The MB PriLand loan package is exclusively for customers borrowing to purchase luxury and ultra-luxury real estate. *Photo: MB*

For young customers, MB developed MB Junior to help users form money management habits. The bank provides modern credit card products, integrating entertainment, shopping, and travel incentives. The multi-channel incentive system helps customers save on consumption costs and access higher-quality services without excessive financial pressure.

In the corporate sector, MB serves as a strategic financial partner for large corporations, small businesses, and household enterprises. For large enterprises, the BIZ MBBank digital platform digitizes entire processes, from capital loans to letter of credit issuance, reducing processing time by 10 times. "Shortening processing times, reducing paperwork waits, and accelerating cash flow are the key values the economy needs," an MB representative stated.

Additionally, the "Power Combo - Becoming a business is not hard" package supports household businesses in transitioning to a corporate model, offering attractive digital account incentives, free transactions, and effective sales management solutions.

The bank also provides solutions to support the transition from individual business to enterprise. In October, the bank launched the "Ease worries - Reduce burdens" package for small traders, offering flexible capital, competitive interest rates, and free payments via VietQR code. This solution helps small traders manage working capital, save costs, and manage cash flow more effectively, building resilience for the economy.

Beyond capital, the bank offers many other utility solutions such as: rain-based weather insurance, mSeller, and payment speakers, supporting household businesses in complying with Decree 70.

|

MB staff guide small traders at Hom Market in digital transformation. *Photo: MB*

These efforts have positioned MB among the top 5 largest banks in Vietnam in terms of operational efficiency and digital transformation. In 2025, the bank ranked among the top 5 banks contributing the most to the state budget for the first time, with pre-tax profit in the first 6 months reaching nearly 15,900 billion VND, an 18.3% increase year-on-year. This reflects MB's effective investment strategy, not just superficial growth.

An MB representative stated that the multi-layered ecosystem strategy is not about "embracing everything," but rather focusing investments on areas that create long-term value for the economy. "We do not see the bank as merely a capital provider; MB aims to become a part of every citizen's financial life," the bank's representative said.

**Creating sustainable value from the community**

Alongside its business activities, MB maintains many community and social welfare programs. A highlight is the Philanthropy App, launched in 2021 under the direction of the Ministry of Science and Technology, in collaboration with MB and the Vietnam Red Cross Society. This initiative opened a new direction for philanthropic activities in the digital age.

Currently, the Philanthropy App has over 2 million patriotic Vietnamese accounts ready to share with the community, alongside approximately 2,000 reputable organizations and individuals. They support large-scale fundraising campaigns such as: "65 years of Vietnam - Cuba solidarity"; the HiGreen Truong Sa Xanh campaign with the message "Millions of green milestones - A pillar of trust." This not only helps MB affirm its technological capabilities and digital vision but also contributes to realizing sustainable development goals, where technology becomes a bridge for compassion.

By designing tailored solutions for customer groups from military personnel, young people, and small traders to businesses, combined with social responsibility, MB is shaping its image as an approachable, sustainable, and comprehensive bank. This foundation helps the bank affirm its "Big 5" position, aiming to become a "digital enterprise, leading financial group."

Thai Anh