A representative from the bank said that the 2025-2030 partnership marks a deep collaboration between two leading organizations in the finance-banking and technology sectors. The agreement aims to build a modern, secure, and sustainable digital service ecosystem, thereby contributing to the national digital transformation process.

|

Representatives of the two businesses exchange the cooperation agreement. Photo: TPBank |

Representatives of the two businesses exchange the cooperation agreement. Photo: TPBank

Within the framework of this partnership, both parties aim to combine technological strengths to enhance the quality of financial and telecommunication services. TPBank will provide Viettel and its customer ecosystem with flexible, automated financial solutions designed for real-time operation. Credit, payment, account management, and digital banking services will be deployed on an open platform, enabling rapid integration and continuous expansion through open banking and embedded banking. When connected with Viettel's digital ecosystem, especially Viettel Money, these financial services can operate seamlessly, quickly, and accessibly.

Conversely, Viettel will support TPBank as a strategic technology partner, bringing core capabilities in digital infrastructure, cloud computing, big data, and artificial intelligence to jointly develop a new generation digital banking model. Both parties will refine operations based on data, automate processes, and build a technology architecture that allows for fast, secure, and scalable transaction processing. Additionally, the combination of Viettel's logistics, transportation, communication, and technology personnel expertise with TPBank's digital operating platform will create a flexible, fast, and scalable operational structure, providing an advantage for both parties in the next growth phase.

|

Representatives of the two businesses at the signing event. Photo: TPBank |

Representatives of the two businesses at the signing event. Photo: TPBank

A key highlight of the agreement is the shared vision for an open digital ecosystem, where financial services, digital utilities, and telecommunication services are uniformly connected, offering a "one-touch" experience for users. The two entities will continue to research co-branded products, expanding connections to daily life services: bill payments, e-commerce, public services, and other areas. This collaboration enhances customer experience, contributes to shaping a cashless payment environment, and promotes inclusive finance, driving new advancements in Vietnam's digital economy.

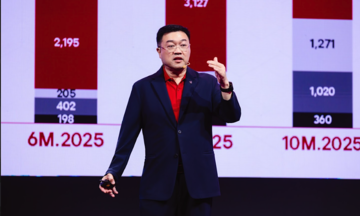

Speaking at the signing ceremony, Do Minh Phu, chairman of TPBank's board of directors, said that the cooperation agreement introduces a new strategic partnership model where the capabilities of both organizations are connected to create added value for the community. He emphasized that this collaboration establishes a link between technology and finance, and represents a convergence of shared visions for a digital future.

According to Tao Duc Thang, chairman and general director of Viettel Group, the partnership holds significant meaning as both parties share strengths, goals, and aspirations to apply technology to daily life more effectively and accessibly. The synergy between the technology-telecommunications ecosystem and the finance-banking ecosystem is expected to create differentiated solutions, delivering tangible value to customers. He emphasized that trust and transparency are the foundations for sustainable cooperative development.

With a long-term orientation, the joint venture expects this strategic partnership to further boost digital finance, broaden access to modern services, and contribute to the development of Vietnam's digital economy. Both parties have also agreed to focus resources on new product research, co-branded card development, and maintaining extensive cooperation to deliver sustainable value to customers, businesses, and society.

Hoang Dan