The investment world is entering a challenging phase marked by global economic and financial fluctuations, from interest rates and inflation to geopolitical events, analysts say. Amid this backdrop, individual investors, an increasingly important source of capital, are diverging into two distinct trends: one group actively chases short-term market gains, while the other pursues a steady strategy of regular investment for long-term wealth accumulation.

Data indicates the latter trend is gaining traction, making mutual funds an increasingly popular choice for both novice and experienced investors.

|

Dragon Capital experts discuss mutual fund investment strategies at Investor Day. Photo: Dragon Capital |

Dragon Capital experts discuss mutual fund investment strategies at Investor Day. Photo: Dragon Capital

Mutual fund growth in Vietnam

With the rapid advancement of technology, increased access to market data, and the proliferation of trading platforms, many first-time investors are drawn to short-term market plays, experts observe. They react quickly to news, ride market waves, and seek quick profits. However, this strategy requires significant time, expertise, and emotional control, which not all individual investors possess. In the past 5 years, the market has experienced at least two sharp declines of 35-45% in short periods, such as during the 2020 Covid-19 crisis and the 2022 corporate bond crisis. Many investors suffered substantial losses and failed to recover when the market rebounded, leading to significant financial and emotional distress.

In contrast, regular investing – allocating a fixed amount monthly to financial products like mutual funds – is proving more effective in the long run. This strategy helps investors navigate market volatility, steadily accumulating assets without worrying about timing the market. It also helps avoid emotional traps, allowing investors to focus on other life priorities.

According to Dragon Capital, investors who hold DCDS fund certificates for over 12 months generally outperform those who hold them for shorter periods. DCDS, a long-standing equity mutual fund in Vietnam, has significantly outperformed the VN-Index. As of 30/6, its cumulative 5-year return reached 143.61%, equivalent to an average annual compound return of 19.5%. This demonstrates the value of a long-term investment strategy, according to the firm.

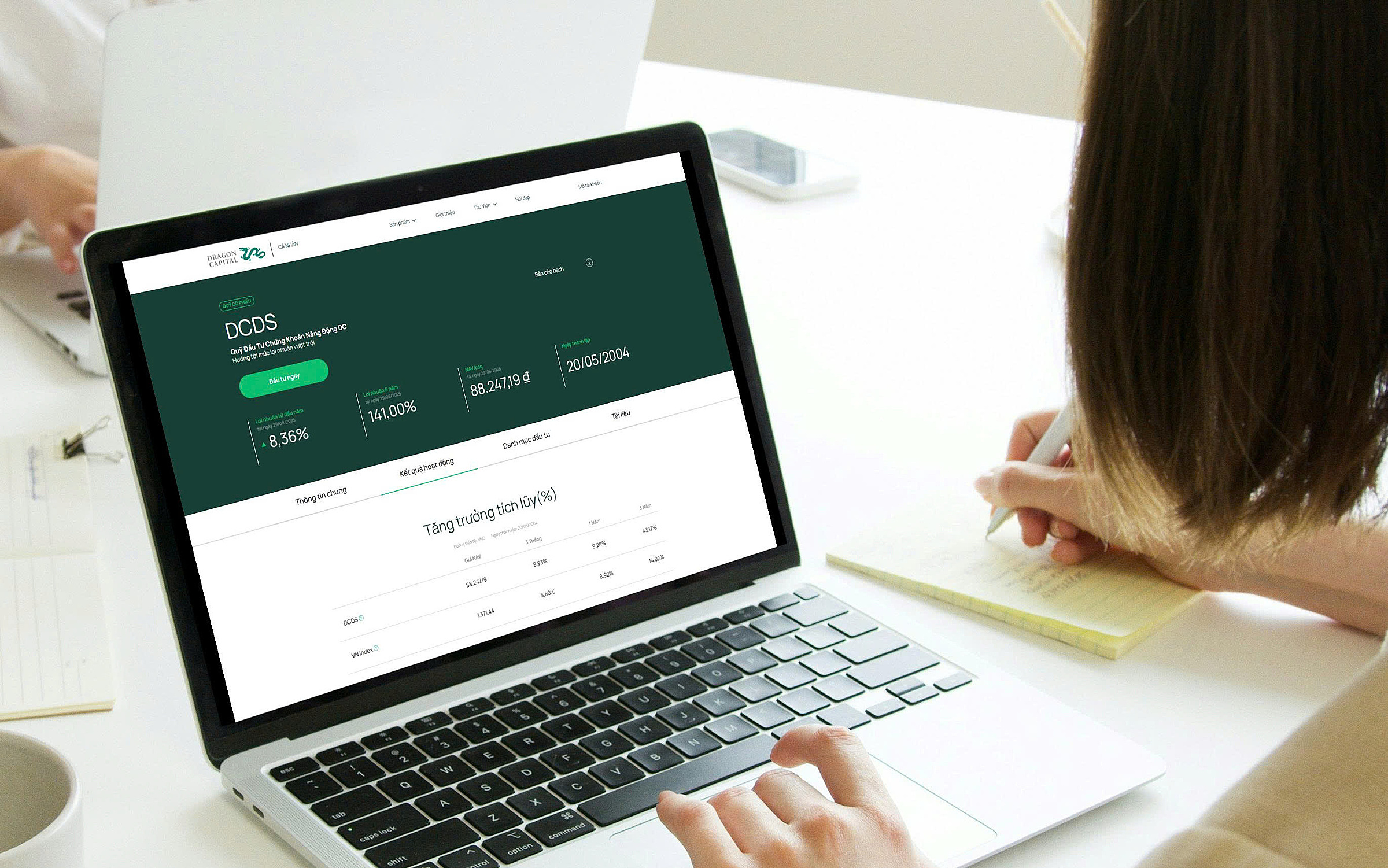

|

DCDS investment performance. Photo: Dragon Capital |

DCDS investment performance. Photo: Dragon Capital

Over the past three years, the number of individual investors participating in Dragon Capital's mutual funds has increased tenfold. Investors come from across Vietnam, with Ho Chi Minh City and Hanoi leading in registration rates. Interest in finance is also growing among younger demographics. Data from Dragon Capital's DragonX app shows that investors aged 30-45 comprise over 60% of capital market participants.

A key advantage of mutual funds is their flexible accessibility, catering to diverse investor needs and allowing for small starting investments, according to Dragon Capital. High liquidity enables investors to buy and sell fund certificates at any time. Professionally managed portfolios diversify risk at a reasonable cost, allowing investors to entrust their funds without constant market monitoring. Investors can start with small amounts, contribute regularly, and gradually build long-term wealth. This flexibility and personalization have made mutual funds an increasingly popular investment channel for both new and seasoned investors.

A long-term pillar of personal finance

Globally, mutual funds have long been an integral part of personal finance strategies. In the US, over 56% of households own mutual fund certificates, according to the latest ICI Factbook 2024. 87% of investors use mutual funds for retirement savings, and 82% believe they will help achieve their financial goals. In Europe, a 2024 BlackRock and YouGov survey indicated that over 52% of investors hold mutual funds or ETFs, with women expected to lead the trend of first-time investment. Meanwhile, in China, 76% of investors are allocating funds to equity funds, according to a 2024 FleishmanHillard survey. A 2019 study by Citi Research and the Bank of Thailand found that mutual funds accounted for the highest proportion (37%) of Thai assets allocated to investment funds, life insurance, and savings deposits.

In Vietnam, total assets under management in public funds (mutual funds and ETFs) reached over 78,000 billion VND by the end of 2024, with Dragon Capital leading the market with a 43% share, according to Dragon Capital statistics. Traditional open-ended funds (OEFs) account for nearly 70% of this, equivalent to 53,000 billion VND, with a net mobilization value of over 23,000 billion VND in 2024. Notably, domestic investors are playing an increasingly significant role, representing over 50% of total assets in public funds.

Experts believe this is an opportune time for mutual funds to flourish and become central to Vietnam's financial ecosystem. Dragon Capital is focusing on three strategic pillars: product diversification, enhancing investor experience, and promoting financial literacy. Besides maintaining long-term investment performance, the company will explore new products, such as thematic funds and asset-class specific funds, to cater to diverse risk appetites and financial goals. Client experience will remain a top priority, encompassing products, technology, services, and long-term support and knowledge sharing to empower investors on their financial journey.

|

Dragon Capital fund products. Photo: Dragon Capital |

Dragon Capital fund products. Photo: Dragon Capital

Along with product development, Dragon Capital emphasizes financial education as fundamental to the market's sustainable growth. The firm has collaborated with the State Securities Commission (SSC) to provide training for first-time investors and created podcasts on digital platforms to disseminate investment knowledge. It also hosts quarterly Investor Day events, livestreamed to connect with investors nationwide.

When citizens are financially literate and actively participate in the economy, not just as consumers but also as investors, they contribute to a robust financial ecosystem. As Vietnam enters a demographic "golden age" with a young workforce comprising 67.4% of the population and development policies paving the way for a breakthrough period, fostering an investment mindset and increasing financial understanding are core social responsibilities that Dragon Capital is committed to.

Experts predict that mutual funds will increasingly promote professional investment, enhance market stability, and contribute to sustainable economic development. Vietnam can learn from successful models in South Korea, India, and Malaysia to expand asset management scale, moving closer to its goal of becoming a high-middle-income country. For individual investors, proper capital allocation, through consistency, discipline, and a long-term perspective, always yields sustainable results. Mutual funds are the bridge enabling individual investors to achieve this.

Hoang Dan