On 20/8/2025, General Secretary To Lam, on behalf of the Politburo, signed Resolution 70 on ensuring national energy security to 2030, with a vision to 2045. The resolution calls for developing the energy market towards increased competitiveness, transparency, and efficiency, in sync with ensuring energy security. It mandates effective implementation of direct power purchase agreements and increased customer choice in accessing and selecting electricity providers that suit their needs.

This means that as the competitive electricity market matures, the retail segment – the direct supplier to end-users – will be separated. According to the 2024 Electricity Law, consumers will be able to choose their retail provider, instead of solely purchasing from EVN as is currently the case.

Many countries worldwide have already liberalized their retail electricity markets to enhance competition and offer consumers more choices.

The UK fully opened its retail electricity market in June 1999, following a gradual privatization process that began in 1990. Previously, electricity sales were handled entirely by state-owned regional companies. Now, all consumers, from households to businesses, can compare different suppliers to find the best prices and services. In 1999, the UK had only 6 suppliers; by 2019, that number had grown to over 70.

|

High-voltage power lines in London (UK) in 2017. Photo: Reuters |

High-voltage power lines in London (UK) in 2017. Photo: Reuters

Suppliers purchase electricity on the wholesale market and resell it to customers. They must pay various charges, including balancing fees to National Grid ESO (the national grid operator) to ensure grid stability. Another charge covers network usage (including the national high-voltage transmission system and regional distribution grids).

Further charges cover social and environmental programs, supporting the UK government's social and energy-saving goals.

Electricity suppliers operate under licenses granted by Ofgem (the Office of Gas and Electricity Markets). Ofgem regulates the fees suppliers pay and sets price caps on the electricity they sell.

Electricity bills in the UK typically combine a fixed daily charge with the cost of actual consumption. Companies offer various payment plans. For example, fixed-rate plans maintain a constant price per kWh for a set period (12-24 months). Variable-rate plans allow prices to fluctuate with the market but remain below Ofgem's price cap.

Ofgem reviews and adjusts the price cap every three months. The most recent adjustment, in late August, set the price cap for October-December 2025 at 26.45 pence (0.3 USD) per kWh, with a fixed daily charge of 53.68 pence.

Energy UK, which represents energy companies in the UK, describes the retail market as highly competitive. Consumers and businesses can switch suppliers based on price and service, resulting in thin profit margins, lower than many other industries. In recent years, several UK energy suppliers have operated at a loss.

In the US, discussions about the opportunities and challenges of introducing competition into retail electricity have spanned decades. However, serious consideration of restructuring the industry began in the mid-1990s, influenced by the UK's privatization experience.

A 2003 study by economist Paul Joskow of the Massachusetts Institute of Technology noted that the first retail competition programs appeared in Massachusetts, Rhode Island, and California in early 1998, spreading to about 10 other states by the end of 2000. Over 10 more states announced similar plans.

Restructuring involved separating retail electricity services from distribution and transmission, allowing customers to choose their retail provider. States also required restructuring power companies to separate competitive services (generation and retail) from monopolistic ones (distribution and transmission).

However, liberalization stalled in subsequent years due to the 2000-2001 California electricity crisis, the Enron bankruptcy, financial difficulties for many power generation and trading companies, and a decline in the number of retailers.

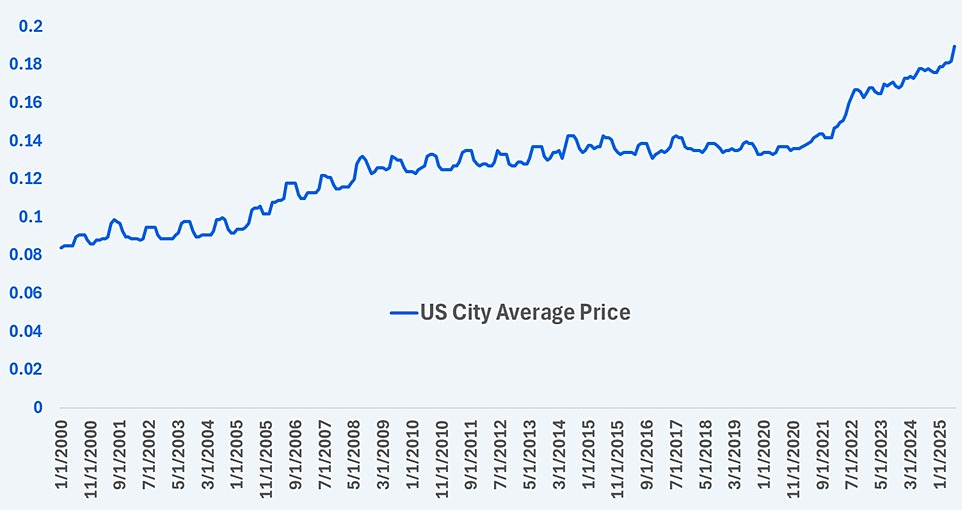

A 2018 study by Professor Alex Hill of the University of Arizona found that in the six years following restructuring, electricity prices in eight participating states decreased compared to projected prices without restructuring. This was primarily due to government-mandated price reductions or freezes. Prices rose again once these regulations ended.

|

Average electricity prices in the US from 2000 to 2025 (Unit: cents/kWh). Photo: Reuters, Fed St. Louis |

Average electricity prices in the US from 2000 to 2025 (Unit: cents/kWh). Photo: Reuters, Fed St. Louis

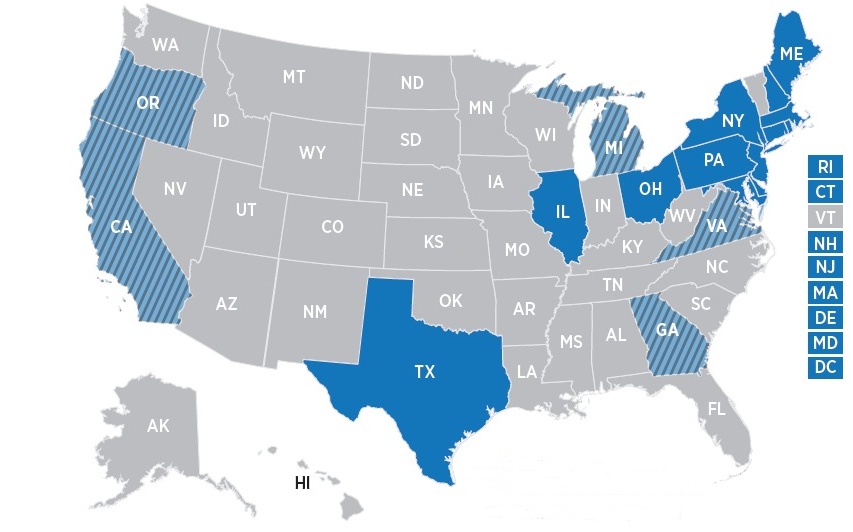

Data from the US Energy Information Administration (EIA) shows that Washington D.C. and nearly 20 states allow residents to choose their electricity provider. However, within each state, only certain areas have this option. In Texas, for instance, choice is limited to those living in areas served by transmission and distribution companies like AEP Central, AEP North, CenterPoint, Oncor, Sharyland, and Texas New Mexico Power.

Retailers utilize the infrastructure of these companies. Transmission and distribution network fees are included in each electricity bill, alongside fixed charges, actual consumption costs, taxes, and other policy surcharges.

Similar to the UK, US retail electricity companies offer various service packages. TXU Energy (Texas) offers plans ranging from 1 to 36 months, with prices from 0.13 to 0.2 USD per kWh. Consumers can choose fixed or variable rates. Electricity prices in the US vary significantly between states and throughout the year.

|

Many areas in the US have fully (green) or partially (striped green) opened their retail electricity markets. Photo: EPA |

Many areas in the US have fully (green) or partially (striped green) opened their retail electricity markets. Photo: EPA

EIA data from 2017 indicates nearly 3,000 operating electricity companies in the US: almost 2,000 municipally owned, over 800 cooperatives (non-profit), and the rest private. The private sector served 110 million customers, four times more than the other two combined. The two largest companies are both in California: Pacific Gas and Electric (serving nearly 5.5 million customers) and Southern California Edison Company (5 million customers).

Like the other countries mentioned, Australia discussed competitive electricity market policies in the 1990s but didn't open its retail market until 2008, starting with Victoria. The process was completed a year later. South Australia fully opened in 2013, New South Wales in 2015, Tasmania in 2014, and part of Queensland in 2016.

By 2018, Australia had over 30 retail electricity companies. The three largest – AGL Energy, Origin Energy, and EnergyAustralia – supplied approximately 95% of households in Queensland, 90% in New South Wales, 80% in South Australia, and 70% in Victoria. Their market share has declined with the emergence of smaller retailers. Barriers to entry in Australia's retail electricity sector are considered low.

The Australian Energy Regulator (AER) manages the retail electricity market in Queensland, New South Wales, Tasmania, South Australia, and Canberra, which have adopted the National Energy Customer Framework (NECF) to regulate electricity and gas retailing.

The AER doesn't set retail prices but establishes a Default Market Offer (DMO) – a safety net price – to protect consumers. Implemented in 2019 for both households and small businesses, the DMO is the maximum price retailers can charge and is adjusted annually.

For example, the 2025-2026 DMO for areas served by the electricity distributor Ausgrid is 1,965 Australian dollars (nearly 1,300 USD) for annual consumption of 3,900 kWh.

Costs like transmission, distribution, and environmental charges are included in the electricity bill. Ausgrid's breakdown shows that 42% of a bill covers generation, 6% transmission, 26% distribution, 19% retail services, 4% environmental costs, 2% infrastructure, and 1% the climate change fund.

In Asia, both Japan and Singapore have liberalized their retail electricity markets. Japan was the first to fully open its market in 2016.

Japan's liberalization process began in the mid-1990s. By 2000, retail sales to large factories, office buildings, and other large-scale users were opened to qualified companies. Japan gradually expanded this to smaller factories and households.

Customers can choose their electricity provider from various retailers, considering price, service, plans, and environmental friendliness. A 2017 Baker McKenzie report stated that over 400 Japanese companies had registered as electricity retailers since the market opened.

Japan's retail electricity market is overseen by the Electricity and Gas Market Surveillance Commission (EGC), under the Ministry of Economy, Trade and Industry (METI). Retail prices are market-driven, with the EGC monitoring competition.

In Singapore, the Energy Market Authority (EMA) has promoted retail electricity market liberalization since 2001. In January 2018, they launched the Open Electricity Market (OEM) pilot program. Households and businesses in Jurong could choose their electricity provider and plan. 108,000 households and 9,500 businesses participated.

By November 2018, the OEM was rolled out nationwide, primarily for households, by area. By 2019, Singapore had fully liberalized its retail electricity market. Currently, 10 retailers serve households, and 14 serve businesses.

In the initial years, Singaporean authorities surveyed customer satisfaction with retailers annually, allowing consumers to rate them on a 5-point scale. Results were published on the OEM website for easy comparison.

Singapore offers two types of electricity plans: fixed and variable. Fixed plans maintain the same price throughout the contract. Variable plans offer discounts compared to the regulated tariff, meaning prices change if the reference price is recalculated.

The current regulated tariff for Quarter III is 29.94 cents/kWh, including tax. This covers energy and non-energy costs (infrastructure, support services, system operation fees, etc.).

Ha Thu