Since her daughter's birth 10 years ago, Tiffany Tagbo has worked two jobs to make ends meet. A few months ago, her second job demanded she increase her hours to 40 per week.

Even so, the income isn't enough, and she's started training for a third, part-time position. "I'm working over 80 hours a week to support my family during these tough times," said Tagbo, 41, of Oklahoma City.

Tagbo's suicide prevention hotline work for autistic children earns her 800 USD per month, but half goes towards health insurance. At the grocery store, even small purchases require careful consideration, like choosing between eggs and her daughter's favorite cheese sticks.

|

Consumers shop for groceries at a supermarket in Los Angeles, California. Photo: AP |

Consumers shop for groceries at a supermarket in Los Angeles, California. Photo: AP

She acknowledges that in some respects, the daily cost of living isn't as alarming as it was a couple of years ago. The annual increase in consumer prices was 2.9% in August, significantly lower than the 9% peak in 6/2022. But despite cooling inflation, many essential expenses are still rising faster than the average.

The Census Bureau reported last week that rent in the US increased by 3.8%, the highest since 2011. Roughly half of renters spend over 30% of their income on housing, exceeding the recommended threshold.

"When you're living paycheck to paycheck, it doesn't feel much better even if inflation is down," Tagbo said.

Adriana Barradas used to spend around 40 USD a month on diapers. Now, the cheapest pack she can find at Costco costs more than that and doesn't last the entire month. "Having a baby these days is really expensive," Barradas said.

She was also shocked by the gas prices since moving to Los Angeles in May. Her most recent bill was 800 USD, compared to her previous average of under 250 USD. Her family is also behind on rent.

|

Costco store in Nashville, Tennessee, USA. Photo: AP |

Costco store in Nashville, Tennessee, USA. Photo: AP

After losing her job at a clothing store in Los Angeles, Maria Madera, 38, has become particularly sensitive to food prices.

"Chicken used to be so cheap, now it's nearly 20 USD just to get enough for my husband and two kids," Madera said. She recently visited a food bank for the first time in her life.

"I felt so guilty, like, what am I doing? So ashamed. But then I saw so many other people just like me. When everything is so expensive, you see them at the food bank," she shared.

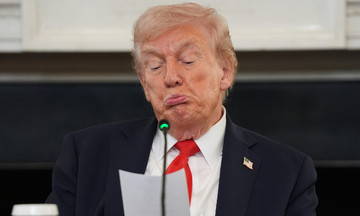

Economists believe that concerns about prices, which contributed to Donald Trump's return to the White House, haven't subsided in recent months, despite inflation being much lower than during Joe Biden's term.

Prices surged in 2022 and 2023, and haven't come down even with decreasing inflation. This price level is now coupled with new increases in sectors like energy.

Experts say the financial burden primarily lies in monthly household bills like utilities, health insurance, and rent or mortgage payments, not infrequent purchases like furniture or clothing.

|

Consumers shop for groceries at a supermarket in California, 13/2. Photo: AP |

Consumers shop for groceries at a supermarket in California, 13/2. Photo: AP

Health insurance costs next year are projected to increase by at least 9% for employer-sponsored plans and over 75% for those purchased through the federal marketplace, according to the Kaiser Family Foundation (KFF), a nonpartisan health policy research organization.

David Kass, a finance professor at the University of Maryland, noted that healthcare costs have generally outpaced inflation for years, citing reasons such as the aging US population and increased utilization of covered services.

According to the US Bureau of Labor Statistics, the number of workers unemployed for six months or longer has doubled since the beginning of 2023. "This shows the dire situation of those who have lost their jobs," warned Josh Bivens, chief economist at the Economic Policy Institute.

"In recent years, most workers' incomes have kept pace with inflation. The post-pandemic period has seen many shocks, but the strong labor market has provided support. Now, there's a risk of inflation rising again, and the labor market is no longer as robust," he explained.

Duc Trung (According to Washington Post, WSJ, AP)