In a social media post last weekend, former US President Donald Trump said he would be "ready" to impose tougher sanctions on Russia if all NATO members stopped buying oil from Moscow. He added that these countries should also impose 50% to 100% tariffs on Chinese goods until the conflict in Ukraine ends.

Earlier, during a visit to Brussels, US Energy Secretary Chris Wright urged the European Union (EU) to reduce its dependence on Russian energy. For most EU countries, halting Russian oil purchases isn't overly challenging. Oil imports from Russia to the EU have fallen sharply since the Ukraine conflict began.

In 2021, the EU imported 45% of its natural gas and 27% of its crude oil from Russia. Last year, these figures dropped to 19% and 3% respectively. In 2024, the EU spent 21.9 billion euros (nearly 26 billion USD) on Russian fossil fuels, accounting for about 10% of Moscow's total global energy export revenue.

|

An oil tanker anchors at the port of Kozmino, near Nakhodka, Russia, 12/2022. Photo: Reuters |

An oil tanker anchors at the port of Kozmino, near Nakhodka, Russia, 12/2022. Photo: Reuters

However, Hungary and Slovakia's insistence on their need for Russian oil has complicated Europe's efforts to completely abandon energy from Moscow. These two EU countries were granted temporary exemptions, allowing them to continue importing Russian oil and gas via the Druzhba pipeline that runs through Ukraine.

The exemptions were intended to give Hungary and Slovakia more time to find alternative suppliers. However, observers note that both countries have used this opportunity to increase their purchases of Russian oil and gas at discounted prices, deepening their dependence on imports from Moscow.

"Hungary has increased its dependence on Russian crude oil from 61% before the conflict to 86% in 2024, while Slovakia is almost 100% reliant on supplies from Moscow," according to a report by the Centre for Research on Energy and Clean Air (CREA) in Finland.

A spokesperson for the Slovakian Ministry of Foreign Affairs stated that completely cutting off Russian energy would lead to "very serious consequences" for the country's economy and for Europe as a whole. "Therefore, we firmly oppose the proposal," the spokesperson said.

Three anonymous European officials believe Trump's new demand will give the European Commission more leverage to push Hungary and Slovakia to act. EU Energy Commissioner Dan Jorgensen is expected to negotiate with the two countries on this issue in the coming weeks.

But if the demand to stop buying Russian oil and gas is extended to the entire NATO bloc, as Trump suggests, the obstacle will not just be Hungary and Slovakia. Turkey, a key NATO member strategically located to control access to the Black Sea, has refused to participate in sanctions against Russia. Instead, Ankara has re-exported billions of USD worth of Russian oil to Europe and elsewhere.

Former Turkish diplomat Sinan Ulgen, a senior fellow at the Carnegie Europe think tank, said it is "highly unlikely that Ankara will comply with the request at this time."

Analysts believe it would take significant pressure from Trump to persuade Turkish President Recep Tayyip Erdogan to change course. Turkey is currently facing a domestic cost-of-living crisis, and high energy prices could fuel public discontent, threatening Erdogan's power.

Last year, Turkey received 41% of its gas from Russia, according to senior energy analyst Aura Sabadus of the consulting firm ICIS. Meanwhile, Homayoun Falakshahi, lead crude oil analyst at Kpler, noted that Ankara also imported 57% of its oil from Moscow last year.

This makes observers believe that NATO is unlikely to reach a consensus on ending Russian energy imports.

The Trump administration has described increasing US liquefied natural gas (LNG) exports to Europe as a "mutually beneficial" opportunity. "We want to completely replace Russian gas. The more we undermine Russia's ability to finance the war, the better off we all are," Wright said during his visit to Brussels.

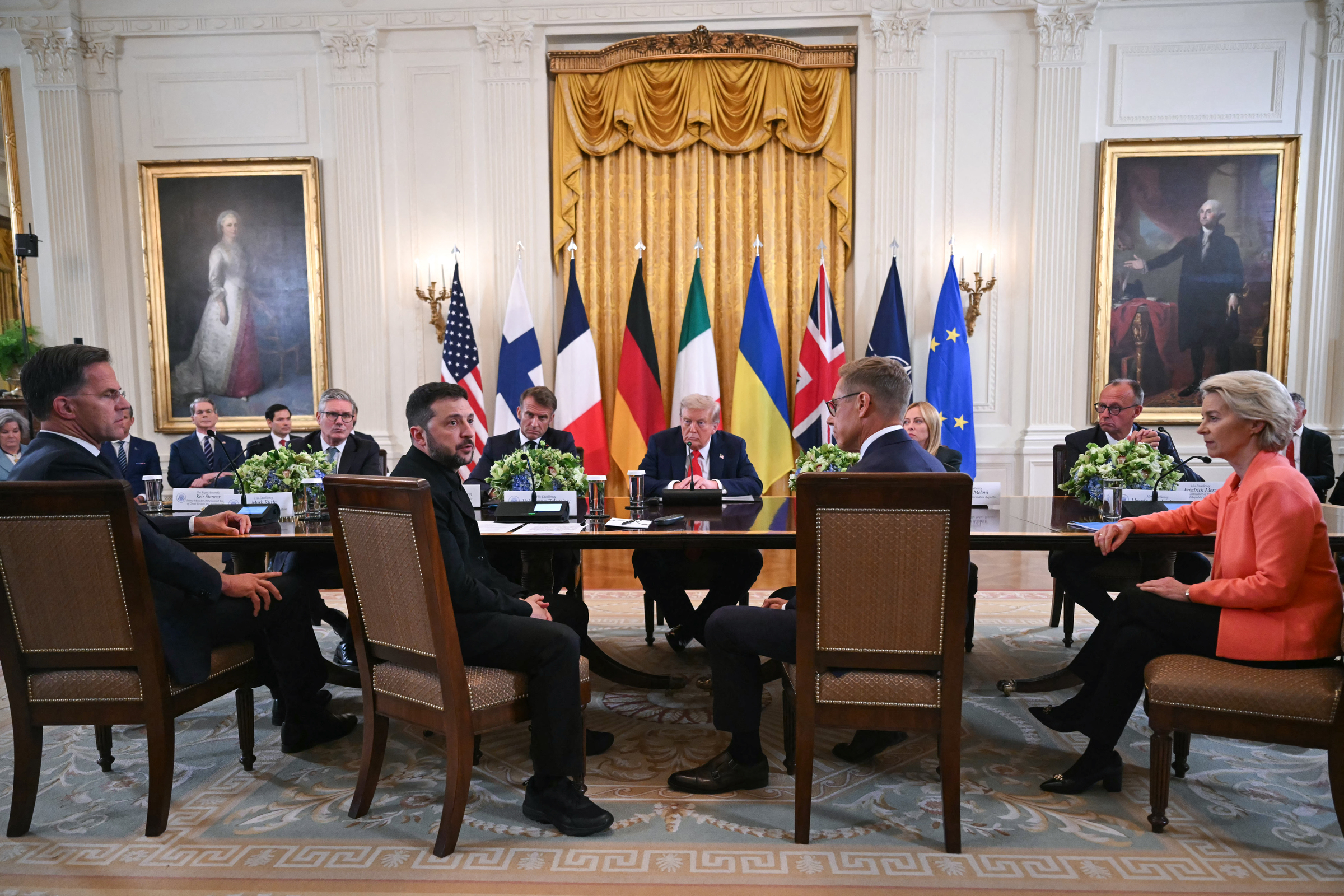

|

US President Donald Trump meets with Ukrainian President Volodymyr Zelensky, European leaders, and the NATO Secretary General at the White House on 18/8. Photo: AFP |

US President Donald Trump meets with Ukrainian President Volodymyr Zelensky, European leaders, and the NATO Secretary General at the White House on 18/8. Photo: AFP

In July, the US used tariff negotiations to demand that the EU commit to buying 750 billion USD worth of oil and gas from Washington before the end of Trump's term. However, analysts point out that this demand is nearly impossible to fulfill.

Laura Page, a senior analyst at Kpler, said the EU spent over 444 billion USD on energy imports last year, of which only about 90 billion USD came from the US. To meet the new demand, the bloc would have to triple its imports from the US in the next three years. This would mean rejecting other suppliers like Norway, which provides cheaper gas through existing pipelines.

Page further noted that in 2024, the US only exported 166 billion USD worth of oil and gas, meaning that under the new demand, they would need to divert all of their exports to Europe and still need to make up the difference. "That will never happen," she said.

Regarding the demand for tariffs on China, experts also consider this impossible, as both politically and economically, imposing tariffs on Beijing would be a critical blow to the EU.

Over the decades, the EU economy has become increasingly intertwined with China, as its consumers have grown accustomed to cheap imported goods from the country. While the bloc has pledged to reduce its dependence, key sectors of the economy, from auto manufacturing to wine and fashion, would find it difficult to sever ties with China.

China is the EU's third-largest trading partner, after the US and the UK, for both goods and services combined. The country accounts for about 21% of the EU's imports. In addition, Beijing has signaled that it would not hesitate to strongly retaliate against any "provocative" actions from the bloc.

"High tariffs on China would cause great damage. We've seen that from the US, they had to withdraw this move," said David Henig, an analyst at the European Centre for International Political Economy.

Thanh Tam (According to Politico, AFP)