President Donald Trump's Omnibus Budget Bill of 2025 (OBBBA), also known as the "big beautiful bill," passed the US House of Representatives on 3/7 after 29 hours of debate and negotiation. The bill, approved by a narrow margin of 218 to 214 votes, marks Trump's first major legislative achievement of his second term.

Trump has promised this will be one of the most successful laws in American history, establishing the budgetary foundation for his campaign promises. These include extending tax cuts, increasing defense spending, tightening border security, boosting efforts to deport undocumented immigrants, and cutting certain social and healthcare benefits.

Experts predict the OBBBA will boost the US economy and benefit some industries and workers, while others may face disadvantages.

|

US President Donald Trump waves to supporters at a rally in Des Moines, Iowa, on 3/7. Photo: AP |

US President Donald Trump waves to supporters at a rally in Des Moines, Iowa, on 3/7. Photo: AP

Large business groups, including the US Chamber of Commerce and the Business Roundtable, applauded the Senate's passage of the bill on 1/7. They are also expected to be the primary beneficiaries of the OBBBA's tax cuts.

American corporations and businesses have already benefited from the 2017 Tax Cuts and Jobs Act (TCJA), which allowed them to fully deduct equipment expenses in the first year of purchase. These benefits have been phasing out since 2023 and were set to expire this year. The "big beautiful bill" makes these corporate tax breaks permanent.

The bill also allows businesses to deduct research and development expenses in the year they are incurred. Starting in 2022, the TCJA required companies to amortize these expenses over five years.

US manufacturers are particularly pleased with the bill's provision for immediate and full deduction of new factory construction costs. This provision is retroactive to facilities that began construction after 19/1/2025 and will continue to apply to projects started before 1/1/2029.

To encourage domestic chip production, the bill increases tax credits for semiconductor companies building US-based facilities.

Small businesses are another group that will benefit. The National Federation of Independent Business (NFIB), the leading small business lobby, praised the bill for permanently extending a special deduction for owners of certain pass-through entities.

These are businesses where profits and losses are passed directly to owners or investors and taxed at the individual level, rather than the corporate level.

This deduction, applicable to small businesses and partnerships of lawyers, doctors, and investors, increased from 20% to 23% in the House version of the bill.

High-income Americans also benefit from the bill's tax deduction provisions. The Penn Wharton Budget Model estimates that the top 20% of earners will see their net income increase by nearly 13,000 USD annually after taxes and transfers, a 3% average increase for these households.

The top 0.1% of earners will see an average annual income increase of over 290,000 USD.

Residents of high-tax states will also benefit from an increased deduction limit for state and local taxes to 40,000 USD annually for five years, applicable to households with incomes up to 500,000 USD.

However, a new Senate provision denies unemployment benefits to millionaires who lose their jobs.

Some workers will receive additional tax deductions through 2028.

Tipped service workers are another beneficiary group. In the US, these workers typically receive tips equivalent to 10-20% of the bill. The new bill allows them to deduct up to 25,000 USD in tip income from federal income tax. Overtime workers can deduct up to 12,500 USD in overtime earnings.

Many low-income individuals will be negatively impacted by significant cuts to social safety net programs, particularly Medicaid and the Supplemental Nutrition Assistance Program (SNAP).

For the first time in its 60-year history, Medicaid will have work requirements. Recipients must participate in work, training, or community service for a specified time to maintain their healthcare coverage.

Work requirements will also apply to SNAP, commonly known as food stamps. Parents with children aged 14 and older are among those who will have to work, volunteer, study, or participate in job training to maintain benefits.

Millions of low-income Americans risk losing benefits due to these work requirements and other changes to Medicaid and SNAP under the OBBBA.

The Congressional Budget Office (CBO) reports that few people cut from Medicaid will have access to employer-sponsored health insurance.

A Wharton School study shows that the lowest earners, those making under 18,000 USD annually, will see a 165 USD decrease in income after taxes and transfers due to social safety net cuts, a 1.1% decrease.

Those earning between 18,000 and 53,000 USD annually will see a 30 USD increase, or 0.1%.

Middle-income households earning between 53,000 and 96,000 USD will see a 1,430 USD increase, or 1.8%.

|

Changes to each US household income group under the "big beautiful bill." Graphic: Economist |

Changes to each US household income group under the "big beautiful bill." Graphic: Economist

The bill's healthcare provisions will not only affect low-income individuals. The Senate is also tightening verification requirements for federal insurance subsidies under the Affordable Care Act (ACA), potentially causing some middle-income Americans to lose coverage.

Overall, the bill could leave over 10 million Americans uninsured by 2034.

Hospitals are also unhappy with the healthcare provisions, which reduce state government support for Medicaid patients and increase uncompensated care costs for treating uninsured patients.

"The real-world consequences of cutting nearly one trillion USD from Medicaid, the largest ever proposed by Congress, would inflict irreparable harm on the health care system, diminishing access to care for all Americans and severely weakening hospitals' and health systems' ability to care for our most vulnerable patients," said Rick Pollack, CEO of the American Hospital Association.

The association expressed "extreme disappointment" with the bill, despite its 50 billion USD fund to help rural hospitals cope with Medicaid cuts. Many hospitals say this is insufficient.

The clean energy and electric vehicle sectors are also affected. The Senate removed a last-minute excise tax on wind and solar energy that experts warned would be a "blow" to the clean energy industry.

However, the Senate bill also eliminates tax incentives for wind, solar, and other renewable energy projects from 2027, while imposing stricter requirements for developers to qualify for incentives.

The American Clean Power Association criticized the bill as a "step backward for US energy policy," claiming it will lead to job losses in the clean energy sector and higher electricity bills.

Electric vehicle manufacturers could also be negatively impacted, as the bill ends the up-to-7,500 USD electric vehicle tax credit from September. These incentives were previously scheduled to run through 2032, providing a strong incentive for electric vehicle purchases in the US.

The elimination of these tax credits is one reason Tesla CEO Elon Musk strongly opposes the "big beautiful bill."

|

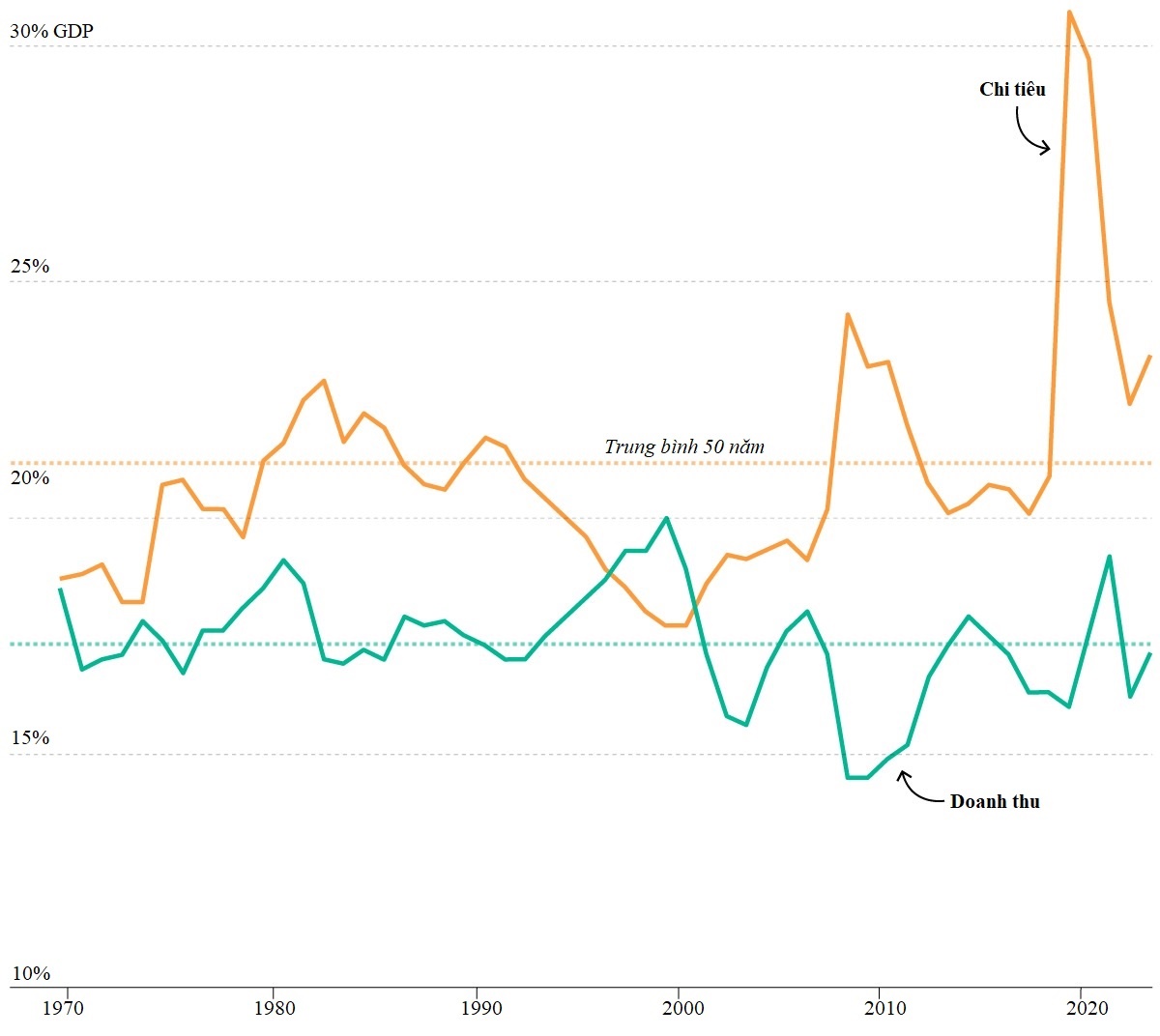

US federal revenue vs. spending. Data: The White House |

US federal revenue vs. spending. Data: The White House

The CBO projects that the OBBBA could increase the US budget deficit by about 3.4 trillion USD over the next decade.

Adding trillions of USD to the national debt could push already-high interest rates even higher, making it more expensive for Americans to borrow for cars and homes, and for businesses to invest.

Higher interest rates will also force the federal government to spend more on servicing its debt. The CBO expects federal interest costs to exceed one trillion USD annually. US interest costs have more than tripled since 2017, surpassing the defense budget.

Despite these concerns, Trump hailed the bill as an "extraordinary victory" for America, citing its tax cuts and increased border security spending. He signed it into law at 5 PM on 4/7 (4 AM on 5/7 Hanoi time), on US Independence Day.

"There is no better birthday present for America than the extraordinary victory we just achieved with Congress passing the big beautiful bill to Make America Great Again," he declared at a rally in Iowa. "All of the big promises I made to the people of Iowa in 2024 have come true."

Vu Hoang (CNN, AFP, Reuters)