Former President Donald Trump on 20/8 publicly called for Federal Reserve Governor Lisa Cook's resignation after Federal Housing Finance Agency (FHFA) Director Bill Pulte urged the Justice Department to investigate her for alleged mortgage fraud.

|

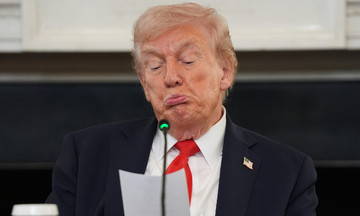

Lisa Cook at a Senate confirmation hearing in Washington in 2022. Photo: Reuters |

Lisa Cook at a Senate confirmation hearing in Washington in 2022. Photo: Reuters

In a social media post, Pulte said Cook took out a mortgage in 2021 on a home in Ann Arbor, Michigan, claiming it as her primary residence. Two weeks later, she secured another mortgage for a condo in Atlanta, Georgia, also claiming it as her primary residence.

In response, Cook stated she would not resign based on "questions raised on social media."

The Justice Department is investigating similar allegations against two Democratic lawmakers: New York Attorney General Letitia James and California Senator Adam Schiff, both outspoken critics of Trump.

A spokesperson for the Fed's Board of Governors declined to comment. An attorney for Schiff described the accusations as "patently false," while a spokesperson for James called them evidence of the "weaponization of the justice system."

The allegations revolve around "primary residence mortgage fraud," where borrowers falsely claim a property as their primary residence to obtain favorable loan terms typically reserved for owner-occupied homes.

Banks generally offer better terms for primary residence mortgages, including lower down payments and interest rates, compared to second homes or investment properties.

For instance, down payments for primary residences are often 3-5% of the property value, while second homes require 10-20%, and investment properties at least 20%.

Mortgage rates for second homes are typically 0.25% to 0.50% higher than primary residences, according to Garth Graham, senior partner at mortgage consultancy Stratmor Group. Rates for investment properties are usually 0.50% to 0.75% higher. In some cases, misrepresentation can also lead to lower property tax bills.

The average rate for a standard 30-year fixed mortgage recently hovered around 6.58%.

Graham noted that banks used to verify proximity between the property and the borrower's workplace to assess residency. However, the rise of remote work has rendered this method less effective.

Not everyone with multiple primary residence mortgages intends to defraud the system. Some may initially plan to live in a property but end up renting it due to unforeseen circumstances like job changes.

When banks detect potential mortgage fraud, they file Suspicious Activity Reports with the FBI and notify mortgage guarantors like Fannie Mae, Freddie Mac, or the Department of Veterans Affairs.

"There are clear consequences for mortgage fraud," said Ryan Dibble, co-founder and CFO of wholesale mortgage lender Flyhomes.

Mortgage attorneys emphasize that lying on a loan application is a serious offense. Convictions can result in up to 30 years in prison and fines of up to one million USD. Lenders can demand immediate repayment of the entire mortgage balance if they discover falsified information.

In 2024, the FBI received around 3,600 reports of potential mortgage fraud from lenders. Around 1,900 cases have been recorded so far this year. Subsequent investigations are conducted by relevant agencies. Dibble added that state regulatory agencies, along with the FBI and the Justice Department, are involved in investigating and prosecuting fraud.

However, based on recent data, very few individuals are convicted or fined for mortgage fraud. The number of violations has also declined significantly. In 2024, only 38 people were convicted of mortgage fraud, according to data from US officials, with an average prison sentence of 18 months.

The rate of borrowers misrepresenting their occupancy status peaked at 6.8% during the 2006 housing bubble and later fell to 2-3% in the post-bubble period, according to a 2023 report by the Federal Reserve Bank of Philadelphia.

Pulte alleged, based on "online records," that Cook rented out her Atlanta condo in 2022 without reporting the rental income on her financial disclosures that year.

In recently released financial disclosures, Cook listed three mortgages from 2021, with interest rates ranging from 2.5% to 3.25%. She also reported rental income from her Ann Arbor home in 2024 and 2025.

"I will address any questions about my financial history seriously, as a Fed member. I am gathering all accurate information to answer any questions truthfully," Cook stated.

Vu Hoang (WSJ, Market Watch, AP)