On 22/12, Phu Quy Gold Investment Joint Stock Company listed silver bullion at 2,98 - 3,07 million VND per tael, marking an increase of about 6% compared to yesterday. Sacombank - SBJ traded this commodity around 2,82 - 2,89 million VND per tael.

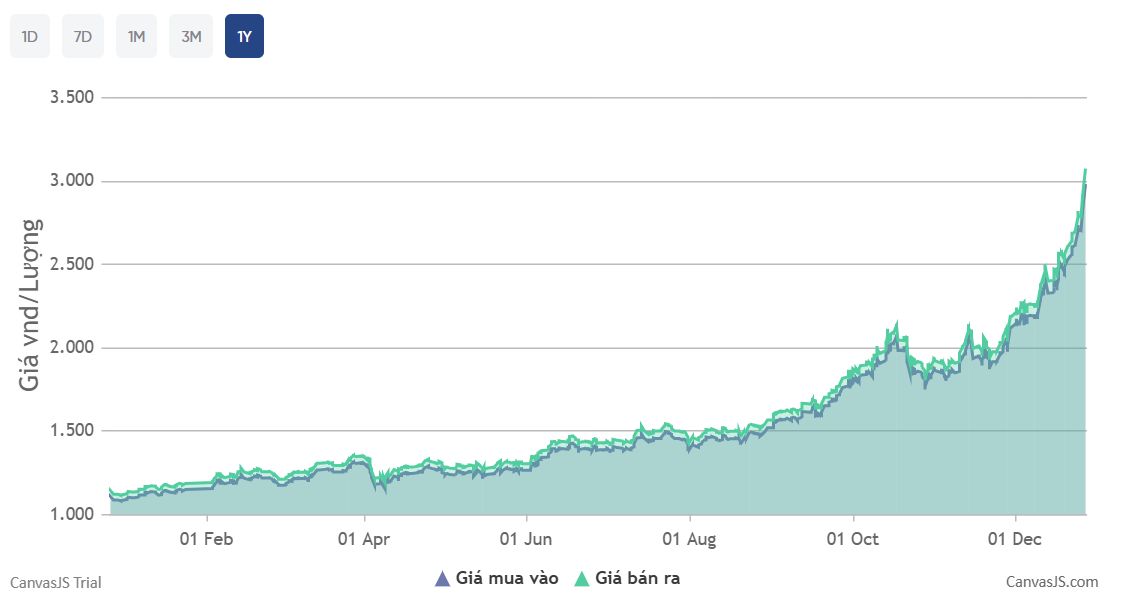

Since the beginning of the year, silver bullion prices have risen by approximately 169%. Converted to kilograms, this metal is currently traded at 79,5 - 81,9 million VND.

Domestic silver bullion prices are following international trends. At the close of trading on 26/12, the global price of this metal reached 77,4 USD for the first time. This development pushed the year-to-date increase to 167%, primarily due to supply shortages, robust investment demand, and silver being considered an essential metal by My.

|

Domestic silver price movements over the past year. *Photo: Phu Quy*

Domestic gold prices also rose today. Saigon Jewelry Company (SJC) listed gold bullion at 157,7 - 159,7 million VND per tael, an increase of 500,000 VND compared to yesterday. PNJ, Doji, and Bao Tin Minh Chau similarly raised their prices for this precious metal.

For plain gold rings, SJC also increased prices by 300,000 VND compared to yesterday, reaching 153,1 - 156,1 million VND per tael. PNJ and Doji traded this item 1,9 million VND higher than SJC. Bao Tin Minh Chau listed the highest prices for gold rings among brands, at 156,7 - 159,7 million VND per tael.

Domestic gold prices are positively trending with international rates. At the close of trading on 26/12, global spot gold prices increased by 54 USD to 4,533 USD per ounce. Converted using Vietcombank's exchange rate, global gold is equivalent to 144,2 million VND per tael, a difference of 15 million VND compared to domestic prices.

This precious metal is experiencing its strongest year of price growth since 1979. The primary reasons include the Fed's policy easing, increased reserve purchases by central banks, higher investment from ETFs, and the global de-dollarization trend.