HAGL Chairman Doan Nguyen Duc announced the decision to launch an initial public offering (IPO) for HAGL International Investment Joint Stock Company at a conference on the afternoon of 25/11. This move comes after the company achieved operational efficiency and completed its financial restructuring.

HAGL International Investment, formerly Hung Thang Loi, manages a significant agricultural land portfolio in Laos. Bananas currently generate the company's primary cash flow, with durian and coffee now entering their growth phases.

The company targets a minimum 30% annual profit growth following the IPO. It reports a charter capital of 1,685 billion dong, owner's equity of 3,701 billion dong, and total assets exceeding 14,000 billion dong. Profits are projected to reach 2,700 billion dong in 2027.

Duc noted the company possesses clean land, mature orchards in their production cycle, and complete infrastructure, presenting an attractive valuation potential. While he refrains from predicting the exact stock price, he expresses confidence in the real value of their assets and cash flow, stating that the market will ultimately determine the final valuation.

|

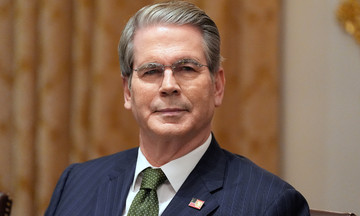

Doan Nguyen Duc, Chairman of Hoang Anh Gia Lai, addresses shareholders in Ho Chi Minh City on the afternoon of 25/11. *Photo: HAG* |

The IPO announcement coincides with over a month of severe storms and floods that have impacted Vietnam's Central and Central Highlands regions. This timing has prompted investor questions regarding the resilience of large-scale agricultural models to natural disasters. Concerns have been raised about potential damage to HAGL's banana, durian, and coffee crops due to escalating extreme weather.

Duc affirmed that the company has implemented a robust risk mitigation system. Its growing regions in Vietnam are on the western plateau of the Truong Son range, where higher elevation naturally reduces flood risk. In Laos, an area less prone to direct storm impact, farms are strategically located at altitudes of 1,200 to 1,500 meters. These farms also utilize water-saving irrigation systems to sustain production during extended droughts. Investor delegations who surveyed the sites after recent floods confirmed that HAGL's operations sustained no significant damage.

According to Duc, the primary challenge in agriculture lies not with the weather but with market access. Without market control, investments in seeds, technology, and infrastructure can become ineffective. Drawing on years of experience, the company has scaled up operations to attract customers proactively. HAGL also lists its banana products on Chinese auction platforms, ensuring price transparency and stable consumption. For silk, the company benefits from commodity trading in Shanghai. Both bananas and durian maintain stable market access through substantial production volumes and expanded cold storage facilities.

Despite these efforts, he acknowledges that current production volumes remain low and the company has not yet significantly expanded its distribution channels. China continues to be their primary market focus.

During the event, HAGL also unveiled its plans for this year, projecting revenues of nearly 7,700 billion dong and profits nearing 2,800 billion dong. These figures significantly surpass the targets initially set at the beginning of the year. BIDV Securities Company evaluates Hoang Anh Gia Lai's banana production as stable, anticipating that durian, pigs, and silk will drive growth from 2026 onwards. Coffee is expected to become a substantial contributor to the company over the next three to four years.

Thi Ha