VPBank reached a new milestone at the end of Quarter II, with consolidated total assets reaching 1.1 quadrillion VND and individual bank assets reaching 1.05 quadrillion VND, an increase of 20% and 21% respectively compared to the beginning of the year. The bank's total asset target for the year of 1.13 quadrillion VND was almost achieved in just half a year.

|

Customers transact at VPBank headquarters. Photo: VPBank |

Customers transact at VPBank headquarters. Photo: VPBank

This increase demonstrates VPBank's internal strength and breakthrough strategy, accumulated over 32 years of development. In particular, since 2010, the bank has transitioned to a modern retail model, embarking on a journey of rapid growth for nearly 15 years.

Specifically, VPBank marked many milestones: establishing FE Credit in 2014; listing on HoSE in 2017; selling 49% of FE Credit's charter capital to SMBC Consumer Finance in 2021; selling 15% of VPBank's charter capital to strategic shareholder SMBC in 2023; and taking over GPBank earlier this year.

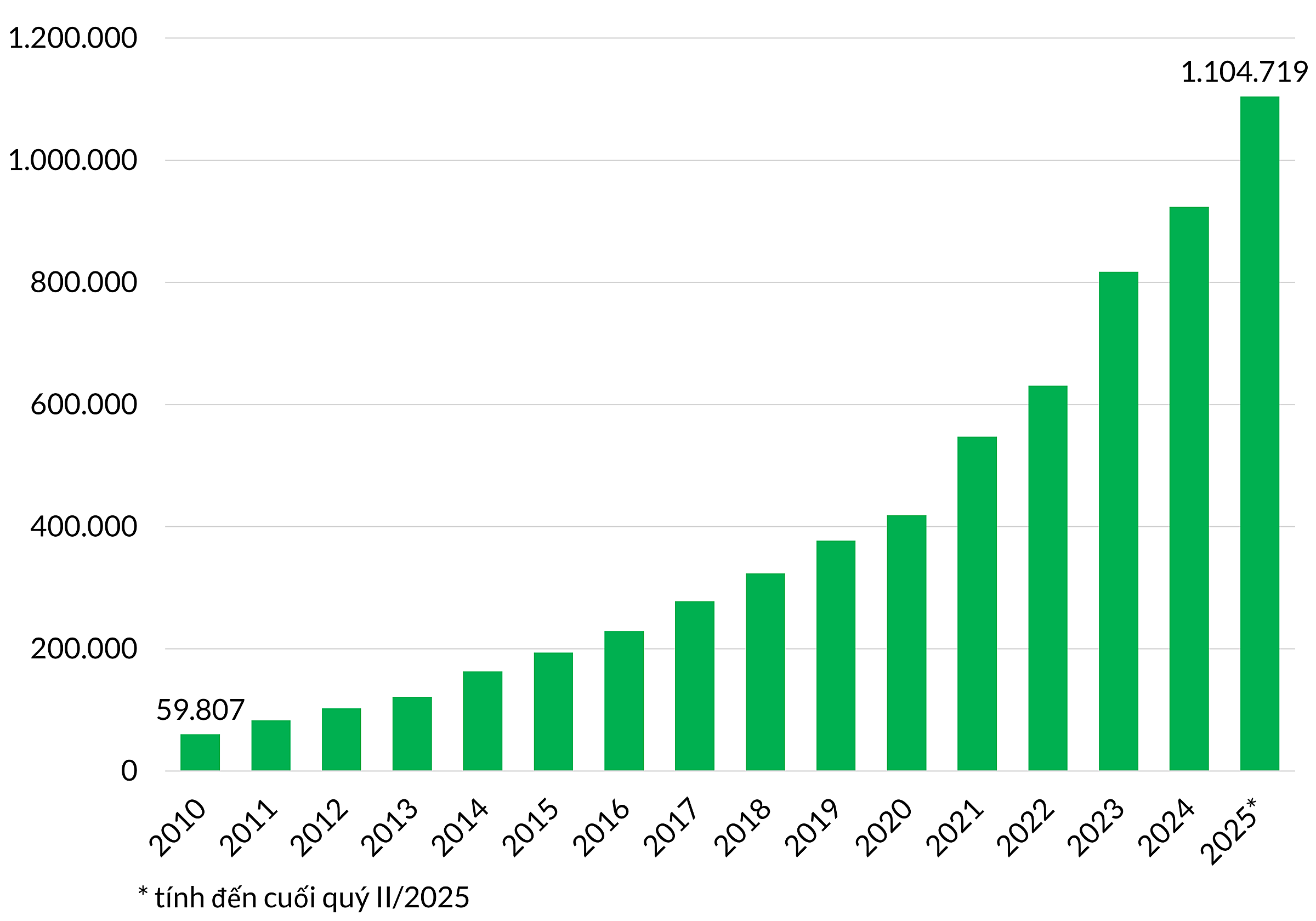

In 2010, VPBank ranked 8th among private banks with total assets of nearly 60,000 billion VND. By the end of Quarter II, its asset size had increased almost 19 times. From 2010 to 2024, the compound annual growth rate (CAGR) reached about 22%.

Throughout its development, VPBank has not only expanded its asset scale but also improved its quality, reflected in key indicators such as charter capital, equity, and capital adequacy ratio (CAR), consistently ranking among the top in the system. This private joint-stock commercial bank has surpassed many state-owned corporations and enterprises in terms of total assets.

|

VPBank's total assets increased about 19 times after nearly 15 years. Photo: VPBank |

VPBank's total assets increased about 19 times after nearly 15 years. Photo: VPBank

VPBank's main driver was outstanding credit growth in the first half of the year. By the end of Quarter II, consolidated credit balance reached over 842,000 billion VND, an increase of nearly 19% compared to the beginning of the year, thanks to contributions from both the parent bank and subsidiaries.

Credit growth was supported by strong mobilization. Deposits and the value of issued valuable papers of individual banks increased by nearly 28%, more than 4 times the industry average. VPBank also recorded a significant increase in current account savings account (CASA) and successfully raised 1.56 billion USD from international financial institutions.

The bank's CAR remained around 14%, among the highest in the system. The individual non-performing loan ratio according to Circular 31 was at 2.31%, with the size of group two debt decreasing for four consecutive quarters. Consolidated pre-tax profit for six months reached over 11,200 billion VND, a 30% increase over the same period and achieving 44% of the annual plan.

A highlight of VPBank's strategy is building a distinctive and expanded open ecosystem. The bank not only focuses on lending but also provides comprehensive value to customers.

VPBank's financial ecosystem includes the parent bank; subsidiaries in consumer finance (FE Credit), securities (VPBankS), non-life insurance (OPES); GPBank; digital bank CAKE by VPBank; Be Group; and LynkID. At the recent annual general meeting, VPBank approved a plan to expand the ecosystem with two new additions: a life insurance company and a fund management company.

The strategic partnership with foreign shareholder Sumitomo Mitsui Banking Corporation (SMBC) from Japan also contributes to VPBank's special position. This is the only large private joint-stock commercial bank with a foreign strategic shareholder. This cooperation brings strong financial resources and access to the FDI customer network, along with international standard management capabilities, technological expertise, and sustainable development.

Based on these foundations, VPBank sets out its strategic vision for 2022-2026: to become one of the three largest banks in Vietnam and among the top 100 banks in Asia. This year, VPBank aims for 25% credit growth, over 30% deposit growth, and pre-tax profit of 25,300 billion VND (nearly one billion USD). In the period 2026-2029, VPBank sets a target of breakthrough growth of 30-35% per year.

(Source: VPBank)