On 1/12, electric vehicle news site Inside EVs reported on insights from businessman John McNeill, who served as Tesla's President from 2015 to 2018 and is currently a board member at General Motors (GM).

McNeill described Tesla's culture as "sponge-like," constantly absorbing knowledge. During his nearly three-year tenure, the company disassembled Chinese electric cars, learning from them and applying those lessons to the Model 3 and Y—two models that later became global bestsellers.

According to McNeill, the biggest lesson for them was to maximize component sharing across different car models, a strategy he deemed "super smart."

"Chinese engineers are very disciplined about sharing parts under the hood, where customers rarely notice," he stated, adding that this strategy significantly reduced costs.

|

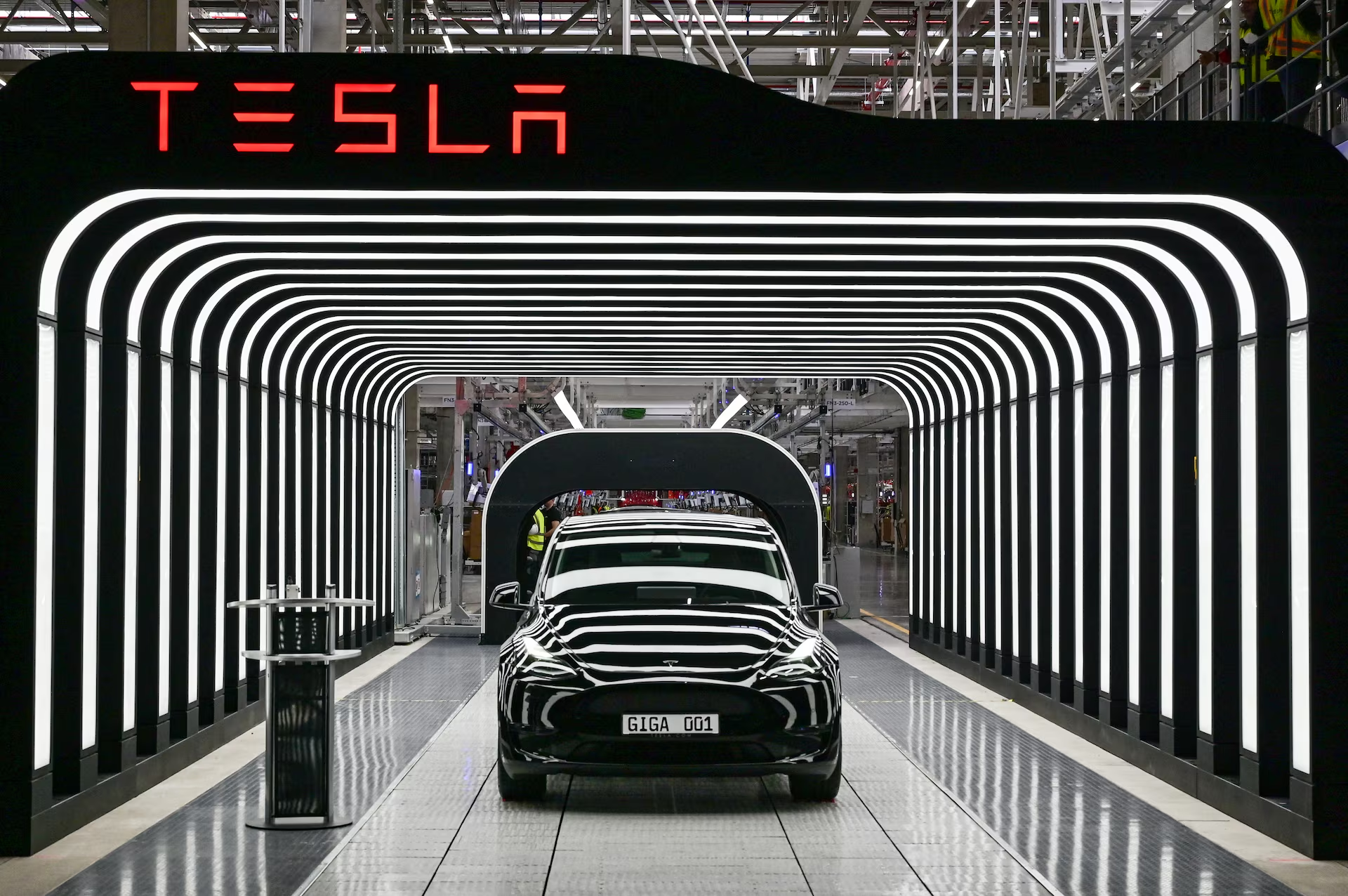

Model Y vehicles at the opening ceremony of the Tesla Gigafactory in Gruenheide, Germany, 22/3/2022. Photo: Reuters |

In the automotive industry, companies frequently test and disassemble competitors' vehicles. This practice explains why a Xiaomi car was found at a Ferrari factory. In Tesla's case, McNeill did not specify which Chinese models were examined. However, in his role at GM, he has observed the disassembly of BYD vehicles, noting that the Chinese company employs component sharing at an advanced level.

Engineers disassembling BYD cars found they used the same type of wiper motors, heat pumps, and ducts, components that do not directly enhance the user experience.

The component sharing strategy was previously acknowledged by CEO Elon Musk. During the 2020 shareholder meeting, Musk stated that the Model 3 and Y shared approximately 75% of their platform, powertrain, interior parts, and many other components. For example, the front seats are nearly identical, differing only in their higher mounting position in the Model Y.

A spokesperson for Tesla did not comment on the former president's statements.

McNeill also noted that Tesla's philosophy of maximizing shared components helped reduce production costs, allowing the company to lower prices for end-users. This made Tesla's compact electric vehicles highly competitive in the US and Europe.

In the US, the Model 3 garnered significant attention upon its market launch, achieving sales of around 138,000 units and becoming the best-selling premium car in 2018.

The Model 3 also gained popularity in China, with sales exceeding 137,000 units in 2020. However, Tesla is currently facing challenges in the populous market, with October sales dropping to a three-year low. The company's market share also fell from 8.7% to 3.2% compared to the previous month, according to CNBC.

"Tesla is surrounded by numerous Chinese carmakers," said Michael Dunne, CEO of Dunne Insights, an automotive and technology market analysis firm. He likened the domestic companies to "a swarm," with each firm vying for a share of the US carmaker's sales.

While Tesla's strategy of learning from competitors proved effective for a period, Chinese carmakers now produce more affordable vehicles better suited to local consumer preferences. Many Chinese models also offer superior technology, including faster charging, greater power, and more features that meet buyer demands—features that Tesla lacks.

For instance, phone maker Xiaomi recently entered the electric vehicle market, with Q3 sales reaching 109,000 vehicles, equivalent to 64% of Tesla's sales during the same period. Leapmotor's C10 mid-size SUV is priced at half the cost of a Model Y. Another trend in China involves technology giants partnering with established automakers. Meanwhile, Tesla's popular model in this market remains the Model Y, a vehicle that has held its position for many years.

Despite the former president's praise for Tesla's continuous learning, the company's cost-reduction efforts have not been enough to ensure competitiveness in China, one of the three largest automotive markets globally.

In the other two major markets, Europe and the US, Tesla is also experiencing a downturn. In the US, October vehicle sales decreased by 24% after the 7,500 USD tax credit policy ended.

In Europe, sales were nearly halved compared to the same period last year. Tesla vehicles have seen declining popularity in this market since CEO Elon Musk's increased involvement in politics late last year.

Bao Bao (according to Inside EVs, CNBC, Business Insider)