On 23/7, the Polk County Sheriff's Office in Florida announced the arrest of 3 individuals among a group of 8 suspects. They are charged with racketeering, grand theft, and fraud in a federal bank fraud scheme totaling $8.8 million USD, impacting 235 victims, mostly senior citizens.

Sheriff Grady Judd explained that the suspects secretly transferred funds into newly opened accounts, then withdrew the cash for personal expenses.

The investigation began in 4/2023 when Synchrony Bank detected suspicious activity related to a month-old account belonging to 27-year-old Michael Nevarez. This account received $250,000 from another bank, which was quickly dispersed into various personal accounts.

Police also uncovered a connection to 25-year-old Kevin Clayton. He opened a Synchrony Bank account around the same time as Michael and also received large sums, ranging from $15,000 to $54,000, from other bank accounts. Kevin then transferred money from his Synchrony account to other personal accounts.

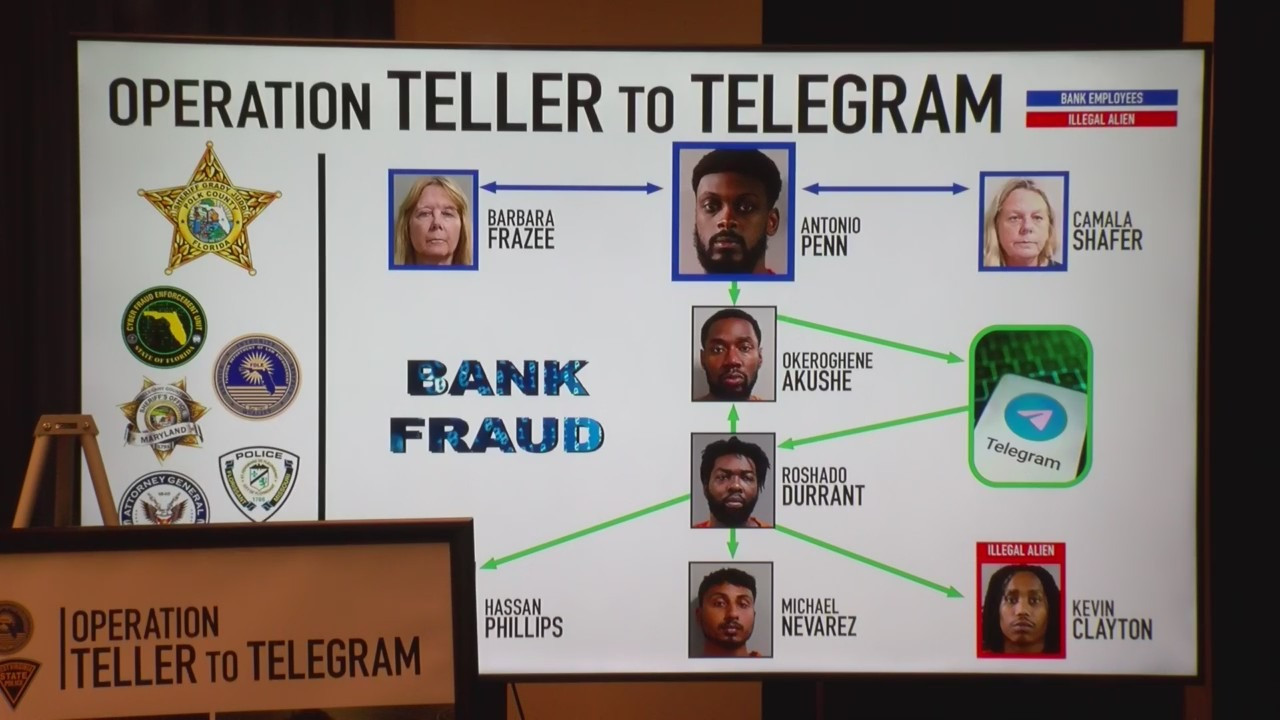

Investigators traced the source of the stolen account information to three employees at a Maryland bank: 65-year-old Barbara Frazee, 57-year-old Camala Shafer, and 32-year-old Antonio Penn.

Barbara and Camala were veteran employees with over 35 years of service and full access to customer data. Antonio, an employee of 5 years at the same branch, lacked this access. He requested the other two to log in and take photos of customer account information.

Authorities revealed that from 2/2022 to 6/2023, Antonio shared the stolen account information with 29-year-old Okeroghene Akushe. Okeroghene then recruited others to open fraudulent accounts, transfer funds, and recruit additional participants. The suspects communicated via Telegram, sharing screenshots of personally identifiable information to access victims' bank accounts.

Police documented a total of $8,842,398.25 in illegally accessed funds during the investigation.

|

Police revealed the operational scheme of the 8 suspects in the bank fraud case. Photo: WFLA |

Police revealed the operational scheme of the 8 suspects in the bank fraud case. Photo: WFLA

"This wasn’t a small-time scam, this was a well-organized scheme to steal millions of dollars from innocent victims across the country," Sheriff Judd said.

The case highlights that sophisticated fraud doesn't always originate from strangers through phishing emails. It can come from within the bank.

What can customers do to protect their money?

Since this crime involved insiders with legitimate access, typical advice like "don't click on suspicious links" is ineffective. However, you can take these steps to secure your accounts:

- Set up transaction alerts: Enable text or email notifications for all account activity, especially large withdrawals, bank transfers, or logins from new devices. Many senior citizens don't check their accounts daily, so this can provide timely warnings.

- Understand your bank's safeguards: "Before you trust people with your money, ask 'what are you doing to protect my money?'", Sheriff Judd advised. This means confirming the bank uses two-factor authentication, monitors internal risks, and protects account holders from unauthorized transactions.

- Review transactions monthly: Make it a habit to regularly check bank statements, especially for older family members. Look for unexplained withdrawals, transfers, or changes to contact information.

If you suspect fraud, immediately contact your bank's fraud department and file a complaint. In many cases, you only have 60 days to dispute fraudulent transactions.

Tue Anh (according to Fox, Moneywise)