On 21/7, 45 of Thong’s, 47, "underlings" were tried in the Hanoi People's Court for property extortion.

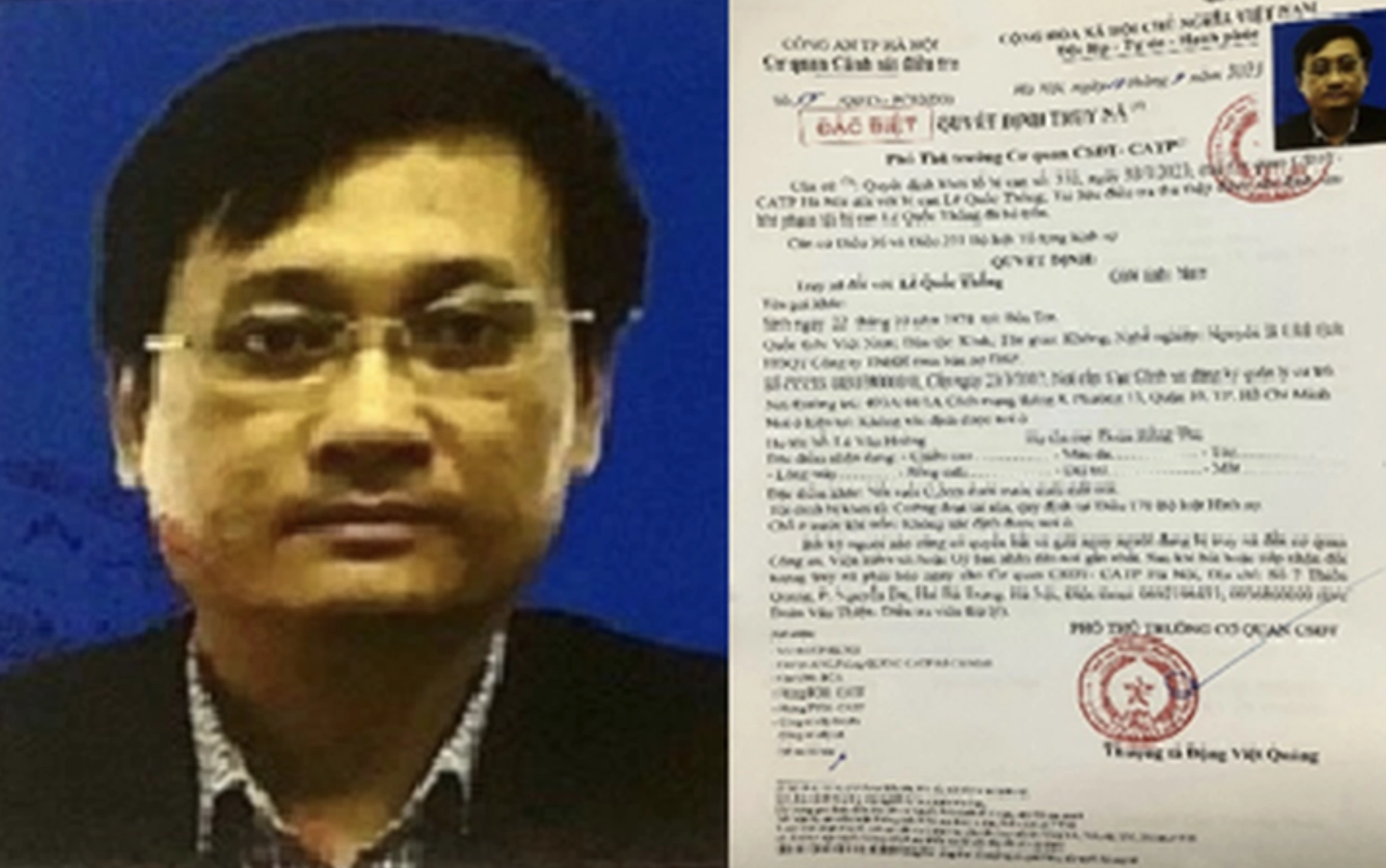

Thong, identified as the mastermind, remains at large. Among the defendants are two of his key operatives: Tran Hong Tien, 51, the overall operations director, and Nguyen Duc Khoa, 34, Thong's deputy and general director of three companies.

|

Tran Hong Tien (standing) and other defendants in court. Photo: Danh Lam |

Tran Hong Tien (standing) and other defendants in court. Photo: Danh Lam

The source of over 3,500 billion VND in bad debts.

According to the indictment presented by the People's Procuracy this morning, Mirae Asset Vietnam Finance Company Limited Liability Company offered unsecured personal loans. Borrowers were required to provide photocopies of their identification cards, household registration books, current phone numbers, and contact information for relatives and friends.

Monthly payments of principal and interest were mandatory. Mirae Asset sold overdue or unpaid loans (bad debts) to other companies for collection. Among these were seven companies co-founded by Thong and Tien, which purchased the debts at 12-15% of their face value for collection.

These companies include: Omnia Investment Joint Stock Company; Kien Cuong Law Limited Liability Company; DSP Debt Trading Limited Liability Company; Thoi Dai Financial Services Joint Stock Company; Kien Long Financial Services Joint Stock Company; Bac A Financial Services Joint Stock Company; and Nam A Financial Services Joint Stock Company.

Although registered under the names of Thong and Tien's employees, these companies were effectively controlled by the two kingpins. They shared the same debt collection methods and operated from the same location despite having different registered business addresses. According to the People's Procuracy, this was done to "conceal and evade detection by the police of their illegal debt collection activities".

Authorities determined that between July 2018 and August 2022, Thong and Tien's group acquired 238,160 debts from Mirae Asset, totaling over 3,500 billion VND, and successfully collected 571 billion VND.

|

Le Quoc Thong is currently a fugitive. Photo provided by the Police |

Le Quoc Thong is currently a fugitive. Photo provided by the Police

Using 'terror' tactics to collect debts and earn commissions.

After receiving customer information and debt details from Mirae Asset, Thong and Tien tasked their Operations (Account) and IT departments with uploading the data into the seven companies' private systems. The debtor information was then distributed to 103 debt collectors.

Each collector had a monthly quota of 400-500 debtors. These 103 collectors, mostly in their 20s and 30s, were divided into 11 teams, each with its own monthly collection "KPI". The indictment states that failure to meet the quota for two consecutive months resulted in termination.

Team leaders pressured their collectors to maximize collections and earn commissions based on successful recoveries. Debtors could pay directly at the office or transfer funds to four designated company bank accounts.

The company also used an automated calling system and voice-changing software (male to female and vice-versa) to contact debtors.

By February 2022, Thong's seven companies had a staff of 114, divided into five departments.

The Human Resources department, headed by Nguyen Thi Ai Van, handled recruitment, attendance records, parking permits, and bank cards for employees. The Accounting department, led by Vo Thi Cam Van, managed payroll and collected and summarized payment receipts. Nguyen Thi Kim Tram managed the Operations (Account) department, responsible for distributing debtor data to collectors' accounts.

The IT department, under Pham Van Son, oversaw employee accounts, granted access privileges, checked debtor information assigned to collectors, and corrected data errors. IT also assisted in creating and removing manipulated explicit images of debtors.

The Debt Collection department, led by the fugitive Le Hien Thao, managed and instructed the 103 collectors.

Manipulated explicit images used to coerce debtors.

The People's Procuracy alleges that the debt collection tactics included using multiple burner phone numbers to make incessant calls and send abusive messages, threatening the debtors' children, relatives, and colleagues, even those unrelated to the loan, to pressure them into paying.

|

The defendants in court. Photo: Danh Lam |

The defendants in court. Photo: Danh Lam

A more aggressive tactic involved manipulating images of debtors or their relatives into explicit content, creating false narratives (out-of-wedlock pregnancies, prostitution, incest, drug addiction, extramarital affairs) and posting these on social media to defame them.

For instance, a 42-year-old Hanoi resident, Nam, borrowed 50 million VND at an interest rate of 5.25% per month for 24 months, with monthly payments of 3.7 million VND. After 12 months, he could no longer afford the payments. His debt was then sold to Thong's company, where it ballooned to 175 million VND including principal, interest, and penalties.

After harassing Nam and his wife, Thong's employees called his son's elementary school and teacher, pretending to be family members picking him up. When the school refused, the school's website and Facebook page were bombarded with insults, abusive comments, and false accusations of teacher-on-student violence.

The indictment notes that although the defendants deleted the posts, investigators were unable to retrieve the original content to determine the duration of the posts or the number of viewers. Therefore, authorities lack sufficient evidence to prosecute the defendants for defamation or humiliation.

So far, investigators have identified 26 victims extorted out of a total of 904 million VND. The remaining cases have been delegated to local police departments for further investigation.

Thong's wife left the country in August 2022 with no record of re-entry. Her testimony has not been obtained, and her role in the case remains unclear. Her actions have been separated for further investigation.

Regarding Mirae Asset Vietnam, the investigation found that at the time of selling the bad debts to Thong's companies, all loan interest rates were below 100% per year. The company was "unaware of Thong and his accomplices' extortion activities" and is therefore not being prosecuted for extortion or usury.

The trial is scheduled to last seven days.

Hai Thu