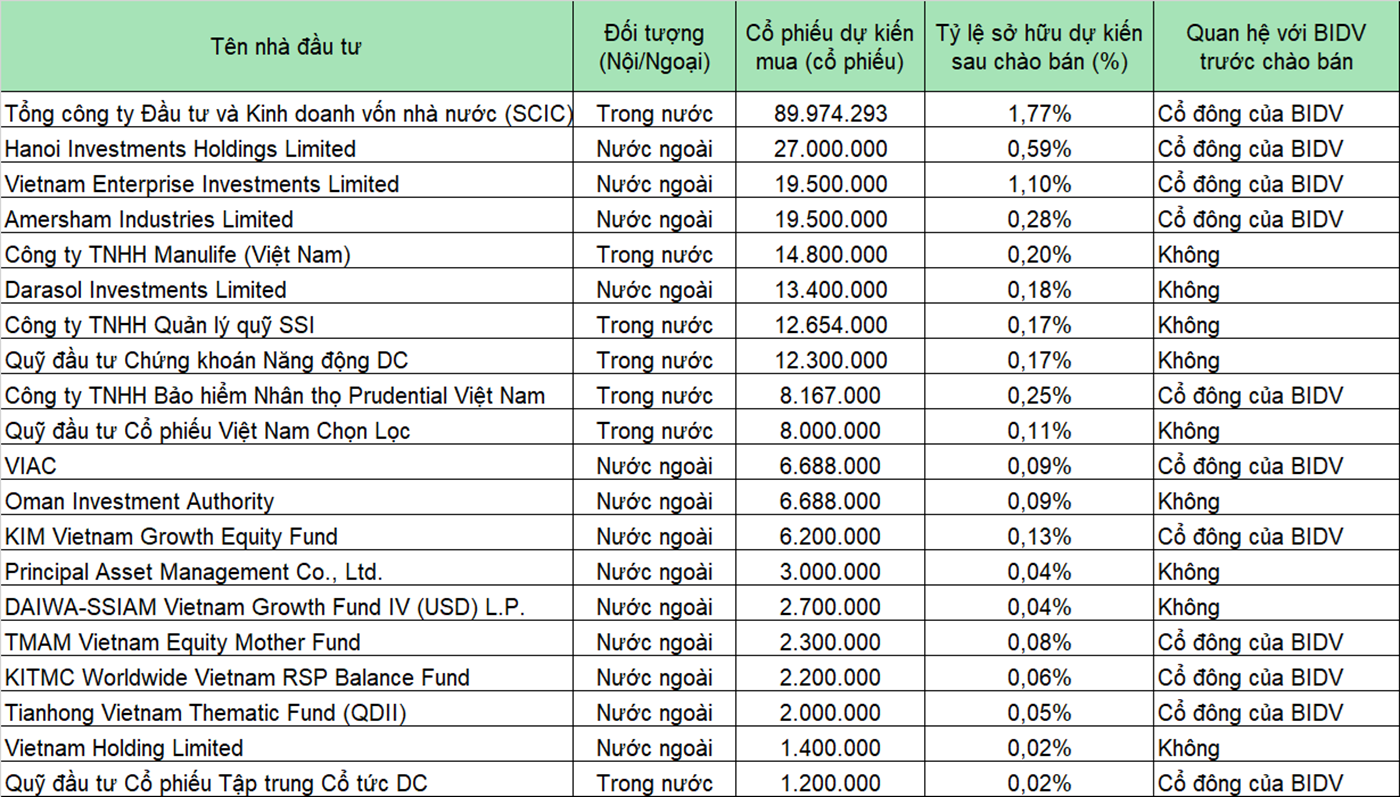

The Bank for Investment and Development of Vietnam (BIDV) recently announced a list of 33 investors for its private placement of over 264 million shares. These investors are professional and renowned securities investment organizations from both Vietnam and abroad.

The State Capital Investment Corporation (SCIC) emerged as the largest buyer, securing 90 million shares. Investors linked to Dragon Capital, the market's largest foreign fund, including Hanoi Investments Holdings Limited, Vietnam Enterprise Investments Limited, Amersham Industries Limited, and Chung khoan Nang dong DC, collectively acquired 88,3 million units.

SSI Asset Management Company Limited (SSIAM), Darasol Investments Limited, Manulife Vietnam, and KIM are also among the entities that will purchase over ten million shares.

|

Investors set to acquire over 1 million shares in BIDV's offering. Data: BID |

Priced at 38,900 VND per unit, which is 29% below the market rate, BIDV anticipates raising 10,272 billion VND. These funds will supplement the bank's capital for its credit activities in 2026.

The placement is slated for Quarter I. Shares acquired through this private offering will have a one-year transfer restriction.

In 2025, BIDV reported a record profit exceeding 36,000 billion VND, with its return on assets (ROA) at 1,01%. By 31/12/2025, the bank's total assets surpassed 3,25 million billion VND, marking a 20% growth from 2024 and positioning it as the largest bank in Vietnam.

The bank mobilized 2,4 million VND over the past year, while its credit outstanding reached 2,3 million billion VND, a 15% increase. The non-performing loan (NPL) ratio, as per Circular 31, was 1,2%.

Trong Hieu