Following yesterday's afternoon turnaround, the VN-Index remained positive throughout the day. The market opened strong with high demand for blue-chip stocks. The financial services sector and certain oil and gas stocks with specific narratives also provided support. Although trading volume was lower than the same period last year, the dominance of buyers kept the index above 1,680 points consistently.

|

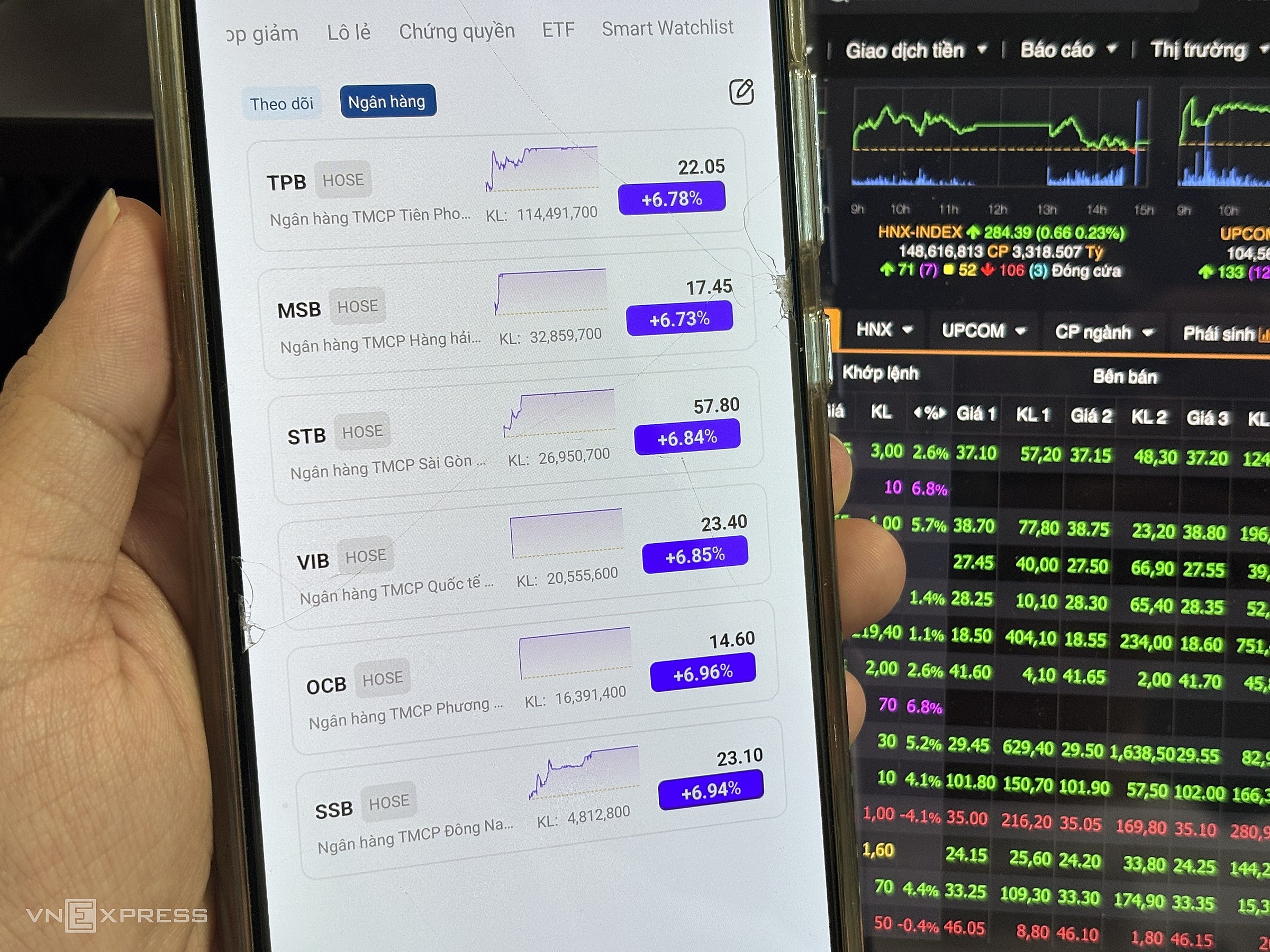

Bank stocks hit their ceiling prices on 21/8. Photo: Tat Dat |

The market cooled slightly in the early afternoon as profit-taking occurred on some stocks that had risen sharply in the morning. However, the overall trend remained positive. The HoSE index then rebounded, reaching nearly 1,694 points at one stage, up 29 points from the reference point and setting a new market record. Increased selling pressure then moderated the gains.

At the close, the VN-Index reached 1,688 points, a gain of nearly 24 points compared to the previous day. However, the market experienced a deceptive rally, with 214 declining stocks, almost double the 118 advancing stocks.

The index's gains were almost entirely due to the banking sector. There were no declining stocks in this sector. TPB, MSB, STB, VIB, OCB, and SSB all hit their ceiling prices. TPB and STB had particularly high trading volumes, exceeding 2,500 billion and 1,500 billion VND, respectively. VPB, ACB, HDB, BID, and EIB also gained between 3% and 5.7%.

Nine of the 10 stocks contributing most to the VN-Index's increase were banks: VPB, BID, VCB, LPB, ACB, TCB, STB, CTG, and HDB. This sector also led the market in liquidity.

Market liquidity decreased significantly, down over 16,500 billion VND or 24% compared to the previous day. Total trading value on HoSE reached approximately 51,500 billion VND.

Foreign investors continued their selling streak, with a net sell of about 2,417 billion VND. This is the 11th consecutive session where they have favored selling. Stocks with net selling exceeding 100 billion VND included VPB, HPG, CTG, GEX, KDH, NLG, KBC, and VIX. Conversely, foreign investors were actively buying SSI.

Tat Dat