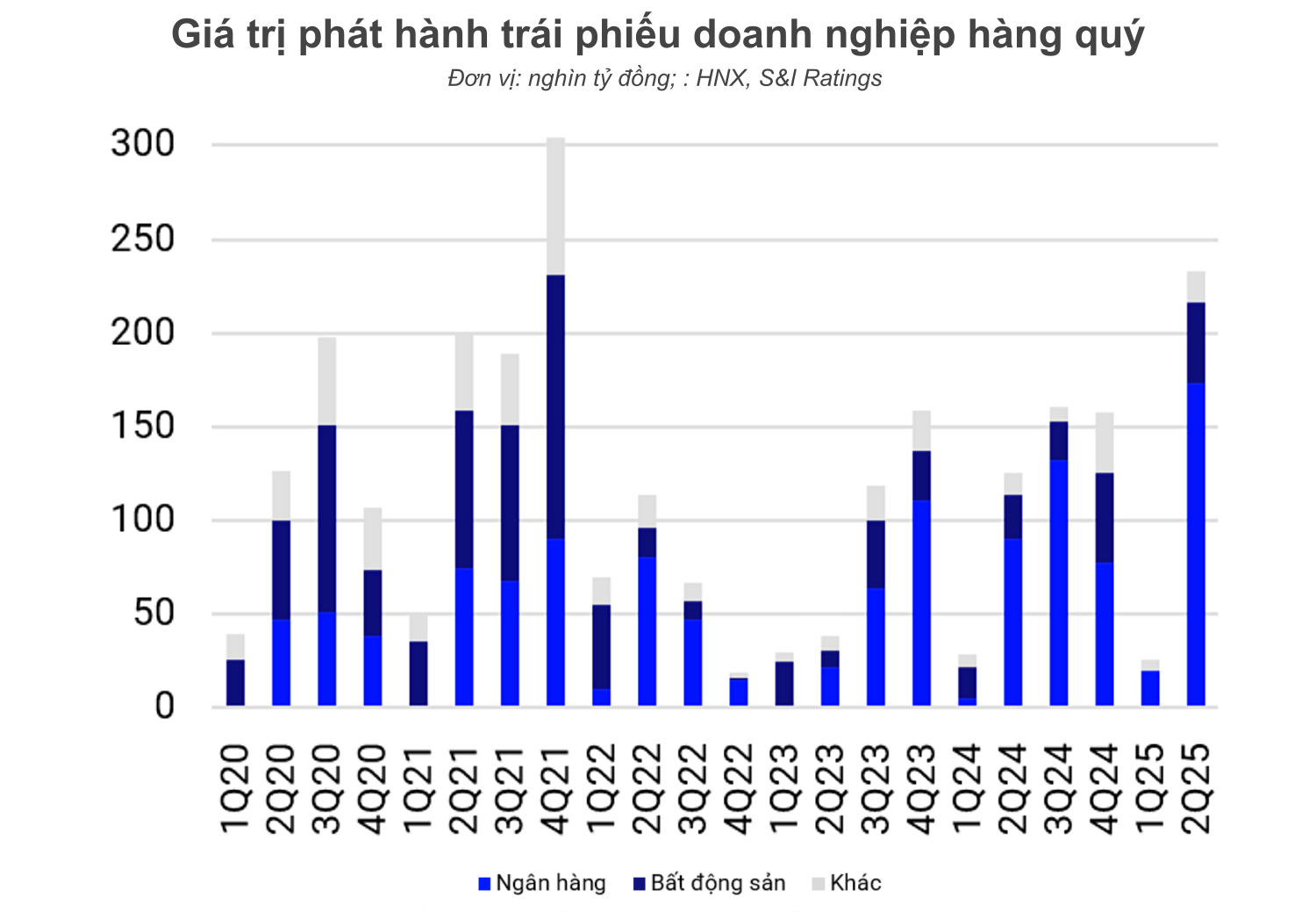

According to S&I Ratings, the corporate bond market is recovering significantly, with the issuance scale in the first half of the year increasing by 67% year-on-year, reaching 258,000 billion VND. Banks played a dominant role, contributing 75% of the issuance value, equivalent to 193,000 billion VND.

The second quarter saw banks raise the most capital through bond issuance in the past 5 years, with approximately 174,000 billion VND. In June alone, nearly 50 bond offerings were successful, raising approximately 72,000 billion VND.

The average interest rate for bank bonds fluctuated around 5.79% per year. Some lots had fixed interest rates below 5%, while most others applied floating interest rates with an additional margin ranging from 1% to 3%.

Both state-owned and private banks accelerated their bond issuance. According to the analysis team of MB Securities, the largest issuers since the beginning of the year are Techcombank (37,000 billion VND), ACB (29,200 billion VND), and BIDV (17,800 billion VND).

"Banks are increasing bond issuance to take advantage of low interest rates to supplement medium- and long-term capital and increase tier 2 capital. This helps reduce pressure on deposit mobilization and facilitates maintaining low deposit interest rates in the first half of the year," an S&I Ratings expert said.

|

According to Nguyen Tung Anh, Director of Credit Research and Sustainable Finance at FiinRatings, compliance with capital adequacy regulations is also an important driver for banks to issue bonds.

The FiinRatings expert believes there are several common characteristics among banks that are actively raising capital through bond issuance. First, most banks maintained bond interest rates at 5.5% per year, slightly lower than the previous period, demonstrating they are taking advantage of the low interest rate environment.

This expert said, "This is a quite attractive rate compared to other investment channels in the current context." He forecasts that in the coming time, the interest rate level will be maintained at a stable level, unless there are major fluctuations from monetary policy or inflationary pressure.

The second common point is that the average maturity of bank bonds is about 4 years, suitable for medium- and long-term capital needs to finance lending and investment activities.

Finally, most banks choose the form of private placement, focusing on institutional investors with experience and market understanding. According to him, this helps them optimize issuance costs and ensure effectiveness.

Experts predict that banks will accelerate bond issuance to supplement medium- and long-term capital while credit growth remains high, and deposit mobilization shows signs of slowing down. In fact, many banks have announced plans to raise capital from a few hundred to a few thousand billion VND through bond channels in the coming time.

Earlier this month, Agribank announced a plan to issue 10-year bonds to raise a maximum of 10,000 billion VND, while LPBank plans a public offering to raise 4,000 billion VND.

Mid-last month, Eximbank planned to issue 10 bond lots in the remainder of this year with the goal of raising 10,000 billion VND. Kienlongbank is also about to issue a 900 billion VND bond lot with a first-year interest rate of 6.9%.

Phuong Dong