According to a report by Vietnam Investment Information and Credit Rating Joint Stock Company (VIS Rating), banks' traditional lending business is under pressure from intense competition, shrinking profit margins, and credit growth limits. In the first 3 months of the year, banks' net interest margins (NIM) decreased by 0.35 percentage points to 2.9% compared to the same period last year.

In this context, more and more banks are increasing their securities brokerage and capital market services – areas with higher profit margins than traditional lending – while also strengthening and developing their financial ecosystems.

VnExpress has observed that in the past 6 months, some private banks like Sacombank, SeABank, and MSB have announced plans to acquire stakes in securities firms, while VIB and OCB plan to establish strategic partnerships with them.

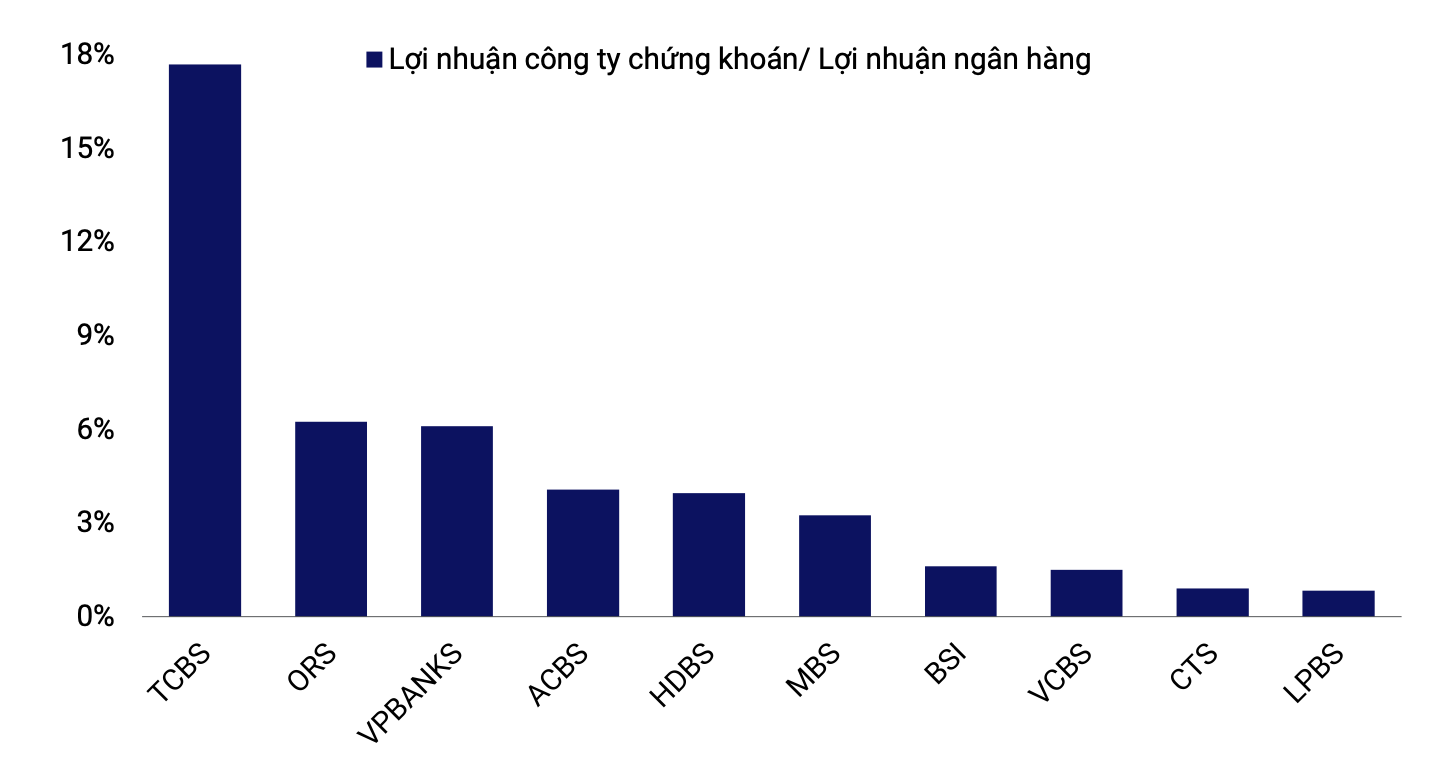

While investing in securities subsidiaries may reduce capital adequacy ratios in the short term, banks believe that expanding into this area will generally improve profitability. In 2024, some bank-affiliated securities firms like TCBS contributed significantly – nearly 20% – to their parent banks' profits.

|

Some securities companies contribute significantly to the parent bank's profit. Source: VIS Ratings |

Some securities companies contribute significantly to the parent bank's profit. Source: VIS Ratings

Over the past three years, securities companies affiliated with private banks have risen to prominent positions among the top 30 in terms of asset size, thanks to large capital increases. These companies' margin lending market share also increased from 19% in 2022 to 30% in 2024, reflecting strong growth.

According to VIS Rating, bank-affiliated companies often leverage their parent banks' capital and customer networks to expand their brokerage and bond distribution market share. This is an advantage that securities companies outside the banking ecosystem find difficult to compete with. Therefore, VIS Rating expects that companies affiliated with private banks will continue to lead profit growth in the industry over the next 12-18 months.

Over the past three years, the return on average assets (ROAA) of these companies has also reached an average of 5.5%, surpassing the 3.5% of other companies in the same industry. Conversely, profit growth for foreign-owned and small domestic securities companies will be slower due to limitations in customer base and operating scale, which reduce their competitiveness.

While acknowledging the good profit margins in this segment, VIS Rating also recommends that these affiliated securities companies exercise caution in customer selection and collateral management when expanding their corporate bond business.

|

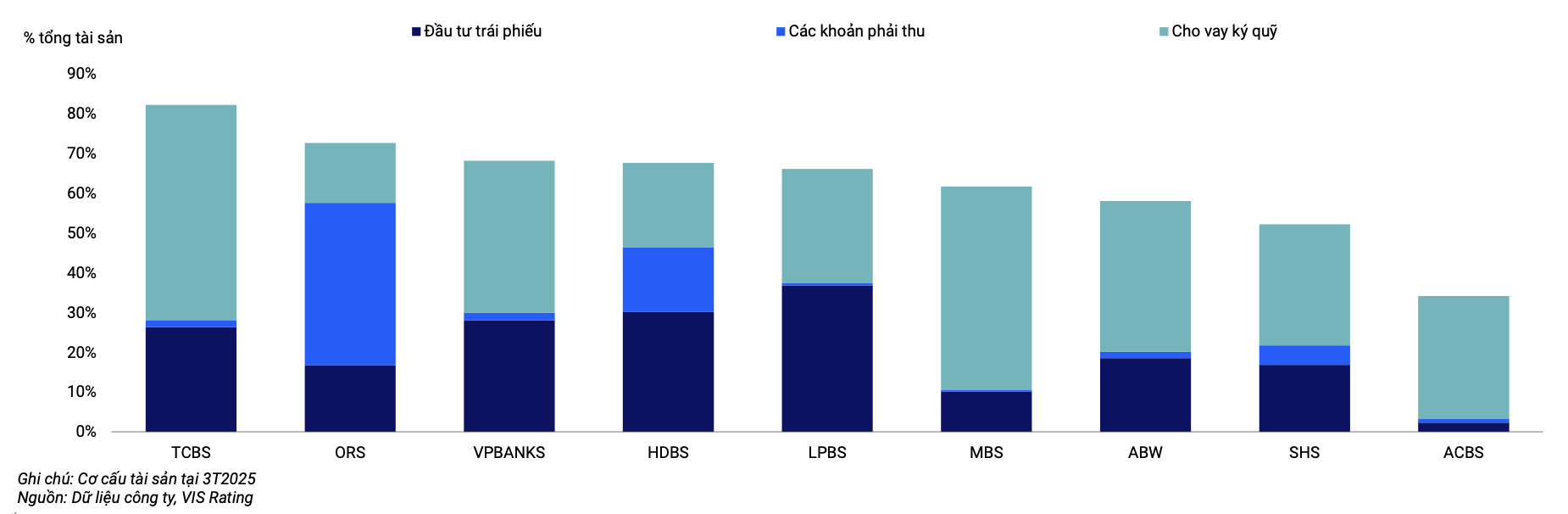

Proportion of bond investments, margin loans, and receivables in the asset structure of bank-affiliated securities companies. |

Banks and affiliated securities companies often cooperate closely to lend to large enterprises – mainly in real estate and renewable energy – through customer loans, bond investments, or margin lending.

Some businesses have recently encountered legal issues related to projects or delays in corporate bond repayments. Additionally, securities companies may also commit to repurchasing bonds sold to individual customers as part of their bond distribution activities.

Therefore, the high credit concentration of banks and securities companies on large enterprises is increasing operational risks, making them vulnerable to credit risks related to individual large customers, which could lead to mass withdrawals.

To limit credit losses, according to VIS Rating, banks and affiliated securities companies need to establish good criteria for selecting new customers and strengthen collateral management.

Quynh Trang