In the operations of SMEs, funds are not always actively circulating. There are periods when money sits idle, acting as a buffer between expenses and income, awaiting payment, or held in reserve. With the daily interest-bearing super yield account, part of Vietnam International Bank (VIB)'s VIB Business digital financial management toolkit, these idle funds can generate returns every day.

|

The super yield account helps businesses earn up to 4.5% annually on their idle funds. Photo: VIB |

Super yield and VIB's toolkit turn idle funds into profit.

Many SMEs are familiar with the scenario of purchasing inventory today but only receiving payment 1-2 weeks, or even a month later. During this waiting period, they must maintain a capital buffer for operations. Previously, SMEs often deposited these funds for very short terms (with penalties for early withdrawal) or left them idle in their payment accounts, missing opportunities for returns.

Now, by simply activating the super yield feature on VIB Business, these short-term funds will automatically earn daily interest. Businesses can still make payments, transfer funds, pay taxes, etc., at any time, and the accumulated profit up to the point of use is retained. This means that operational reserve funds, while not in use, still generate value.

For example, a fresh fruit supplier in Ho Chi Minh City typically purchases large quantities of goods at the beginning of the week, while payments from customers are received at the end of the week. Therefore, they always need a buffer of several hundred million Vietnamese dong. By using the super yield account, the total actual monthly income can be several hundred thousand to several million dong (depending on the balance maintained in the super yield account), enough to offset some electricity, water, and transportation costs.

In addition, by taking advantage of other features on VIB Business such as QR Checkout and softPOS, the company can receive payments instantly, shortening the cash flow gap. The voice alert feature provides immediate payment notifications. If revenue is slower than expected, the VIB Business Card serves as a quick source of funds with a credit limit of up to one billion dong, requiring no collateral and offering interest-free periods of up to 58 days, suitable for pre-purchase and post-payment scenarios. For larger capital needs, businesses can access a 150 billion dong funding package with quick disbursement and interest rates of approximately 6.7% per year.

|

The VIB Business Card also provides quick access to funds for businesses, with credit limits up to one billion dong. Photo: VIB |

Funds awaiting payment or held in reserve can still generate returns.

Similarly, in B2B operations, businesses often set aside funds for debt repayment and timely payments to suppliers. Most businesses leave these funds idle because term deposits lack flexibility.

However, using VIB's super yield account, businesses can maintain funds for scheduled expenses, while any unused capital earns daily interest with a maximum yield of 4.5% per year. Importantly, the funds can be withdrawn immediately on the payment date, and the accrued interest up to the withdrawal point is retained. As a result, businesses maintain liquidity while maximizing capital utilization.

On the VIB Business platform, the debt cycle is further accelerated through e-invoices, online payment gateways, and B2B connections via VnPay. With faster transaction processing, SMEs reduce the pressure to hold large amounts of short-term capital, meaning more idle funds have the opportunity to generate returns.

Additionally, all SMEs require reserve funds for risks or quick inventory purchases. Simply leaving these funds in a payment account is wasteful. A modern management approach involves tiered funds: tier one for daily expenses and value growth while maintaining liquidity—this goes into the super yield account; tier two for investments based on risk appetite.

For example, a manufacturing workshop maintaining a reserve fund of approximately 300 million dong could structure it as follows: 150 million dong in tier one (flexible and earning daily interest); 150 million dong considered for suitable investment channels.

|

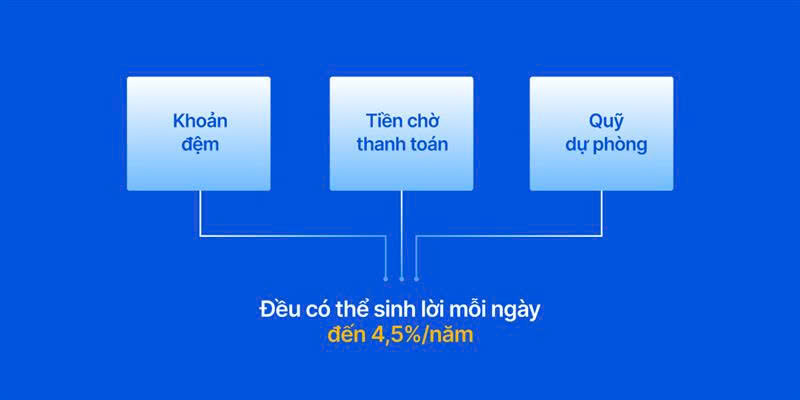

Suitable funds for businesses to use the super yield account. Graphics: VIB |

Three capital states: short-term buffers, funds awaiting payment, and reserve funds were once considered dead points in cash flow. However, with the super yield account and VIB Business, they can become points of active profit generation: unused funds no longer lie dormant but accumulate daily returns until needed. With the right tools, SMEs can shift their mindset: every bit of short-term capital, even while waiting, can create value.

Diep Chi