In the first 6 months of the year, the VN-Index, Vietnam's benchmark stock index, increased by 8.6%. The real estate sector became the market's focus as some stocks like VHM, NVL, and DXG performed even better. However, cash flow has not been distributed across the entire sector but concentrated in a few stocks.

Speaking with VnExpress, Nguyen Minh Hoang, Director of Analysis at Nhat Viet Securities (VFS), remains optimistic about the potential of real estate stocks in the second half of the year. "Most of the lingering issues of the real estate sector in the 2022-2024 period are being resolved, helping companies operate more stably, and thus, stocks will continue to rise," Hoang said.

This expert believes that the increasing supply of real estate is the first positive signal supporting stocks. With a series of projects launched at the end of this year and early next year, companies in the industry can record high profits.

Nguyen Trong Dinh Tam, Deputy Director of ASEAN Securities' Analysis Division, also maintains a positive view of the real estate sector and forecasts that supply this year will increase by 12% compared to 2024.

According to statistics from Vietcap Securities, many businesses such as Vinhomes, Khang Dien, Nam Long, and Dat Xanh could launch thousands of apartments from now until 2027.

Not only is supply increasing, but demand for the real estate market is also more attractive thanks to macroeconomic factors. Nguyen Minh Hoang said that the Vietnamese dong depreciating by 3% against the USD, or 17% against the euro, makes savings deposits less profitable. "Thanks to the dong's depreciation, the stock and real estate channels have become more attractive to investors," the VFS expert said.

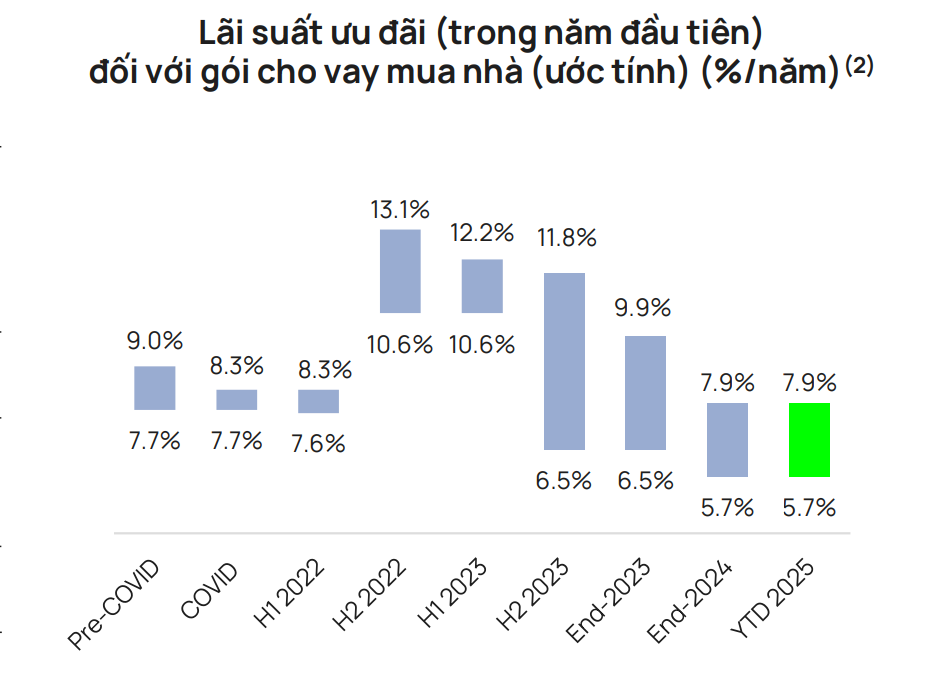

In addition to improving supply and demand, Hoang believes that low-interest rates are also a supporting factor for the real estate sector.

According to data from the State Bank of Vietnam, the average lending rate for new loans from banks in the first 6 months of 2025 was 6.29% per year, a decrease of 0.64 percentage points compared to the end of 2024.

According to Vietcap Securities, the preferential interest rate in the first year for homebuyers is about 5.7-7.9% per year, the lowest since 2019.

|

Preferential interest rates in the first year for real estate buyers. Photo: Vietcap. |

Preferential interest rates in the first year for real estate buyers. Photo: Vietcap.

The VFS expert added that the easing of the legal framework is also a factor worth mentioning. Earlier this year, Prime Minister Pham Minh Chinh requested the removal of obstacles for more than 1,500 long-delayed projects with the approach of "handling errors where they occur," to avoid setting bad precedents.

In addition, the head of the government also directed the Ministry of Construction to simplify 361 administrative procedures and 447 business conditions in the management field. The goal is to reduce processing time, compliance costs, and business conditions by at least 30% in 2025. This ministry must also streamline construction permit procedures for projects that already have detailed 1/500 planning or are located in areas with urban design.

Besides the reasons mentioned by Nguyen Minh Hoang, Nguyen Trong Dinh Tam added that the positive signals for the real estate sector this year come from business results. This expert forecasts that the after-tax profit of listed companies in this industry could increase by 15-17% this year.

|

Investors look at the price board at Rong Viet Securities (District 1, Ho Chi Minh City). Photo: An Khuong. |

Investors look at the price board at Rong Viet Securities (District 1, Ho Chi Minh City). Photo: An Khuong.

The ASEAN Securities expert said that investor cash flow will rotate and differentiate between real estate stocks. "If large-cap stocks attracted cash flow in the first half of the year, opportunities will come to the mid-cap group in the second half," Tam said.

Regarding some notable stocks in the second half of the year, with the view that "high risk, high return," Nguyen Minh Hoang suggests that Novaland's NVL stock is an option. "NVL is a typical stock for the 2022-2024 downturn; however, recently, many of the company's projects have had their legal issues resolved," Hoang said.

In mid-June, Dong Nai province's leaders approved the local adjustment of the detailed 1/500 construction planning for the component projects of Aqua City, including Aquacity and Aqua Waterfront City. Simultaneously, the dossier for adjusting the 1/500 detailed planning for the Phuoc Hung Islet High-End Commercial Service Urban Area (Phoenix subdivision) was also approved on the same day.

Aqua City is one of Novaland's key projects. "This legal milestone is a step forward for Aqua City to carry out procedures to announce sufficient business conditions for subdivisions in accordance with the new planning and is the basis for financial institutions to deploy additional credit packages as previously committed," a Novaland representative said.

In addition to NVL, the VFS expert also suggests some other stocks with sustainable development, sound finances, continuous project development, and stable cash flow such as NLG, KDH, and DXG.

Regarding these stocks, Nguyen Trong Dinh Tam predicts that Nam Long will benefit from the fact that business results could increase by 25% this year. Along with that, the company also recorded sales from the Southgate project in Ho Chi Minh City.

With Khang Dien, the ASEAN Securities expert said that the company's profit could increase by 15% this year, along with benefiting from the Gladia project in Ho Chi Minh City. This is the urban area that Khang Dien is cooperating with Keppel Land to develop.

Finally, Dat Xanh will record good results thanks to the Gem Sky World project in Dong Nai, according to Nguyen Trong Dinh Tam. In addition, the company also has The Prive subdivision to "cushion" in the next two years.

Trong Hieu