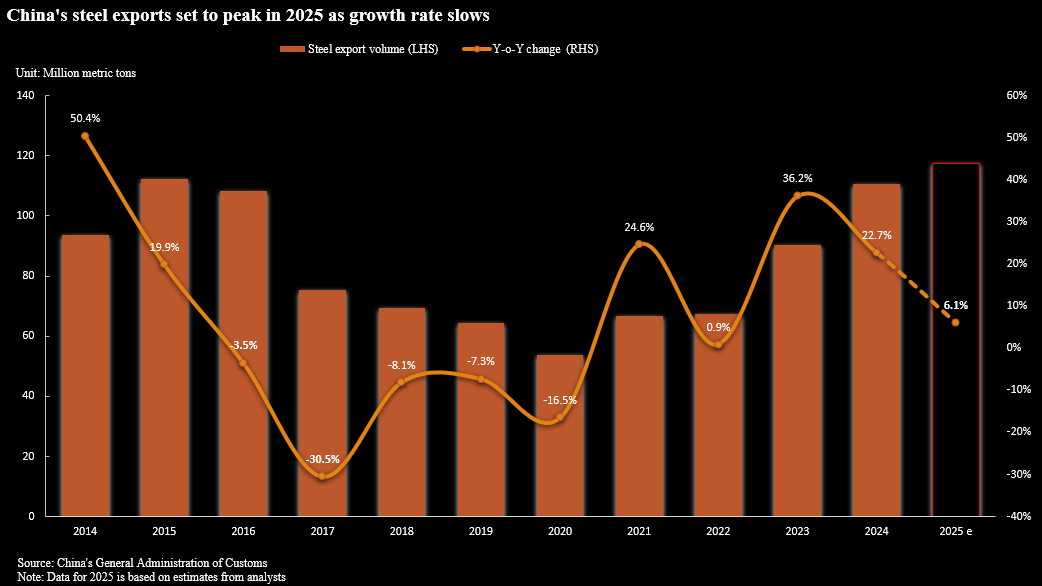

A Reuters poll of 11 analysts predicts that China's steel exports will increase by 4-9% this year, reaching 115-120 million tons. Previously, all analysts expected exports to decline in 2025.

The country's highest steel export volume occurred in 2015. Afterward, output declined due to increasing trade barriers and strong domestic demand fueled by a real estate boom.

Currently, steel exports have surged as producers seek new markets after domestic demand peaked in 2020, before the real estate market downturn. They have successfully maintained international markets by shifting focus to countries with fewer trade barriers.

|

China's steel exports over the years and 2025 forecast. Unit: million tons. Source: *Reuters* |

In the first 7 months of the year, steel exports to Saudi Arabia, Malaysia, and Thailand increased by 24%, 14%, and 13% respectively, compared to the same period in 2024. Conversely, consumption in Vietnam and South Korea decreased by 20% and 10% respectively, due to anti-dumping measures, according to the China Iron and Steel Association (CISA).

"There are almost no orders from Vietnam and South Korea now. We have no choice but to develop new markets," said a trader in eastern China.

According to the China Trade Remedy Information System, from the beginning of 2024 to the present, there have been 54 trade remedy investigations and barriers targeting domestic steel products, exceeding the total number of cases in the previous 5 years. Analysts suggest that record-high exports increase the risk of new trade barriers.

In July, Malaysia imposed anti-dumping duties on some steel products imported from China. Earlier this month, the European Union announced it would seek to curb steel imports. Last week, Mexico also mentioned plans for tariff reforms, including raising taxes on Chinese steel.

Last month, Baojun Liu, general manager of Baosteel, acknowledged facing a record number of trade disputes, including anti-dumping lawsuits. "But with our current scale, we have to export," he said.

Baoshan Iron & Steel, China's largest listed steel producer, said emerging markets in the Middle East, Central Asia, and North Africa are growing rapidly, with exports expected to reach 10 million tons this year.

|

Steel coils at a factory in Changshou, Chongqing, China. Photo: *Reuters* |

China produces over half of the world's steel. They typically export high-value products, but producers are gradually shifting to semi-finished forms to incur lower tariffs.

Specifically, exports of steel billets in the first 7 months tripled compared to the same period last year, and exports of rebar used in construction increased by 77%. In contrast, hot-rolled steel coils—a common type used in manufacturing and often subject to tariffs—decreased by 23%, according to customs data.

The shift to exporting lower-value products has reduced the value of exports despite the strong increase in output, according to Alexis Ellender, senior analyst at Kpler. In the first 8 months of the year, exports increased by 10% in volume but decreased by 1% in value in USD.

Furthermore, this year's record steel exports from China could also mark the peak of the country's international sales. Tomas Gutierrez, head of data at Kallanish Commodities, points out that a sharp increase in semi-finished product sales often signals that exports are nearing their peak.

"Overseas markets are saturated, and trade barriers are increasing. Selling abroad will no longer be easy," Gutierrez added.

Kpler forecasts that China's steel exports will decrease to 100-105 million tons in 2026. Three other analysts predict output will fall below 100 million tons. But even at this level, China would remain the world's second-largest supplier after India.

Phien An (*Reuters*)