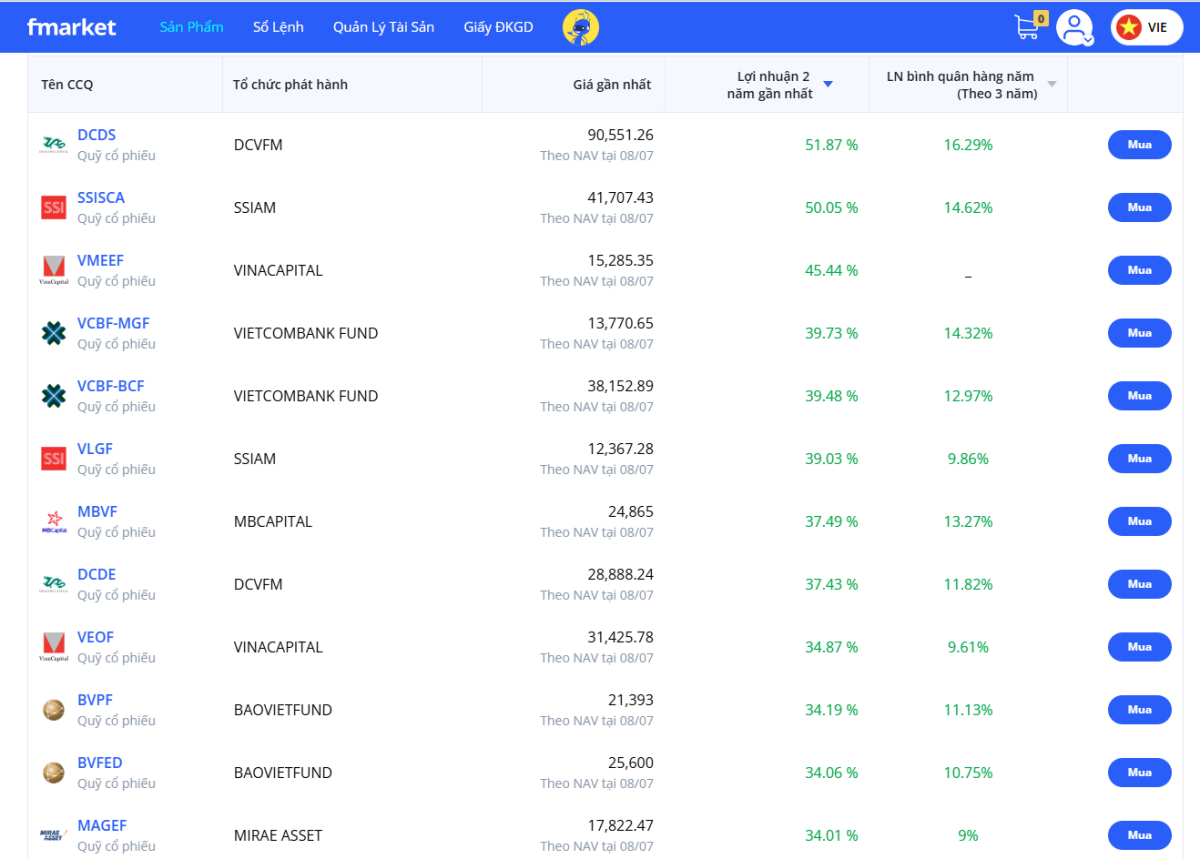

Dragon Capital's Dynamic Stock Investment Fund (DCDS) leads the equity fund performance rankings over the past two years, according to Fmarket's fund trading platform data as of 8/7. The fund recorded a 51.87% growth in the last two years. Over the past three years, DCDS maintained its top position with a 57.27% return.

In 2024 alone, DCDS grew by 23.9%, outperforming the VN-Index (12.1%) by 11.8 percentage points. This growth was driven by a flexible asset allocation strategy focused on sectors like banking, software technology, and retail. Dragon Capital has maintained consistent investment performance, demonstrated by DCDS's 10-year average annual return of 14.6%.

|

Two-year fund performance. Source: Fmarket |

Two-year fund performance. Source: Fmarket

According to a Dragon Capital representative, DCDS is currently the company's most popular product, held by about 70% of individual investors. The total number of DCDS investors has now surpassed 35,000.

To update its investment strategy and market trends, Dragon Capital is hosting Investor Day 2025 on 12/7. The hybrid event, held in Hanoi and Ho Chi Minh City, will offer a comprehensive overview of the macroeconomy, stock market, and long-term investment opportunities.

Investor Day 2025, themed "Crystallizing Inner Strength, Leading the Way to Prosperity", connects the investment community across the country. It's an opportunity for investors to network, receive regular updates, and access in-depth analysis from Dragon Capital's experts.

This year's event will address several topics of current market interest: the impact of provincial mergers on public investment and the real estate market; infrastructure and logistics expansion trends; and prospects for foreign direct investment (FDI) following the preliminary trade agreement between Vietnam and the US.

|

Investor Day is held in a hybrid format for the first time. Photo: DC |

Investor Day is held in a hybrid format for the first time. Photo: DC

Drawing from Resolution 68, Dragon Capital experts will also analyze the impact on private sector development, seen as a "long runway" for private sector breakthroughs. The event will also discuss promising long-term investment sectors through analysis of partnerships between state-owned enterprises, private companies, and FDI.

|

Experts analyze investment strategies for DCDS and DCDE at Investor Day Q1/2025. Photo: DC |

Experts analyze investment strategies for DCDS and DCDE at Investor Day Q1/2025. Photo: DC

Another highlight of Investor Day 2025 is the assessment of the Korea Exchange (KRX) system after a period of stable operation. KRX is considered crucial technical infrastructure, supporting Vietnam's stock market upgrade goal for the September evaluation. Institutional reform solutions, improved trading processes, and enhanced investor experiences will also be presented.

|

Dragon Capital experts at the Investor Day event on 12/7. Photo: DC |

Dragon Capital experts at the Investor Day event on 12/7. Photo: DC

Investor Day 2025 brings together Dragon Capital experts, including Le Anh Tuan, Chief Investment Officer; Dang Nguyet Minh, Head of Research; and Vo Nguyen Khoa Tuan, Senior Director of Equities. Nguyen Sang Loc, Portfolio Manager, and Diep Quoc Khang, Senior Director of Fixed Income, will also participate.

Thai Anh

Investors can watch the event live on Dragon Capital Vietnam's Facebook page, Dragon Capital Vietnam's YouTube channel, and CafeF's Facebook page.