The DC Dynamic Securities Investment Fund (DCDS), managed by Dragon Capital, employs a comprehensive investment strategy built on key principles: consistency, perseverance, timeliness, and flexibility. What sets DCDS's approach apart is its "unbiased" investment philosophy. According to a fund representative, this philosophy allows DCDS to maintain open-mindedness in investment decisions, adapting to short-term fluctuations while steadfastly pursuing long-term strategic positions.

|

Dragon Capital experts discuss the DCDS fund at Investor Day on 12/7. Photo: Dragon Capital |

Dragon Capital experts discuss the DCDS fund at Investor Day on 12/7. Photo: Dragon Capital

The focus of DCDS's investment strategy is selecting businesses with real competitive strength, sustainable growth potential, and the ability to create clear intrinsic value. Concurrently, the fund combines long-term goals with portfolio flexibility. This method requires the ability to correctly identify promising sectors or businesses and effectively capitalize on attractive valuations when allocating capital. The fund accepts a higher-than-usual portfolio turnover rate, but without compromising investment quality or abandoning core principles.

According to a DCDS representative, the fund prioritizes sectors tied to domestic economic strengths, such as banking, software, and retail – sectors with growth potential amid the recovery of domestic consumption and investment.

Specifically, during the 2022-2023 period, when the market experienced significant adjustments, DCDS invested in bank stocks like Sacombank (STB) and Techcombank (TCB) at low valuations, with a P/B ratio of around 0.8-0.9. According to the fund representative, these investments quickly became key growth drivers in the portfolio during the market recovery.

A similar strategy was applied to Vingroup stocks. After a long period of maintaining a low allocation, the fund increased its investment in Vinhomes (VHM) when it assessed that the most challenging period for the corporation had passed. According to DCDS, the company's ability to develop large-scale urban areas helps maintain stable cash flow, with annual profits from 25,000 to over 30,000 billion VND, reinforcing confidence in its long-term prospects.

Another notable investment was in Hoang Huy Group (TCH). While the market remained skeptical, DCDS directly engaged with the company's leadership, assessing product quality and financial capacity before investing at a price range of 9,000-12,000 VND per share. Subsequently, the stock nearly doubled and its portfolio allocation was further increased, positively contributing to the fund's investment performance.

|

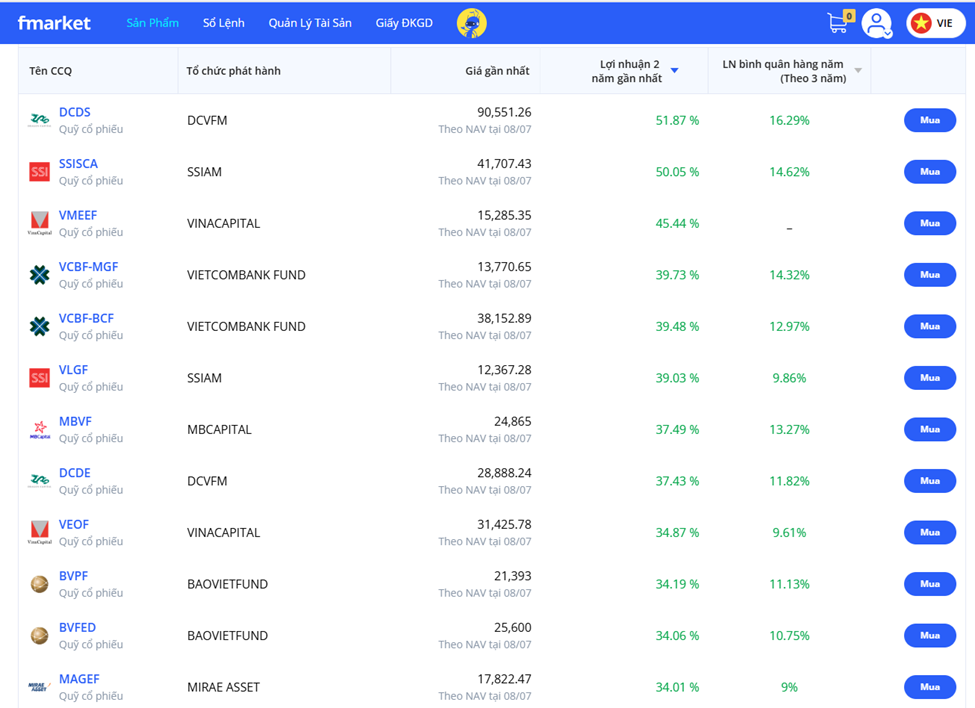

Fund performance over two years. Source: Fmarket |

Fund performance over two years. Source: Fmarket

The investment strategy, based on selecting intrinsic strength, capitalizing on market cycles, and adhering to long-term value investing, has helped DCDS achieve stable performance across various market cycles. According to data from Fmarket, as of 8/7, the fund achieved a 51.87% return over two years. In the last three years, DCDS has maintained its leading position with a 57.27% return. In 2024 alone, the fund recorded 23.9% growth, exceeding the VN-Index by 11.8 percentage points. Over 10 years, DCDS has achieved an average annual compound return of 14.6%.

According to a Dragon Capital representative, DCDS is currently the most popular product in the company's portfolio, with about 70% of individual investors choosing to hold the fund's certificates. The total number of investors with DCDS now exceeds 35,000.

Minh Ngoc