The State Bank of Vietnam is seeking feedback on a draft circular amending and supplementing Circular 15, which regulates non-cash payment services. A new provision specifies the maximum downtime for online banking and digital wallet services.

The State Bank requires that the total downtime for all online payment and intermediary services not exceed 4 hours per year and a maximum of 30 minutes per incident. Exceptions are made for unavoidable circumstances or maintenance and system upgrades announced at least 3 days in advance.

If an incident causes a service interruption exceeding 30 minutes, the payment service provider and intermediary must report to the State Bank within 4 hours. A full report must also be submitted within 3 business days of the issue's resolution.

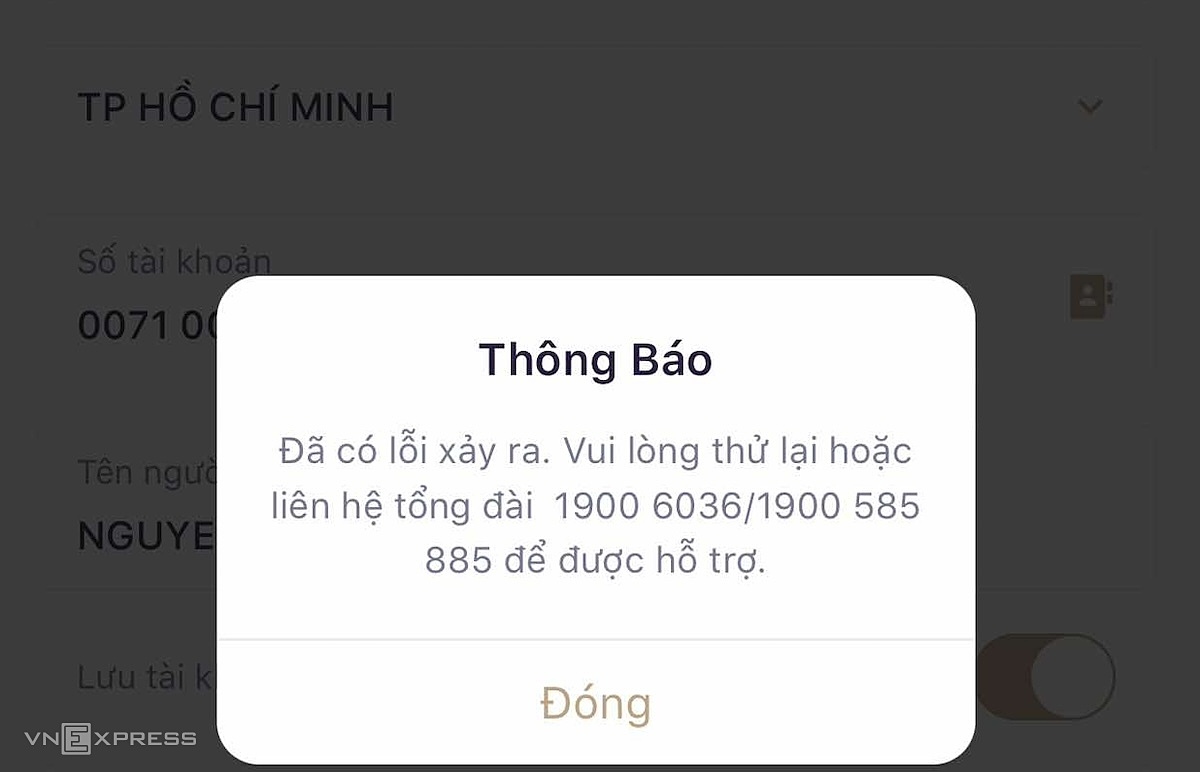

The Payment Department of the State Bank has received complaints from people about errors in some banks' or payment intermediaries' applications, preventing logins or transactions, especially during peak periods (holidays, Lunar New Year). This has frustrated many customers unable to make QR code payments or experiencing network congestion and frozen transactions. In some cases, funds were deducted from customer accounts, but the recipients didn't receive them. Furthermore, some banks failed to issue official announcements, delayed resolving incidents, or conducted maintenance and system upgrades without prior notice.

The State Bank considers this new regulation necessary to protect customer rights and enhance service providers' responsibility.

According to the State Bank, most other countries also regulate maximum downtime to around 4 hours per year. Singapore and China also stipulate a maximum downtime of 4 hours annually. Some European Union (EU) countries have stricter requirements, such as a maximum of 15 minutes per incident, and mandate banks to have contingency plans and backup systems to ensure service continuity. Institutions must conduct regular system checks and reports. They also impose penalties, such as fines or license revocation, for organizations violating downtime requirements.

|

Online transaction interruption notice from a bank. Photo: *Thanh Le* |

The draft circular also tightens regulations on using aliases or nicknames in transactions.

Many have exploited the practice of banks allowing customers to use aliases or nicknames instead of account numbers and names, setting names similar to reputable brands for fraudulent purposes. Using aliases or nicknames can also lead to incorrect money transfers due to incomplete account number and name information during payment processing.

Therefore, the State Bank requires payment service providers to verify payment orders, ensuring the correct account number and name appear on account opening forms and are used and fully displayed on transaction documents.

Quynh Trang