This information was revealed in a recent letter to shareholders by Doan Nguyen Duc (Duc), chairman of Hoang Anh Gia Lai Joint Stock Company.

He stated that in the first half of this year, the company achieved over 60% of its annual profit target, even before recording revenue from durian. The key factor driving this performance was the consistently high banana prices.

In the second half of the year, the company will begin recording revenue from durian, which is expected to become a new growth pillar. Based on this, the company plans to adjust its consolidated after-tax profit target for 2025 from 1,114 billion VND (approved at the annual general meeting on 6/6) to 1,500 billion VND.

In addition, the company expects to record an extraordinary income of over 1,000 billion VND in Quarter III after completing related procedures.

"Including this extraordinary income, the company could reach an after-tax profit of 2,500 billion VND this year," Duc wrote in the letter.

|

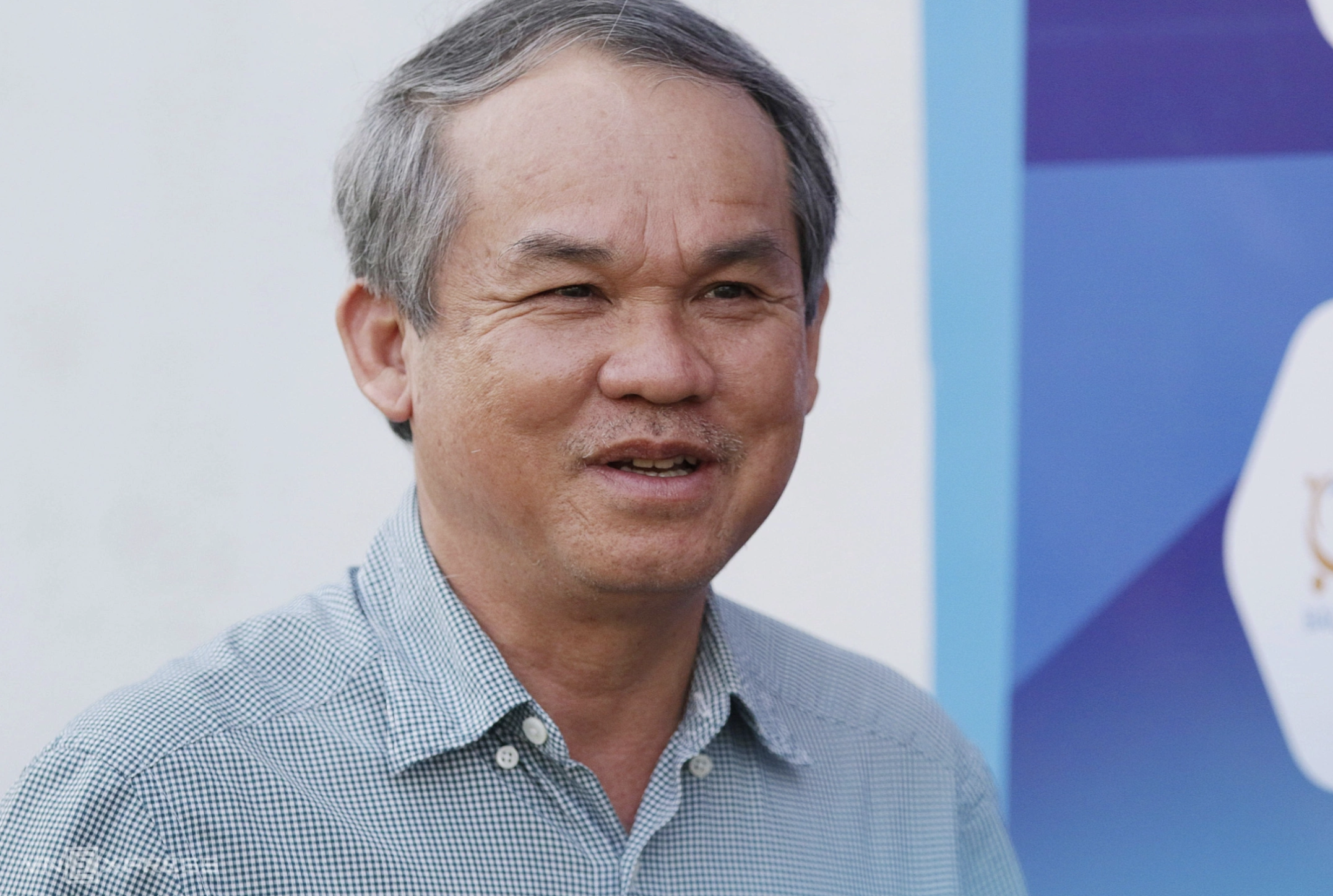

Doan Nguyen Duc, chairman of Hoang Anh Gia Lai Joint Stock Company. Photo: Duc Dong |

Doan Nguyen Duc, chairman of Hoang Anh Gia Lai Joint Stock Company. Photo: Duc Dong

Along with revenue growth, the company announced it will invest in planting 2,000 hectares of coffee and tea and 2,000 hectares of mulberry from 7/2025, after securing financing commitments from several credit institutions. According to the company, this is a strategic step to diversify products, increase the value of the agricultural supply chain, and ensure sustainable long-term growth.

Besides the plan to adjust profit upwards, Hoang Anh Gia Lai's leadership has recently stepped up stock buybacks and is preparing to increase capital through a private placement.

On 19/6, Duc purchased 10 million HAG shares, increasing his ownership from 30.26% to 31.2%, equivalent to nearly 330 million shares. Previously, two members of the board of directors, Vo Thi My Hanh and Ho Thi Kim Chi, each purchased 1 million shares through private agreements.

At the annual general meeting on 6/6, the company presented a plan to issue a maximum of 210 million shares in a private placement to swap for B-series bonds worth 2,520 billion VND. The expected issue price is 12,000 VND per share, with a transfer restriction of one year. If completed, bondholders will hold nearly 19% of the company's shares.

Thi Ha