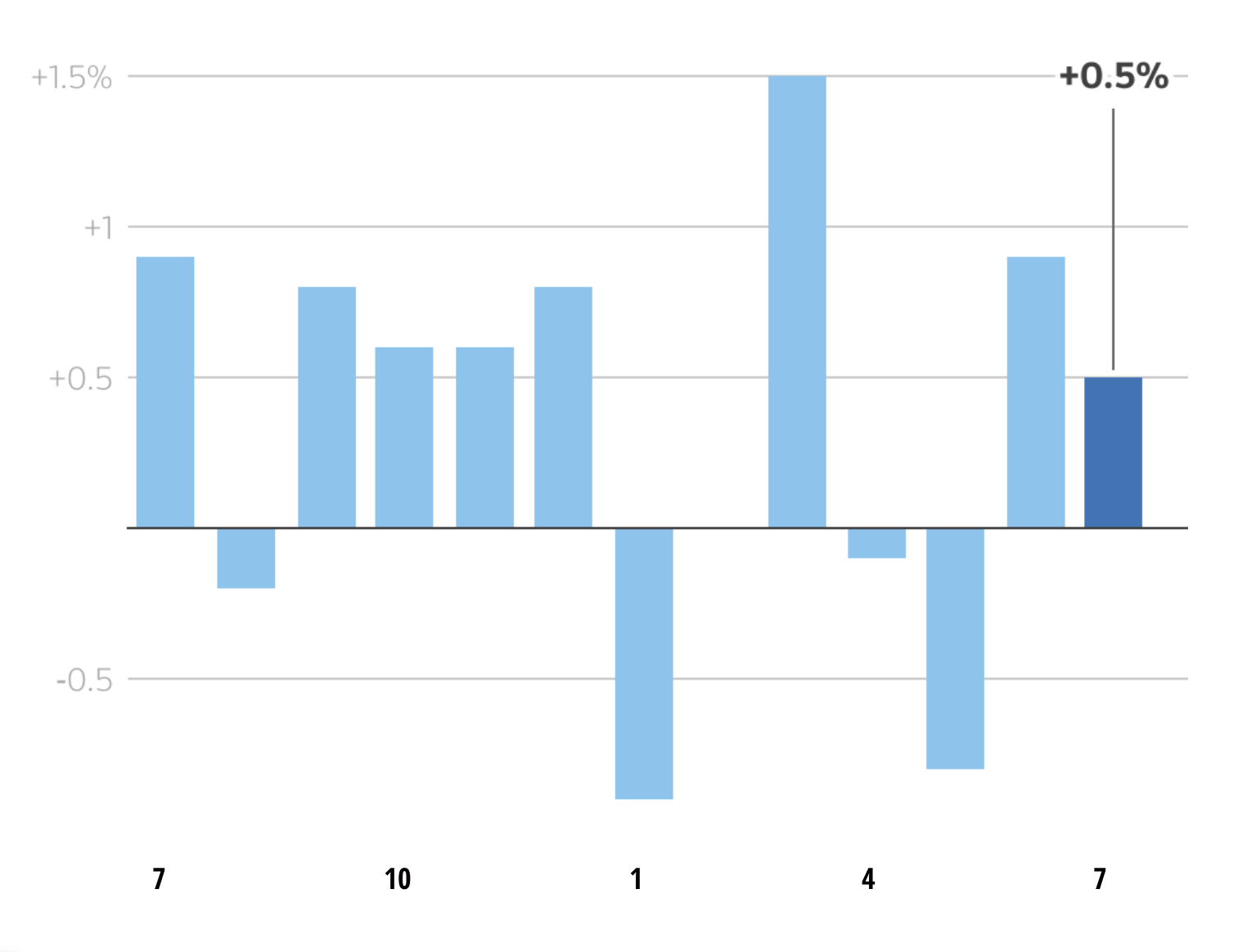

US retail sales rose 0.5% in July compared to the previous month, marking two consecutive months of growth, according to the US Census Bureau. This rise eased some concerns of an economic slowdown following weak job growth figures over the past three months.

Year-over-year, the index increased by 3.9%. Auto sales contributed the most to this growth, with sales at dealerships increasing by 1.6%. According to analysts from J.P. Morgan, this increase was driven by a surge in electric vehicle purchases before the federal tax credit expired on 30/9.

|

Cars at a shipping terminal in San Diego, California, USA, on 26/3. Photo: Reuters |

Cars at a shipping terminal in San Diego, California, USA, on 26/3. Photo: Reuters

Online sales, which grew by 0.8% month-over-month, also contributed to the retail index. Through deep discounts, including back-to-school essentials, Amazon and Walmart attracted millions of inflation-wary consumers.

Revenue from clothing stores also rose by 0.7%, and furniture by 1.4%, while sales of sporting goods, toys, musical instruments, and books increased by 0.8%. However, the increase in revenue did not correspond to the volume of goods sold, reflecting the impact of tariffs.

Conversely, household spending indicators declined. Sales at building material and garden equipment retailers fell by 1%, while electronics and appliance sales dropped by 0.6%. Households also reduced spending at restaurants and bars. Sales in food services and drinking places—a key indicator of household finances—decreased by 0.4% after rising 0.6% in June.

|

Monthly retail sales growth. Source: US Census Bureau |

Monthly retail sales growth. Source: US Census Bureau

Analysts warn of an increasing risk of reduced consumer spending amid a weakening labor market and rising prices for goods and services.

Lydia Boussour, senior economist at EY-Parthenon, predicts consumer demand will decline further in the coming months. The impact of tariffs may become more pronounced as consumers increasingly limit purchases in response to rising costs.

Regarding the impact of tariffs on Americans, supporters within the Trump administration argued that import prices would fall after tariffs were imposed because exporters would lower prices to protect export sales and market share. "We haven't seen that," said Carl Weinberg, chief economist at High Frequency Economics.

For example, import prices for consumer goods excluding motor vehicles increased by 0.4%, indicating that exporting countries did not lower prices to offset the impact of tariffs as the White House suggested.

Furthermore, tariffs are constraining manufacturing activity. A report from the Federal Reserve (Fed) showed that factory output stagnated in July.

Veronica Clark, an economic analyst at Citigroup, said tariffs, supply chain disruptions, and shipping delays are factors affecting overall manufacturing activity. She added that some manufacturing sectors might still benefit from tariffs.

Bao Bao (according to Reuters)