Tesla stock closed down 5.3% on 1/7, its lowest point in three weeks. According to the Bloomberg Billionaires Index, this erased $12.1 billion from CEO Elon Musk's net worth in a single day, making him the world's biggest loser among billionaires that day.

The decline stemmed from Musk's continued criticism on Monday (30/6) of Trump's tax and spending cut bill. Dubbed the "One Big Beautiful Bill" (OBBBA), the legislation would eliminate subsidies for electric vehicle buyers, which have significantly benefited Tesla. Musk also declared on X his intention to form a "Party of America" if the OBBBA passed.

By midday on 2/7, the bill narrowly passed the US Senate. The same day, former President Donald Trump threatened to cut billions of dollars in federal subsidies that Elon Musk's companies receive, marking an escalation in the feud between him and his former ally.

"Musk is losing the electric vehicle incentives. He's upset about a lot of things, but he can lose a lot more than that," Trump said at the White House. On Truth Social, the former president added, "No more rocket launches, no more satellites, no more electric car production, our country will save a tremendous amount of money."

|

Former President Donald Trump (right) and Elon Musk at the White House on 30/5. Photo: AP |

Former President Donald Trump (right) and Elon Musk at the White House on 30/5. Photo: AP

Before leaving the administration in late May, Musk led the Government Performance Board (DOGE), aiming to reduce federal spending. Trump now says DOGE might scrutinize subsidies given to Musk's companies. "Do you know what DOGE is? It's the monster that can come back and swallow Elon," he said.

In response to the threat, Musk wrote on X, "I'm serious, cut them all. Right now." He later added that he could escalate the tension with Trump, but "will refrain for now."

While Musk has advocated for eliminating subsidies, Tesla has benefited from billions in tax breaks and other policy support for clean transportation and renewable energy, according to Reuters. Losing electric vehicle subsidies would cost Tesla an additional $1.2 billion, or 17% of its 2024 operating income, according to J.P. Morgan estimates.

The Trump administration controls many of these subsidy programs, including the $7,500 incentive for electric vehicle buyers or lessees to stimulate demand. Trump posted on Truth Social that "without subsidies, Elon would probably fold up shop and go back to South Africa."

Gary Black, CEO of The Future Fund and a longtime Tesla investor, recently sold all his Tesla stock. He told Reuters that the loss of the electric vehicle tax credit would be a significant blow to the automaker. On X, Black wrote, "I don't understand why Elon Musk didn't anticipate that opposing Trump's 'beautiful' bill would lead to this."

Earlier last month, Musk and Trump clashed over the OBBBA. Musk criticized the bill as a "hideously awful mistake." Trump responded with threats to cut government contracts with Musk's companies. This sent Tesla stock down more than 14% in one session, wiping $152 billion off the company's market capitalization and $34 billion from Musk's wealth.

|

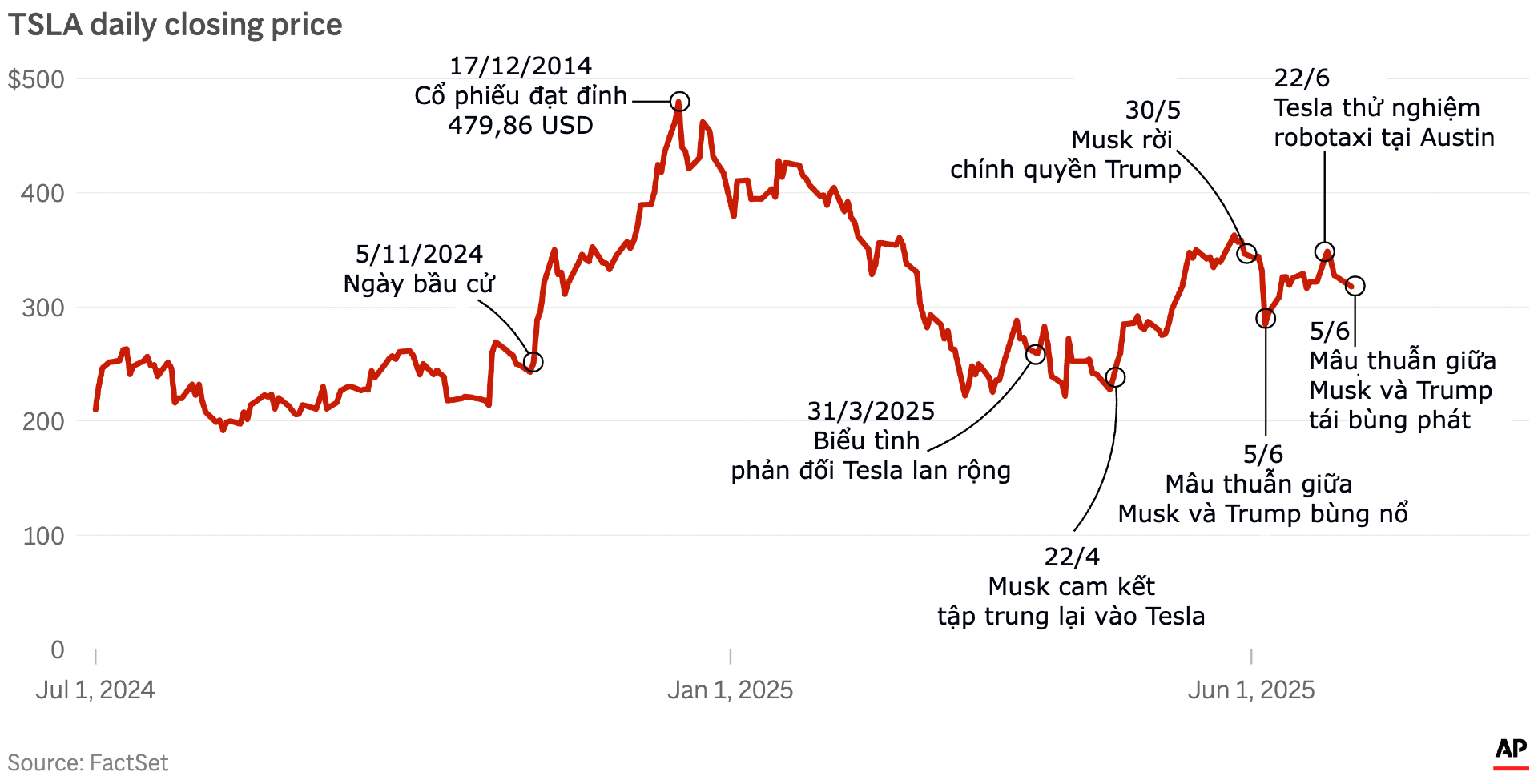

Tesla's stock performance over the past year (USD). Graphic: AP |

Tesla's stock performance over the past year (USD). Graphic: AP

Tensions cooled afterward, but experts say Musk's reigniting the feud just a month later could pose further challenges to his business empire, especially as his primary asset, Tesla, is heavily betting on the robotaxi service currently being tested in Austin, Texas.

The robotaxi rollout depends heavily on state and federal regulations for autonomous vehicles. The US Department of Transportation will play a key role in deciding whether Tesla can deploy robotaxis en masse. "Tesla's current value is largely based on the progress of self-driving technology. I don't think there will be any major changes right now, but this is clearly a risk," said Gene Munster, an expert at Deepwater Asset Management.

Tesla also generates billions of dollars by selling emissions credits to automakers that don't meet environmental regulations. Without this revenue, the company would have lost money in Quarter I. Analysts predict another difficult quarter for the electric vehicle maker when it releases its Quarter II delivery figures this week.

Musk acknowledged that consumer boycotts over his political views have impacted sales. However, he mainly blamed a less serious and temporary factor: customers eagerly awaiting the new version of the Model Y SUV, postponing purchases for the past few months.

But even with the new version on sale, sales continue to decline. Figures released last week show that sales in Europe in May fell 28% compared to the same period in 2024, the fifth consecutive month of decline.

Ironically, the online feud between Musk and Trump threatens Musk's businesses from both sides. Consumers are hesitant to buy his cars, remembering his previous close relationship with Trump. Now, that fractured relationship risks harming his other businesses.

"In a bizarre world, he’s managed to alienate both sides. It sounds impossible, but he’s actually done it," commented Dan Ives, a financial analyst at Wedbush Securities.

Phien An (according to Reuters, AP)