DCDS, Dragon Capital's Dynamic Capital Securities Investment Fund, launched in 5/2004, is one of the oldest open-ended funds in Vietnam. As of the valuation date on 15/9, the fund's net asset value (NAV) reached 109,435.73 VND per unit, a 34.38% increase compared to the beginning of the year. As of the end of August, the fund's 5-year return reached 170.1%, double that of the VN-Index (75.1%).

|

Fund growth compared to the VN-Index since early 2020. Photo: DCDS |

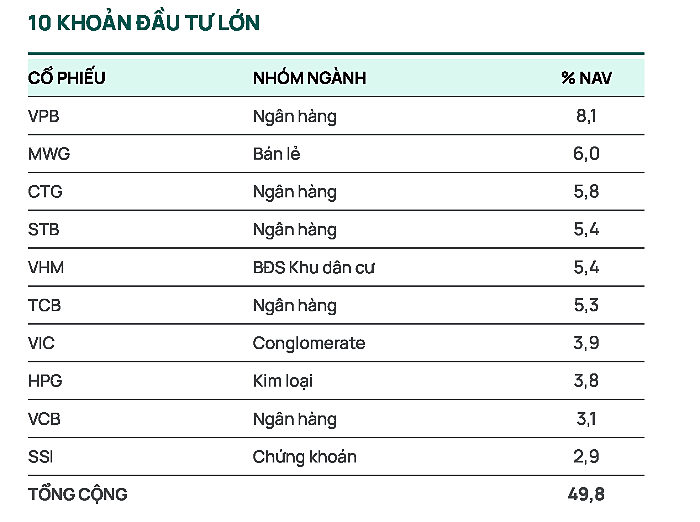

A flexible investment strategy is key to DCDS's success. During the first half of the year, as the VN-Index experienced continuous adjustments, DCDS proactively adjusted its strategy with flexibility. Before April, the fund increased its cash position to 24% and invested when the market declined, focusing on VIC and VHM—stocks that contributed to the VN-Index's recovery after tariff shocks.

By the end of June, the fund gradually reduced its holdings in VIC and VHM, shifting capital to banking stocks including TCB, STB, MBB, and CTG. The proportion of banking stocks increased from 28.28% at the end of May to 31.73% at the end of June. In July, the fund acquired additional VPB shares, increasing its weighting from 2.88% to 8.07% by the end of August. VPB's nearly 90% increase in just two months significantly contributed to the VN-Index's growth.

|

Top 10 investments of DCDS in 8/2025. Photo: DCDS |

This portfolio management approach has enabled DCDS to outperform the market index over the past three months. In the long term, the fund's 5-year performance has reached 170.1%, while the VN-Index has increased by 75.1%. This difference highlights the effectiveness of the fund's asset allocation and risk management strategies.

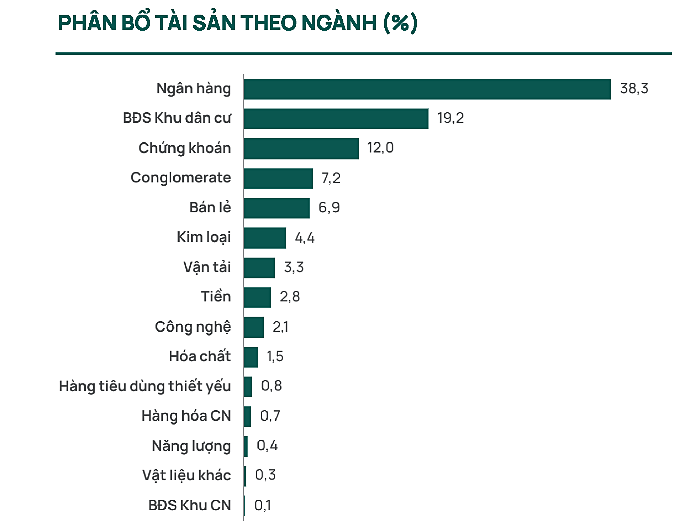

Portfolio diversification is another factor in DCDS's consistent performance. The fund typically holds 50 to 60 stocks, compared to 20 to 40 in many other funds. This broader approach helps diversify risk and ensure liquidity, even as asset size grows.

|

DCDS's investment portfolio in 8/2025. Photo: DCDS |

While DCDS's total assets are significantly higher than many similar funds, its broad portfolio and flexible management approach have kept it among the market leaders. According to the fund's statistics, about 30% of investors who have held DCDS certificates for over two years have seen returns exceeding 45%. This demonstrates the potential for long-term wealth accumulation through methods like systematic investment plans (SIPs) or dollar-cost averaging (DCA).

The experienced management team also plays a crucial role in DCDS's success. Established in 2004, the team has over 20 years of experience in the Vietnamese stock market, navigating various periods of volatility, including the 2008 financial crisis and the Covid-19 pandemic. This practical experience enables them to anticipate market trends and capital flows.

The fund's management team includes several seasoned professionals: Dr. Le Anh Tuan, Investment Director, who will become CEO of Dragon Capital Vietnam on 1/10/2025; Mr. Vo Nguyen Khoa Tuan, Senior Director of Securities; Mr. Nguyen Sang Loc, Portfolio Management Director; and Ms. Luong Thi My Hanh, Domestic Asset Management Director. These members all have 15 to 20 years of experience in the industry.

With its experienced personnel, DCDS pursues a "weather all weathers" strategy, adapting to and overcoming market fluctuations. The fund's positive performance in 2025, as well as over the past three to five years, reflects a combination of a stable macroeconomic environment, market growth, and the management team's capabilities.

Minh Ngoc