On 28/1, following a two-day policy meeting, the Fed decided to keep its benchmark interest rate at 3.5-3.75%. This move matched market forecasts and came after the central bank implemented three monetary policy adjustments last year. Several Fed officials recently stated their preference to observe the impact of these previous cuts before considering further action.

"Economic activity continues to grow at a solid pace," the Fed noted in its announcement on 28/1. It also indicated that inflation "is still picking up speed," while the labor market "shows some signs of stabilizing."

Despite acknowledging that "job growth remains low," the Fed no longer characterized risks to the labor market as accelerating. This shift suggests reduced concern among officials about a rapid weakening of employment conditions.

|

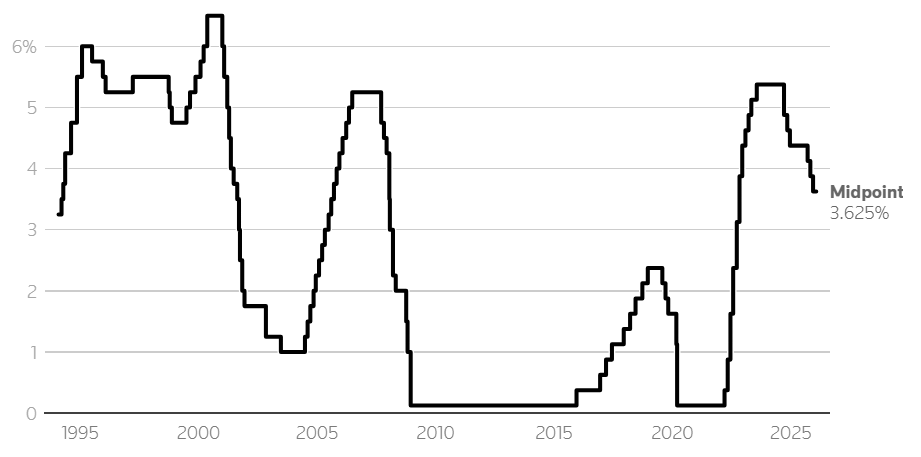

Average benchmark interest rate in the US, 1995-2025. *Graphic: Reuters* |

Prior to the meeting, Fed officials assessed the labor market as relatively balanced. Low job growth was consistent with a slower increase in job seekers, partly due to the Trump administration's stricter immigration policies. The US unemployment rate in December fell to 4.4%.

The Fed's announcement provided no indication regarding the timing of future rate cuts, emphasizing that such decisions would depend on incoming data and the evolving economic outlook.

However, two governors dissented from the majority decision. Christopher Waller, a candidate for the next Fed Chair, and Stephen Miran, temporarily appointed by President Trump to the Board of Governors, both advocated for an additional 25 basis point (0.25%) rate reduction.

This meeting occurred amidst growing scrutiny of the Fed's independence. Just last week, the US Supreme Court heard arguments in a lawsuit involving Fed Board of Governors member Lisa Cook, where judges questioned President Donald Trump's authority to dismiss her based on mortgage fraud allegations.

Adding to the pressure, Fed Chair Jerome Powell released a rare video earlier this month, responding to White House pressure. He revealed he is under federal investigation by prosecutors concerning last year's testimony related to a renovation project at the Fed headquarters in Washington.

This meeting marks one of Powell's three final meetings as Chairman, with his term concluding on 15/5. President Trump may nominate a successor as early as this week.

(according to Reuters)