According to Doctor Can Van Luc, at a personal finance planning forum on 23/8 organized by the Vietnam Financial Consultants Association (VFCA), 60% of clients reported receiving information primarily about financial products, without in-depth analysis or guidance on their financial goals. Data from the State Bank of Vietnam reveals that 65% of clients are mainly introduced to existing financial products, regardless of their long-term personal financial objectives.

"Financial advising currently prioritizes sales to achieve personal KPIs rather than providing effective financial solutions for clients," Luc stated.

This sales-driven approach has led to mismatched products and client dissatisfaction. In 2022-2023, the market witnessed numerous scandals involving investment-linked insurance packages and corporate bonds, damaging the industry's reputation.

|

Doctor Can Van Luc speaking at the forum on 23/8. Photo provided by the organizers |

Doctor Can Van Luc speaking at the forum on 23/8. Photo provided by the organizers

Ngo Thanh Huan, CEO of FIDT Investment Consulting and Asset Management Company, echoed this sentiment. He attributes this common practice to the commission-based income structure of financial advisors. Their earnings depend on sales, not consultation fees, making them more like product brokers than financial advisors.

"Financial advisors should discuss clients' financial goals, not just products," Huan emphasized.

Huan believes competent advisors can be excellent salespeople, even better than brokers, because they offer products based on clients' actual needs and goals. Citing a 2023 survey published in the International Journal of Multidisciplinary Research and Analysis (IJMRA), he noted a high turnover rate among life insurance agents, with over 80% leaving within the first two years, and sometimes even within the first 12 months.

|

Ngo Thanh Huan, CEO of FIDT, speaking at the forum on 23/8. Photo provided by the organizers |

Ngo Thanh Huan, CEO of FIDT, speaking at the forum on 23/8. Photo provided by the organizers

Luc agreed that the current system restricts financial advisors. Bank advisors typically focus on cards, deposits, and credit, while insurance advisors concentrate on insurance products. These institutions often set product-specific KPIs for their staff.

This stems from a lack of a comprehensive ecosystem. Financial institutions offer specialized products (banking, securities, insurance) without close collaboration for comprehensive packages. Furthermore, there's a shortage of training programs in personal finance and financial advising. Advisor qualifications vary due to the absence of standardized competency frameworks or minimum professional certifications.

Huan added that clients are not accustomed to trusting and paying for financial advice. He suggested shifting advisor income towards client-paid fees for consultation services, rather than product sales.

Huan proposed a model based on the UK's Financial Planning Group. Holistic financial advisors would create comprehensive plans, connecting client needs with suitable products. Clients would receive investment advice tailored to short-term and long-term goals. Then, they would be connected with specialized product advisors who possess in-depth knowledge of specific products applicable to various client groups.

This model requires financial institutions to develop diverse solutions and create a transparent, efficient financial transaction environment. More importantly, regulatory bodies need a legal framework for financial advising, including national certifications, standards, and a unified competency framework.

|

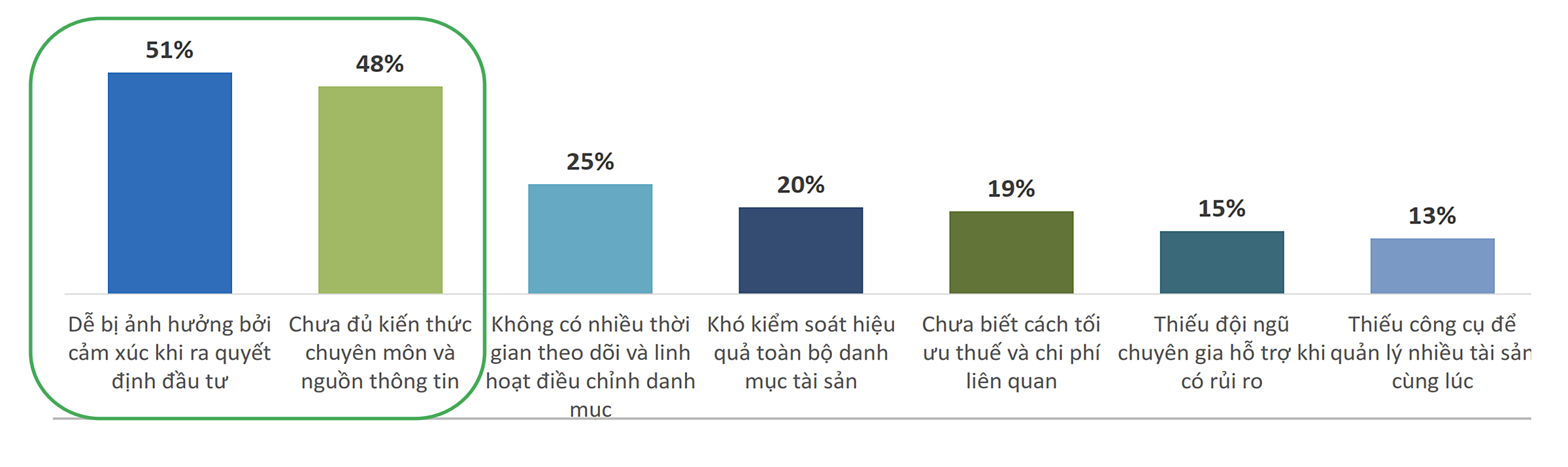

Many individuals make financial decisions based on emotions and lack of knowledge. Image from TVAM's survey |

Many individuals make financial decisions based on emotions and lack of knowledge. Image from TVAM's survey

Financial advice is increasingly essential. A July survey by Thien Viet Asset Management Corporation (TVAM) of 579 investors in five major cities found that 51% of respondents admitted to being influenced by emotions when making investment decisions. 48% acknowledged insufficient knowledge, and nearly one-third expressed a need for comprehensive financial planning advice.

According to Doctor Can Van Luc, professional financial advising can help individuals grow and protect their assets amidst increasing economic uncertainty. This is crucial given the growing complexity of financial products and services, where a lack of knowledge can lead to scams.

Tat Dat