The VN-Index chart today formed a hammock shape, opening quite positively. After the ATO session, the market rose more than 6 points to over 1,388 points, the highest level of the day. Immediately afterward, the market cooled down as selling pressure emerged, pushing the general index below the reference point, but not too significantly. Near lunchtime, the VN-Index regained its positive momentum.

The market fluctuated slightly in the first half of the afternoon session with a low amplitude. It wasn't until after 2 PM that the general index improved significantly as many stocks reversed their course, although buying demand remained low. The VN-Index closed near 1,387 points, up more than 5 points compared to yesterday (4/7).

On the HoSE, 204 stocks maintained gains, double the number of declining stocks. Six stocks hit their ceiling prices, mainly those with small and medium capitalization.

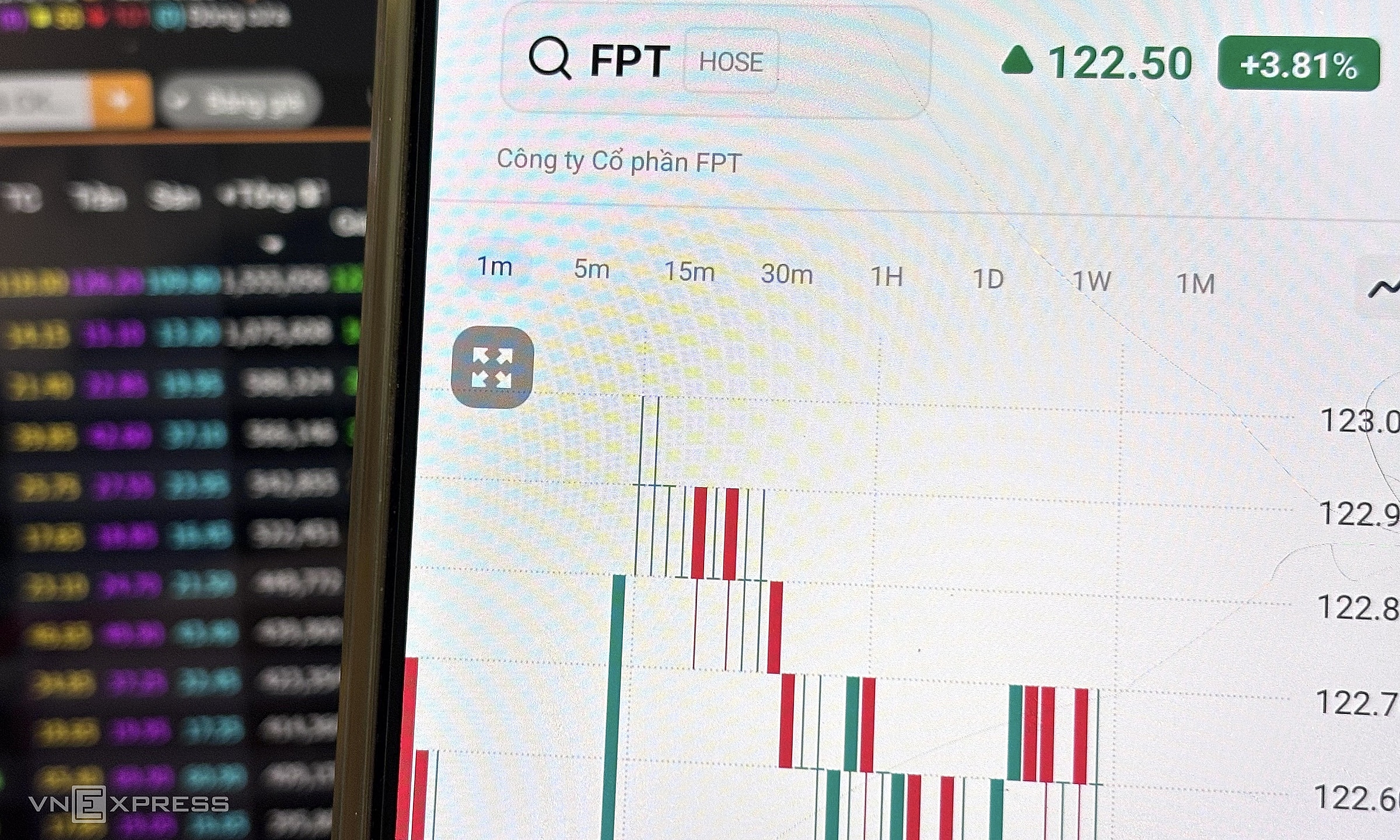

FPT was the stock that contributed the most to the market's gains today. It accumulated 3.8%, reaching 122,500 dong per share. Its liquidity led the market, reaching over 1,555 billion dong, the highest level since mid-April.

|

Investors are following the movements of FPT shares in today's session, 4/7. Photo: Tat Dat |

Investors are following the movements of FPT shares in today's session, 4/7. Photo: Tat Dat

Recently, FPT Corporation's shares have seen renewed investment from proprietary trading and foreign investors. BIDV Securities (BSC) has given the stock a positive rating. This is due to the corporation cutting indirect costs by about 30% and maximizing resources from its ecosystem. In addition, the affiliated company FPT Retail is expected to increase its pre-tax profit by 46% this year, further contributing to FPT's business results.

In the session where the market rebounded, liquidity decreased by almost 37%. Total trading value on the HoSE today fell to nearly 20,900 billion dong.

Foreign investors continued their buying streak for the second consecutive session, with a net purchase of about 1,780 billion dong. FPT was the most heavily invested stock with over 458 billion dong, followed by ACB (273 billion). Foreign investors also had net purchases of over 100 billion dong in FUEVFVND fund, MWG, and HPG.

Overall, the VN-Index gained more than 15 points this week, with the only decline occurring on 3/7, following news of the tariff negotiation results between the US and Vietnam. However, the decline in this session was not too significant. This partially indicates that cash flow is diversifying into stocks with unique narratives, and partially suggests that investors are still waiting for clearer regulations on US countervailing duties.

In the previous session's report, Saigon - Hanoi Securities (SHS) stated that the VN-Index and VN30 are in a short-term overbought state and are under pressure to correct. The current situation shows that the risk of short-term peak distribution in many stocks and groups has emerged as the market faces selling pressure with a sudden increase in volume after a 3-month period of recovery and strong price increases.

Tat Dat