According to the consolidated financial statement, Gelex's net revenue in Q2 reached 10,131 billion VND, a 22.8% increase compared to the same period in 2024. The electrical equipment sector remained the largest contributor, accounting for 64.3% of total revenue with 6,518 billion VND, a 24.8% increase. Member companies such as Cadivi, Emic, Thibidi, and CFT improved operational efficiency by adjusting sales policies and optimizing production management.

Other sectors also recorded positive growth. Revenue from industrial parks and real estate reached 1,110 billion VND (up 39.4%), construction materials 2,149 billion VND (up 11.1%), and infrastructure utilities 343 billion VND (up 17.5%).

The group's gross profit in the quarter reached 2,334 billion VND, a 56.1% increase, bringing the gross profit margin to 23% compared to 18.1% in the same period last year.

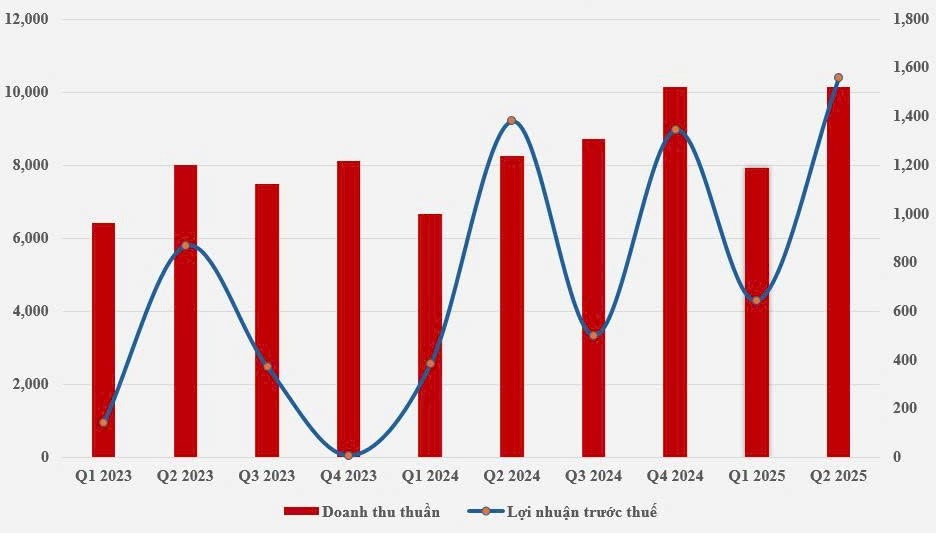

|

Quarterly business results, from 2023 to 2025. Photo: Gelex |

Quarterly business results, from 2023 to 2025. Photo: Gelex

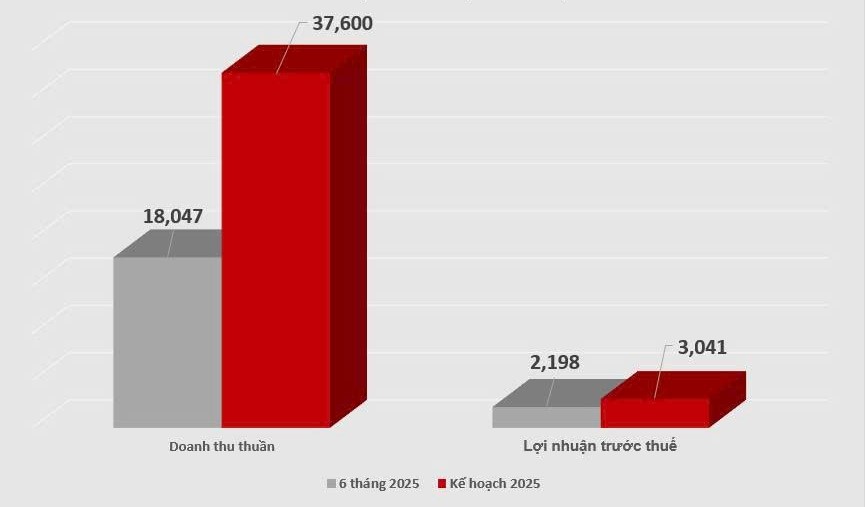

For the first six months of the year, Gelex recorded net revenue of 18,047 billion VND, up 21.1%, and pre-tax profit of 2,198 billion VND, up 24.3% year-on-year. Excluding profit from the transfer of renewable energy projects to partner Sembcorp, pre-tax profit from core business operations still nearly tripled.

Le Tuan Anh, the group's deputy general director, stated that these results reflect the effectiveness of strategy implementation, cost optimization, and flexible adaptation to market fluctuations. As of the end of Q2, the group has achieved 48% of its revenue plan and 72% of its profit target for the year.

|

The group's revenue and profit for the first six months of the year and the 2025 plan. Photo: Gelex |

The group's revenue and profit for the first six months of the year and the 2025 plan. Photo: Gelex

As of 30/6, Gelex's total consolidated assets reached 59,261 billion VND, a 10.2% increase compared to the beginning of the year. Short-term assets increased by 16.4%, mainly due to the expansion of short-term financial investments and an increase in inventory to serve production and business activities. Financial indicators such as debt ratio, liquidity, and solvency remained stable, exceeding standard thresholds.

According to a report published on 18/6 by Japan Securities, Gelex is considered aligned with the ESG (environmental, social, and governance) trend—sustainable investment—thanks to its diversified product strategy, market expansion capabilities, and flexible approach to changes in the business environment.

The group is currently increasing investment in research and development of high-tech, environmentally friendly products, while also strengthening trade promotion and expanding its export market share. Cooperation with international corporations is also helping Gelex access advanced technologies and attract high-quality capital for large projects.

Last June, Gelex secured a non-binding loan of 79 million USD from major international banks, supplementing resources for strategic projects. Concurrently, the group is implementing programs to strengthen internal resources, such as building a risk management framework, digital transformation, and corporate culture renewal, aiming to become a high-performing organization with sustainable adaptability.

Song Anh