Gold saw a stable trading week after several volatile periods, closing last week at 4,226 USD, its highest in two weeks.

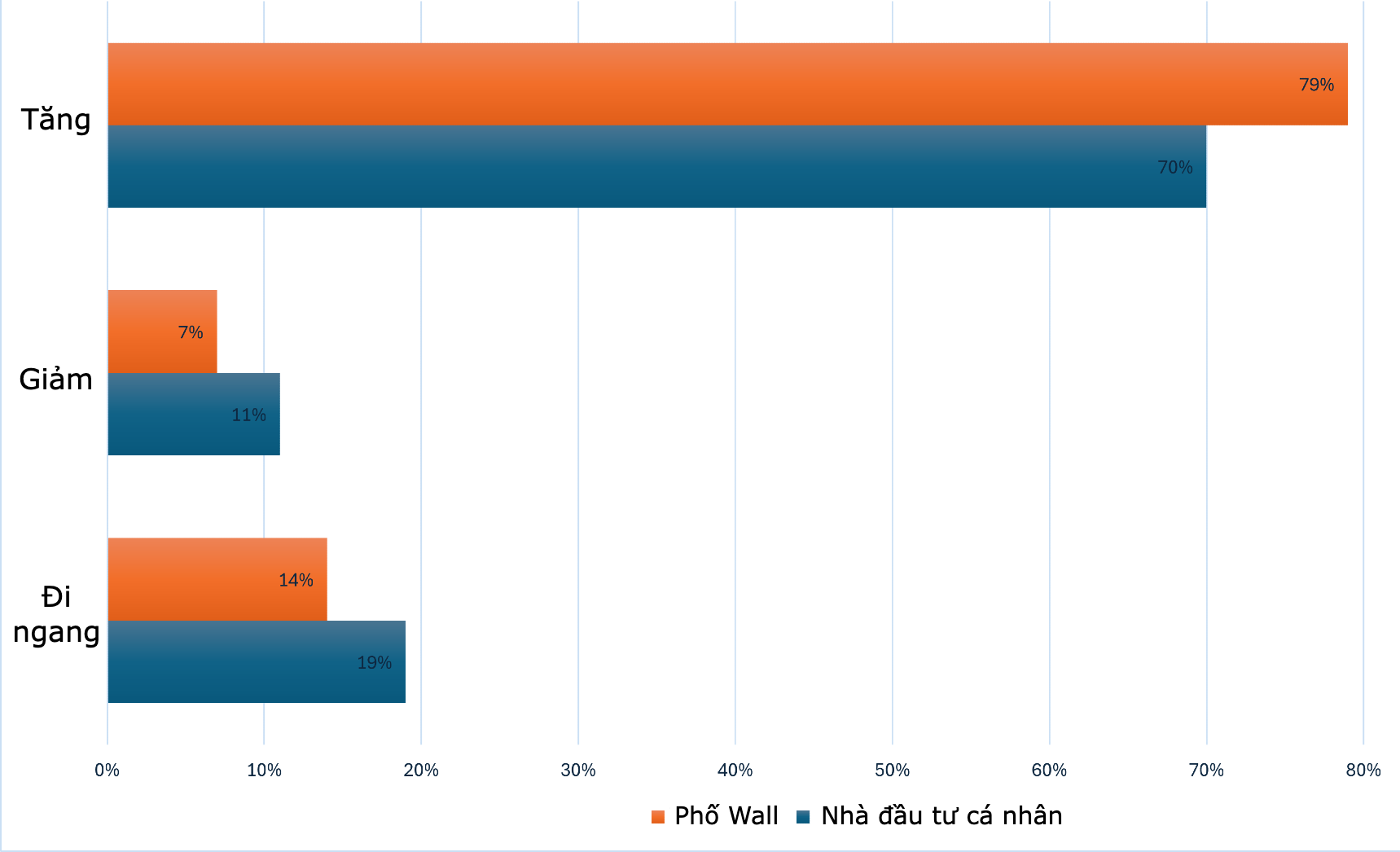

Kitco News' weekly survey revealed increased optimism among Wall Street analysts and strengthened confidence among individual investors for rising gold prices. Of 14 surveyed analysts, 11 (79%) predicted a gold price increase this week, with only one expecting a decline. The remaining two analysts (14%) forecast sideways trading for the precious metal.

An online poll conducted by Kitco gathered 260 votes from individual investors. Of these, 183 votes (70%) indicated a positive outlook for this week. Forecasts for a decline and neutrality stood at 11% and 19%, respectively.

|

Gold price forecast for the week of 1-5/12. *Source: Kitco*. |

Rich Checkan, President of Asset Strategies International, expressed confidence in further gold price increases. He cited "the ongoing Ukraine conflict and growing expectations for the US Federal Reserve (Fed) to implement a third interest rate cut this year" as key supporting factors.

James Stanley, a senior strategist at Forex, sees no reason for pessimism regarding gold. However, he cautioned that "chasing" prices now carries a high risk of "buying the top", as some long-term investors might take profits before year-end.

Alex Kuptsikevich, a senior analyst at FxPro, projected a gold price decrease next week. He noted the precious metal's trading reflects a conflict between expectations of continued Fed monetary easing and other factors that still exert downward pressure on prices.

Adrian Day, President of Adrian Day Asset Management, offered a more neutral outlook, suggesting gold prices will find it difficult to break out until the Fed's official December interest rate announcement. "The rate cut has already been priced in, creating a risk if the Fed does not cut", he stated. "However, it appears a bottom has formed after the October peak, and gold prices might trade sideways before their next upward move".

Phien An (according to Kitco)