Last week, global gold prices continued their upward trend despite a series of positive US economic data releases. Investor concerns about geopolitical risks and US debt briefly pushed gold prices to 3,365 USD per ounce. Overall, the precious metal gained nearly 2% for the week, closing at 3,334 USD per ounce.

This week, the direction of gold prices is uncertain. In a Kitco survey of bank managers, analysts, and traders, 36% believe the price will rise, 28% expect a decline, and 36% anticipate sideways movement.

|

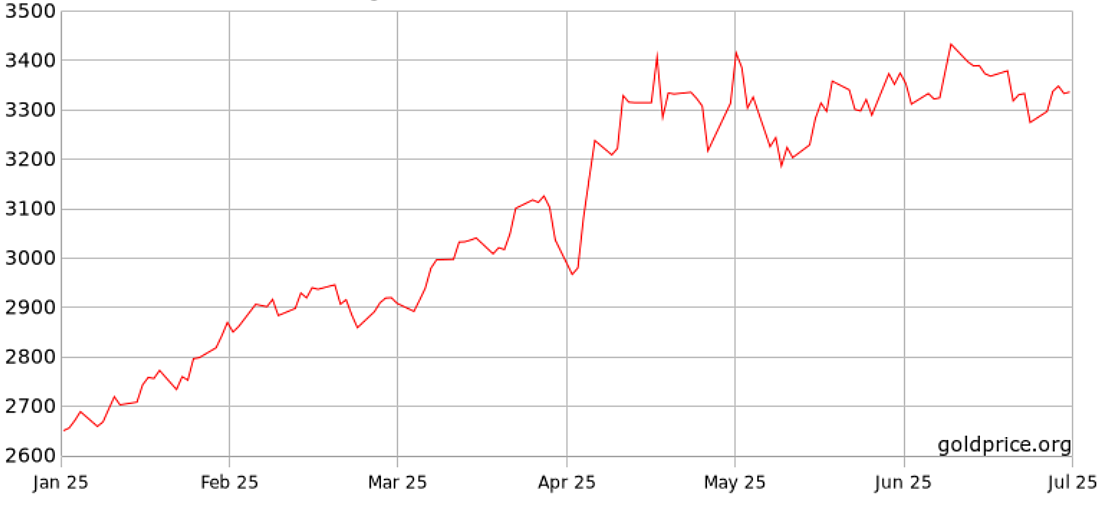

Global gold price movements in the first half of 2025. Chart: Goldprice |

Adam Button, chief currency strategist at Forexlive.com, suggests that the prolonged USD sell-off will support gold. "The dollar initially rose after the jobs report, then fell quickly. The USD sell-off has dominated the first half of the year. If this continues, gold will benefit," he explained.

Meanwhile, Adrian Day, president of Adrian Day Asset Management, believes factors such as trade agreements, the possibility of a Fed rate cut in July, and central banks slowing down gold purchases could put pressure on the precious metal. However, any correction "is likely to be shallow and short-lived."

Marc Chandler, managing director at Bannockburn Global Forex, also leans towards a price decline due to positive US economic data this week. He believes gold is still in a correction phase and could return to the 3,250 USD range.

Colin Cieszynski, chief market strategist at SIA Wealth Management, notes that gold prices haven't shown a clear trend over the past two months. He points out that the market is currently anticipating a total of 80 basis points (0.8%) in rate cuts from the Fed this year.

"This equates to three rate cuts in the remaining four meetings this year," Cieszynski said. But even if the Fed cuts rates soon, he doesn't foresee a major change in gold prices.

This week, investors will receive several key pieces of information, including the Reserve Bank of Australia's policy meeting, the minutes from the Fed's June meeting, and the weekly US jobless claims report.

Ha Thu (via Kitco, Reuters)