A recent weekly Kitco survey reveals industry experts are split between bullish and neutral on gold's short-term outlook. Meanwhile, retail traders have abandoned their bullish expectations.

Of the 15 Wall Street analysts surveyed, seven predict gold prices will rise next week. Only one analyst anticipates a decline, while the rest expect the precious metal to trade sideways.

On Main Street, 231 retail traders participated in Kitco's online poll. 104, or 45%, predict gold will rise next week, while 27% expect the opposite. The remaining 28% anticipate sideways trading.

|

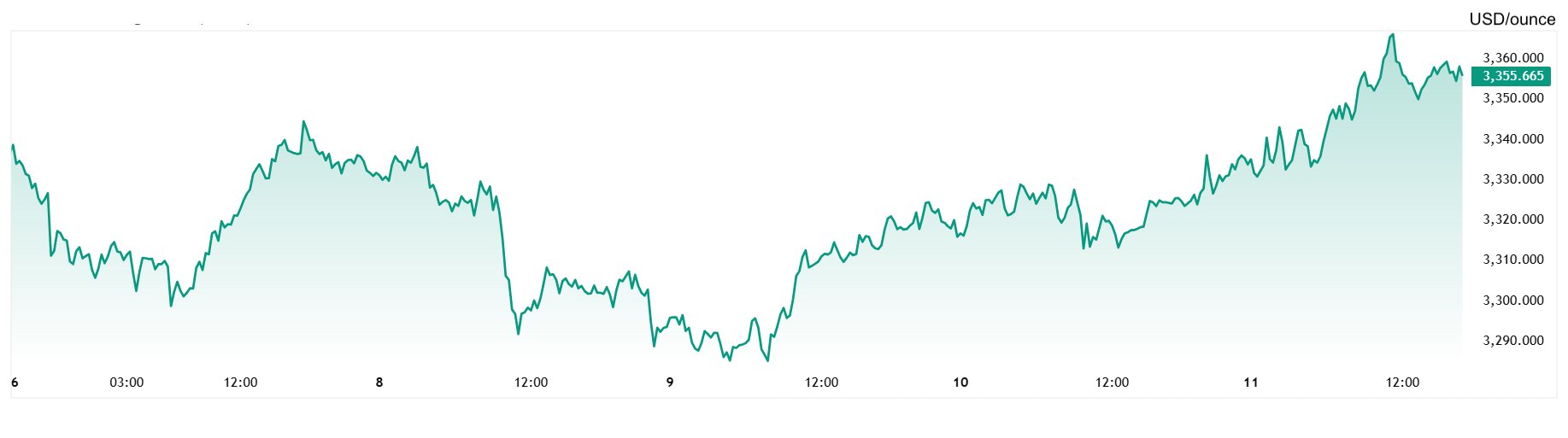

World gold price movements during the week of 7-11/7/2025. Photo: Trading View |

Marc Chandler, managing director at Bannockburn Global Forex, observed gold's decline in the first two days of last week, followed by a three-day recovery. He suggests US tariff policies have helped gold rebound, but is unsure if it has enough momentum to reach its near-record high of 3,500 USD.

"A price increase seems to be only a matter of time; a significant drop is unlikely," he stated.

Adam Button, chief currency strategist at Forexlive, witnessed a divided market last week with the passage of the "Big Beautiful Bill." This bill includes hundreds of provisions, such as adjustments to personal income tax, student loan regulations, and inheritance tax changes. Concurrently, the US will significantly cut spending on social security programs. The law also allocates hundreds of billions of USD to deport immigrants, establishing a two-tiered tax system for US citizens and households with at least one immigrant member, regardless of legal status.

The White House claims workers and families will see "an average increase in after-tax income of more than 10,000 USD per year." However, many analysts consider this figure overly optimistic. Furthermore, estimates suggest the law will increase the national debt by 3,100 to 3,500 billion USD over the next decade.

|

Gold bars at a gold and silver separation plant in Vienna, Austria. Photo: Reuters |

Button notes those optimistic about the bill are buying stocks, while pessimists are opting for precious metals. "The optimists are thinking about how tax cuts will boost growth, while the pessimists are thinking that those tax cuts will need to be paid for in the future," he explained.

Driven by this pessimism, money is flowing into Bitcoin, silver, and gold. Silver and Bitcoin are attracting individual investors and have seen good price increases recently. Meanwhile, gold is appealing to central banks and global reserve managers – those more cautious about President Trump. This group may wait for market sentiment to stabilize after the tariff blows before selling USD and reallocating to gold.

Next week, the market awaits key economic data, including the June Consumer Price Index (CPI) and Producer Price Index (PPI) reports, June retail sales, weekly jobless claims, and the University of Michigan's preliminary consumer sentiment survey. The announcement of the EU's retaliatory tariffs is also significant.

Tieu Gu (according to Kitco)