On 21/6, the US deployed B-2 bombers to strike a suspected nuclear facility at Fordow and launched Tomahawk missiles at Natanz and Isfahan. US President Donald Trump declared these nuclear sites "completely obliterated", marking the first direct US airstrike on Iranian territory.

Experts believe this action escalates tensions in the Middle East, amidst the ongoing conflict between Israel and Iran. The Iranian Ministry of Health reported over 400 casualties from Israeli attacks. Residential areas in Tehran, Isfahan, and Natanz suffered significant damage, including building collapses and disruptions to power and water supplies.

Analysts on Al Jazeera predict the conflict will cost Tehran billions of USD, stifle economic growth, and raise concerns about long-term fiscal policy planning.

Iran is the third-largest oil producer in the Organization of the Petroleum Exporting Countries (OPEC). Data from last year shows its oil output at 3.2 million barrels per day, about 3% of global production. Crude oil is vital to Iran's economy, contributing significantly to its budget and foreign exchange reserves.

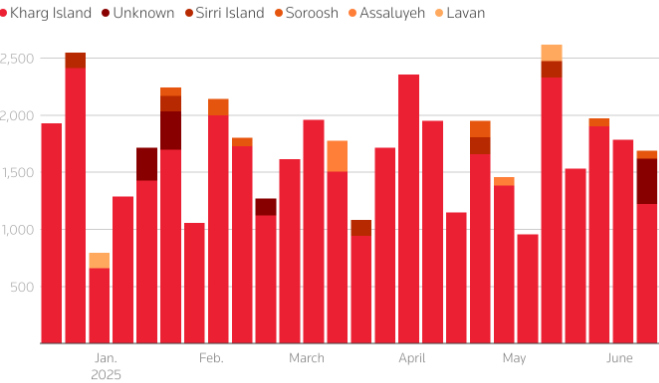

According to the International Energy Agency's (IEA) June report, Iran currently produces 4.8 million barrels of oil and condensate daily. Since the beginning of the year, it has exported an average of about 1.7 million barrels, primarily to China.

|

Weekly Iranian oil and condensate exports. Graph: Kpler |

Since the mid-month outbreak of conflict with Israel, Iran's oil and gas sector has struggled to maintain exports. Reuters, citing inside sources, reports that Tehran has resorted to loading oil onto tankers one at a time. Tankers anchor off Kharg Island, where Iran exports over 90% of its crude oil, then briefly approach the port to load, minimizing their time there.

Iran is also moving floating oil storage closer to China. As a result, its oil exports rose to 2.2 million barrels last week, according to oil data firm Kpler.

However, Israel attacked the Shahr Rey oil refinery near Tehran and fuel depots around the capital. The full impact on Iran's oil production remains unclear.

The natural gas sector has also been affected. On 14/6, Iran announced a partial shutdown of the South Pars gas field in the Gulf, following an Israeli airstrike. South Pars, the world's largest gas field, contributes 80% of Iran's gas production. The extent of the damage is yet to be disclosed.

Iran produces around 275 billion cubic meters of natural gas annually, about 6.5% of global output. However, this gas is consumed domestically due to sanctions preventing exports.

|

Smoke rises after an attack on the Sharan oil depot in Tehran, Iran, on 16/6/2025. Photo: Reuters |

For years, Iran's economy has been impacted by US sanctions, primarily due to its nuclear program. To pressure Tehran into nuclear negotiations, the Obama administration encouraged major economies to reduce or halt Iranian oil imports.

After Iran signed the 2015 JCPOA nuclear agreement with the P5+1 group (US, Russia, China, France, Germany, UK, and EU), economic sanctions were eased. In 2016, Iran exported up to 2.8 million barrels of oil per day.

However, in 2018, President Trump withdrew the US from the JCPOA, reimposing and expanding sanctions on Iran. This severely impacted Iran's foreign currency earnings. According to the Central Bank of Iran, the country earned only 23 billion USD from oil exports between March 2020 and March 2021. This figure gradually improved in subsequent years, reaching 67 billion USD between March 2024 and March 2025.

Beyond oil revenue constraints, Iran faces other challenges. Due to underinvestment, declining gas production, and inefficient irrigation systems, Iran experiences frequent power outages and water shortages.

A persistent budget deficit hinders long-term economic development and infrastructure improvements. President Masoud Pezeshkian has repeatedly highlighted the dire economic situation, claiming it's worse than the Iran-Iraq War in the 1980s. In March, he criticized new US sanctions targeting Iranian oil tankers.

The Iranian rial has depreciated over 90% against the USD since 2018, straining citizens. While official inflation is reported at 40%, some Iranian experts believe the actual figure exceeds 50%. "Accurate figures are difficult to calculate. Years of sanctions have fueled inflationary pressures through the rial's devaluation. Imports have become more expensive", said Hamzeh Al Gaaod, an economist at TS Lombard.

In January, Tasnim news agency quoted Ebrahim Sadeghifar, head of Iran's Labor and Social Welfare Institute, stating that 22-27% of the population lives below the poverty line. The official unemployment rate is 9.2%, but the Iranian Workers' Representatives Committee suggests the actual figure could be much higher.

Tehran has avoided complete economic collapse, partly thanks to China, its largest oil customer and among the few nations maintaining trade relations. According to Iranian customs data, non-oil trade between the two countries reached 34.1 billion USD between February 2024 and March 2025. The International Monetary Fund (IMF) estimates Iran's 2024 GDP at approximately 434 billion USD.

Al Gaaod states that Iran currently holds about 33 billion USD in foreign exchange reserves. "However, if they use these reserves for the conflict, they will face serious long-term risks," he concluded.

Ha Thu (via Al Jazeera, Reuters, DW)