VIB’s iDepo savings solution combines competitive interest rates with transferability, distinguishing it from traditional savings options. It removes the dilemma customers often face between high interest and flexibility. The product allows deposits with an interest rate of up to 7% per year for a 36-month term, with interest paid every six months.

A key feature is the ability to transfer the deposit contract to another person, such as family or friends, via the MyVIB transaction platform when funds are needed before maturity. The original depositor receives their principal plus any accrued interest, while the buyer continues to earn interest for the remaining term.

|

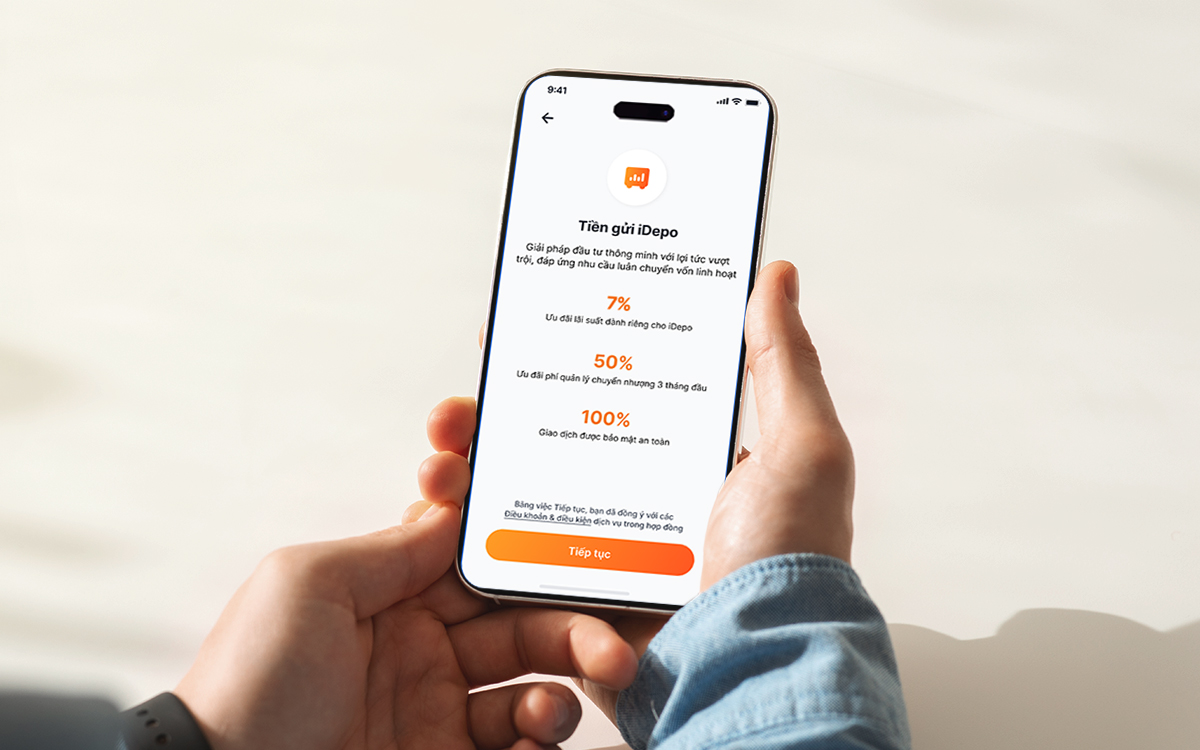

The iDepo savings solution from VIB. Photo: VIB

At year-end, 12-month deposit interest rates at banks typically range from 5,5% to 6,5% per year. While this offers a good return, these rates usually apply only to medium and long-term deposits. To secure these favorable rates, depositors must commit their funds for 12 months.

If unexpected needs arise—such as holiday spending, family support, or investment opportunities—depositors are often forced to make early withdrawals. This results in earning only the non-term interest rate, turning the potential 1,7-2,7% difference in earnings into a significant challenge for many savers.

Minh Tuan, 35, a technology company employee in Hanoi, has 1 billion VND saved for a future apartment purchase within the next 12-24 months. He is currently waiting for the real estate market to adjust and searching for suitable projects. Tuan faces a dilemma: investing his 1 billion VND carries risk, but placing it in a 12-24 month savings deposit means he would lose interest if an ideal apartment appears sooner than expected and he needs to withdraw the funds. With iDepo, if a good opportunity arises, he can transfer his savings without losing accrued interest. For example, after 10 months, if Tuan needs to transfer his 1 billion VND iDepo to buy an apartment, he would receive his principal along with nearly 50 million VND in interest for those 10 months.

Thu Ha and Hai Nam from TP HCM have 2 billion VND accumulated for their daughter's education and healthcare, with plans for her to study abroad in three years. They face the challenge of finding a good investment channel while managing unpredictable costs like unexpected medical expenses or additional courses. Thu Ha noted that with a single 12-36 month savings account, any partial withdrawal would require closing the entire account and losing interest. Dividing the money into multiple small accounts for different terms complicates management and maturity tracking, still risking interest loss if one account needs to be closed early. "We need a solution that allows our money to grow without being locked up, something we can withdraw or transfer when needed without losing interest," Ha said. If Thu Ha and her husband only need a portion of their iDepo funds for unforeseen expenses, they can transfer just the required amount, then consider redepositing the remainder to maintain its earning potential.

Phuc, 65, a retiree, has 500 million VND saved. For seniors, capital preservation is a priority, and he avoids risky investments. However, unexpected medical costs or financial support for his children could arise. Phuc noted that a 12-month savings deposit at 5,5% per year could yield over 27 million VND in interest, but needing 50-100 million VND unexpectedly before maturity would force an early withdrawal, resulting in only non-term interest. "I don't want to burden my children. This money is for my retirement, and I've been hesitant to put it into savings because I'd regret losing the interest if I had to withdraw it suddenly due to illness," Phuc explained. To ensure flexibility, he could divide his funds into iDepo denominations of 50 million, 100 million, or 200 million VND. This way, he can transfer individual amounts as needed while retaining accrued interest on the remaining portions.

All steps, from opening an iDepo account to tracking interest and making transfers, are managed through the MyVIB application. Customers do not need to visit a branch, handle physical passbooks, or wait. This new deposit model requires reasonable financial planning to optimize capital flow, but customers retain full control over their choices.

Hoang Dan