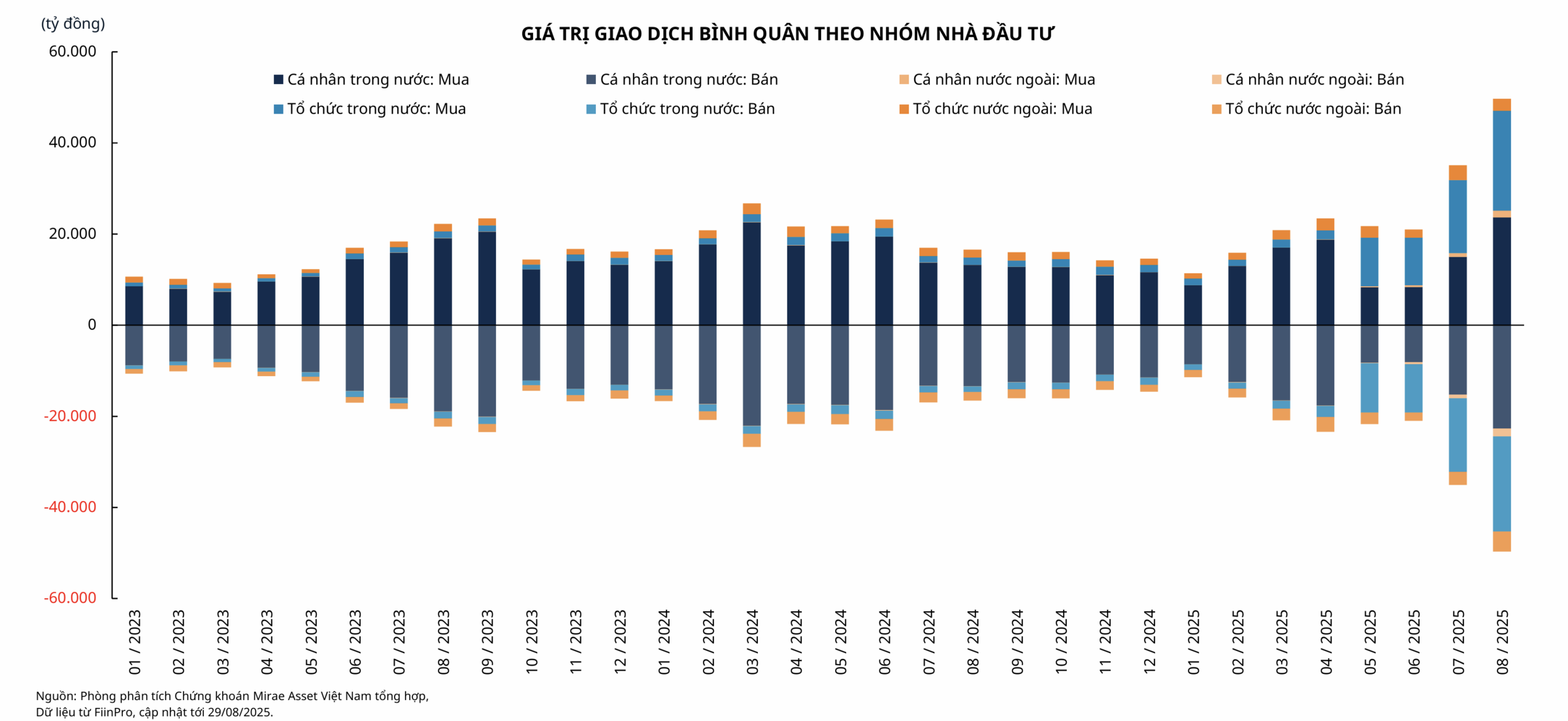

In a recent strategy report, Mirae Asset Securities (Vietnam) (MASVN), citing data from financial platform FiinPro, revealed that domestic institutional investors are increasingly dominating market liquidity. Their average trading value has surged from 6-10% in 2023-2024 to 40-50% in the last 4 months.

In the stock market, domestic institutional investors include commercial banks, finance companies, insurance firms, securities companies, and investment fund managers. These institutions typically command substantial capital, hold significant stock portfolios, and are managed by experienced professionals. They are often referred to as the "sharks" of the market.

|

Domestic institutional investors account for 40-50% of average liquidity in the past 4 months. Photo: MASVN |

Domestic institutional investors account for 40-50% of average liquidity in the past 4 months. Photo: MASVN

Dinh Minh Tri, Director of Retail Client Analysis at MASVN, told VnExpress that the strong buying momentum from domestic institutions propelled the VN-Index from 1,300 points in June to 1,700 in September, even as foreign investors net sold over 3 billion USD (over 80,000 trillion VND).

This buying focused on large-cap stocks, boosting the VN30 index and supporting the VN-Index despite external pressures. With market upgrade expectations on the horizon, Tri believes this presents an opportunity for domestic institutions to accelerate their investments.

Bui Quang Huy, Director of Research and Investment at FIDT, an investment advisory and asset management firm, stated that domestic institutional investors are trading over 15,000 trillion VND per session, a record high. In Quarter III, institutions net bought over 20,000 trillion VND, while individual investors traded at a balanced level, yet the stock market maintained a steady growth of 5-7% quarterly. This reflects the leading role of institutions, with individuals shifting from "wave makers" to "riding the current."

Institutional capital isn't spread thin but is concentrated in banking and real estate. Large-cap state-owned and commercial banks are favored due to their stable profits, consistent return on equity (ROE) of 18-20%, and positive credit growth expectations for the second half of the year.

Simultaneously, institutional capital seeks real estate companies with extensive land banks, sound finances, and direct benefits from the public investment cycle, rather than chasing low-liquidity speculative stocks.

Huy explained that the macroeconomic foundation and business results create conditions for this capital flow to exert its influence, leading to increased investment in large-cap stocks.

With first-half GDP growth at 6.5% and listed companies’ profits up 15-18%, coupled with interest rates remaining low compared to the 5-year average, experts see the current investment positions of domestic institutions as a strategic, forward-looking move.

Institutions bring significant capital, improving the quality of cash flow and market liquidity stability. Two-way trading from mutual funds, exchange-traded funds (ETFs), insurance companies, and proprietary trading desks of securities companies helps maintain market equilibrium, reduces volatility, and facilitates faster recovery from corrections.

"Domestic institutional capital serves as a support, a leading pillar, creating a solid foundation for market growth," Huy commented.

Dinh Minh Tri added that the uptrend from 2021-2022 was driven by speculative retail investors with a fear of missing out (FOMO) mentality, resulting in high volatility.

Currently, institutional capital dominates, focusing on large-cap stocks with strong fundamentals. This stabilizes the market, evident in price fluctuations or corrections that are primarily technical rather than extreme sell-offs. The VN30-Index outperforming the VN-Index shows that capital flows favor blue-chip stocks.

Another positive change is the stable liquidity provided by "sharks," shielding the market from shocks similar to the previous FOMO period.

|

Investors monitor the electronic board at a securities company in Ho Chi Minh City. Photo: Quynh Tran |

Investors monitor the electronic board at a securities company in Ho Chi Minh City. Photo: Quynh Tran

The leadership of financial institutions also differentiates overall market valuation. According to FIDT data, the VN-Index price-to-earnings (P/E) ratio is around 14-15 times, significantly lower than the 20+ times in 2021-2022. This reflects reasonable prices and lower risk compared to the FOMO phase. In 2021-2022, retail investors sometimes disregarded company fundamentals, leading to sharp price increases even in penny stocks.

"The strong participation of domestic institutions has transformed the market from a 'playground of rumors' to a 'sustainable, fundamentally-driven flow'," the Director of Research and Investment at FIDT assessed.

According to data from the Vietnam Securities Depository (VSDC), Quarter II/2022 saw over 1.17 million new individual accounts – a record increase. The pace of new account openings slowed in 2024-2025, averaging around 400,000-600,000 accounts per quarter. This reflects natural selection as the market increasingly demands discipline and knowledge from investors.

In reality, many retail investors are still experiencing losses, yet to "break even" despite the market's strong growth. Meanwhile, institutional performance is improving, with many investment funds achieving double-digit growth.

According to statistics from fund trading platform Fmarket, many equity mutual funds have achieved high performance, with some cases increasing by 50% after nearly 4 months since the tariff event. Specifically, Dragon Capital's DCDS recovered over 60.7%. Other mutual funds like Bao Viet Fund's BVFED, Mirae Asset Global Investments' MAGEF, and VinaCapital's VOEF also increased by over 58.7%, 55%, and 53.1% respectively during this period.

Looking long-term, Bui Quang Huy believes the growing presence of institutions compels individuals to upgrade their investment mindset and tools. Short-term profits based on rumors or speculative narratives are dwindling. Individual investors seeking sustained returns need to learn how to track signals from institutional capital flows, like ETFs or mutual funds, and combine this with fundamental analysis. Adaptable individuals will capitalize on the overall upward trend, while those clinging to short-term speculation based on rumors will face increasing difficulty.

Tat Dat