Nguyen Viet Cuong, Vice Chairman of Kafi's Board of Directors, stated that the increased charter capital will allow Kafi to expand its scale, invest in technology, and develop products and services. With the new capital, the company plans to expand its core businesses, such as margin lending and securities services, aiming for 350,000 accounts by the end of this year. In the first 8 months of the year, Kafi's margin lending activities increased by 100% compared to the same period in 2024, reaching 10,000 billion VND. As of Quarter II/2025, Kafi is among the top 10 securities companies with the largest asset size.

|

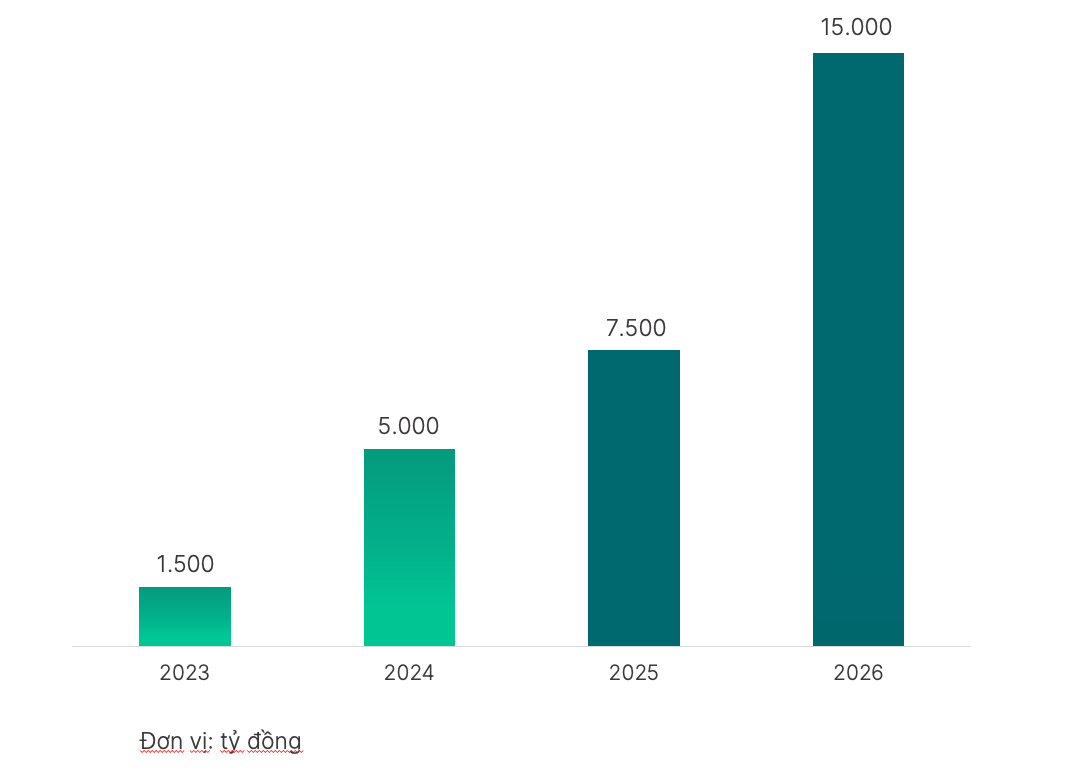

Kafi's capital growth rate from 2023, projected to 2026. Source: *Kafi* |

Kafi plans to list its shares on the UpCOM exchange in Quarter IV/2025 to increase transparency, enhance prestige, and gain wider access to both domestic and international investors. The company also aims to increase its charter capital to 15,000 billion VND and reach 1.5 million accounts by the end of 2026.

Starting in September, Kafi plans to launch a bond trading program and unveil a new version of its application and website with an improved interface and features, making the investment process more convenient. Promotional programs for trading and margin lending rates will also continue to be implemented to optimize costs and improve profitability for investors.

|

The company's headquarters are located in Ho Chi Minh City. Photo: *Kafi* |

Kafi Securities Joint Stock Company was established in 2016. In 2024, the company received the "Fast Enterprise Award - Asia's Fastest Growing Companies" from the Asia Pacific Enterprise Awards. At the end of 2024, the company announced the completion of its charter capital increase to 5,000 billion VND.

See details here

Thai Anh