Since late July, the Vietnamese stock market has rebounded strongly, exceeding its 2022 peak and currently hovering around 1,600 points. However, many stocks have not recovered to their previous highs. According to statistics from the open-end fund distribution platform Fmarket, as of the end of July, nearly 1,140 stocks, representing about 70% of the total traded stocks, were more than 10% below their peak values.

The VN30, a basket of 30 stocks accounting for about 80% of market capitalization and 60% of trading value, also saw a significant number of stocks that have not returned to their early 2022 levels. Comparing the list of stocks in this basket in 2022 and now, 13 stocks have not recovered to their prices of 3 years ago. These stocks are mainly in the real estate and manufacturing sectors.

Among them, NVL of Novaland has the lowest performance, with its closing price on 12/8 only about 22% of its peak value. Following closely is PDR of Phat Dat, with a current price at about 39% of its former peak. The list also includes MSN, SAB, PLX, VRE, POW, KDH, VNM, SSB, GVR, TPB, and GAS.

While the stock market is performing well, not all stocks have benefited or recovered to their previous peaks. Dinh Kien Vuong, a research and analysis specialist at Thanh Cong Fund Management Company (TCAM), explained that many businesses are performing worse than in the past, so even though the market is rising, investors "are still hesitant to invest in these stocks".

Furthermore, in the past, many stocks experienced "artificial increases" due to market manipulation. With increasingly stringent regulations and stricter control over price manipulation, it will be difficult for many stocks to return to their previous prices.

Nguyen Minh Hanh, Director of the Analysis Center at Saigon-Hanoi Securities (SHS), added that the difference in the nature of the market between 2022 and now is another reason why many stocks have not recovered.

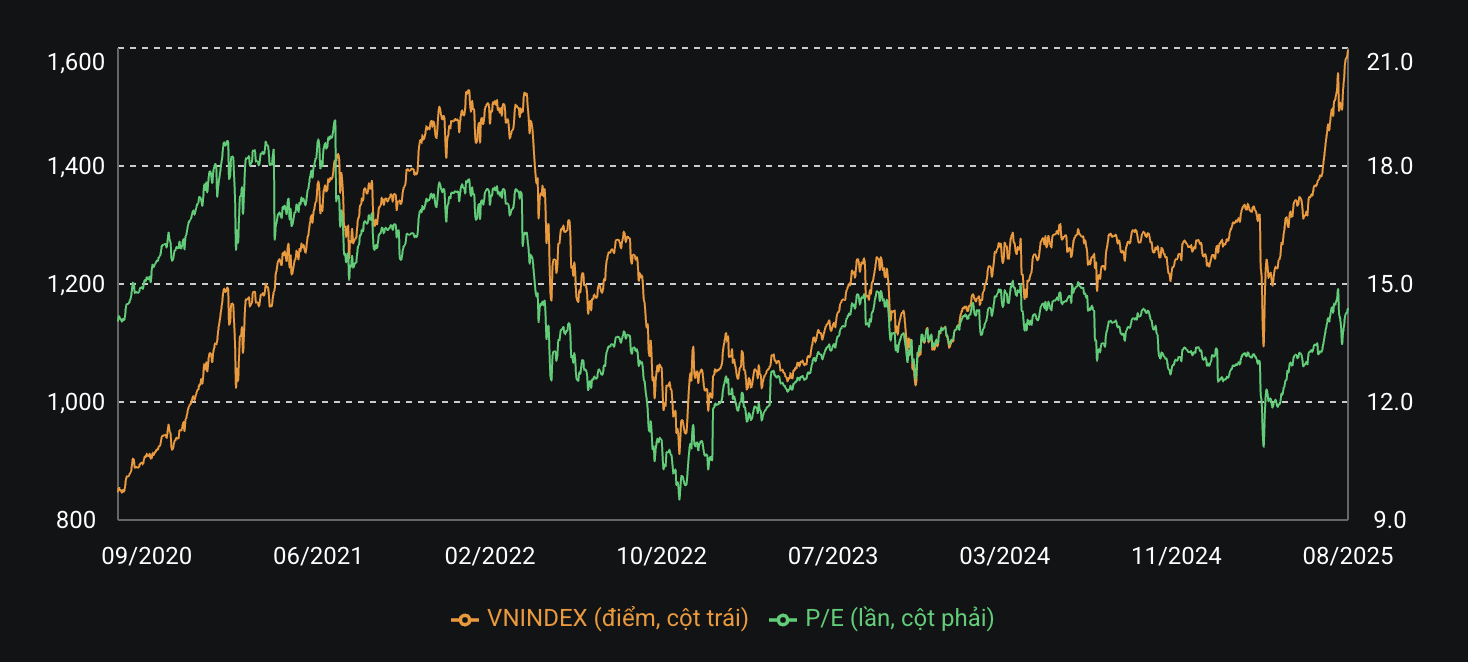

In 2022, the stock market surged after the Covid-19 pandemic, fueled by idle cash accumulated during lockdowns and cheap capital globally (low interest rates). This flow of money was primarily speculative, concentrating heavily on real estate and financial services - securities. This pushed the market to a high valuation, with a price-to-book ratio (P/B) of 2.8 and a price-to-earnings ratio (P/E) of 19 when the VN-Index was around 1,500 points, despite the economy being heavily affected by the pandemic, with many sectors almost paralyzed.

When the era of cheap money ended, the market quickly declined. The previously leading sectors, such as real estate and securities, mostly returned to their low prices from 2 years prior. Conversely, sectors with solid foundations, like banking, maintained growth and good price levels.

Currently, the driving force behind the market's rise comes from attractive valuations and capital rotation from other investment channels, such as savings deposits with decreasing interest rates, and gold and cryptocurrency markets, which had previously experienced rapid growth. In addition, investor anticipation of positive economic prospects and a market upgrade is also contributing to the inflow of capital.

Therefore, although many stocks are still catching up to the new price levels, SHS experts believe that the market has many positive factors (stable internal strength and potential external forces), creating a more solid foundation compared to 3 years ago.

|

Investors are watching the market board at a securities company in Ho Chi Minh City. Photo: Quynh Tran |

Investors are watching the market board at a securities company in Ho Chi Minh City. Photo: Quynh Tran

Conversely, 21 stocks have recovered, with more than half belonging to the banking sector. LPB of LPBank has the best performance, with its current price more than three times its previous level. This sector also includes representatives such as MBB, HDB, STB, TCB, TCG, and ACB.

The expert from TCAM explained that the demand for credit capital depends heavily on banks. When the corporate bond channel is not well-developed, banking becomes a "non-cyclical" sector with high annual profits and growth. Consequently, their book value also increases, creating attractive valuations for stocks and attracting investment flows.

Another reason is that stocks in manufacturing sectors have not seen outstanding growth. In the VN30 basket, only a few manufacturing companies stand out, such as HPG, MSN, and SAB, but their scale and profit growth are modest compared to the banking sector. This makes bank stocks perceived as having higher investment opportunities.

Overall, the fact that many stocks have not surpassed their historical peaks also helps keep the stock market's valuation from becoming too high. According to data from SSI Securities, the VN-Index is currently trading at a forward P/E of about 12.6, lower than the regional average of 15 for Thailand and 13 for Indonesia. This figure is also below the 5-year average.

This development, combined with expectations of a continued uptrend, abundant liquidity, and the potential for a market upgrade, leads securities companies to believe that the current price range remains attractive to investors.

|

VN-Index valuation based on P/E over the past 5 years. Photo: VnDirect |

VN-Index valuation based on P/E over the past 5 years. Photo: VnDirect

However, the SHS expert cautioned that the fact that many stocks have not surpassed their previous peaks does not mean they all have strong growth potential. There are cases where stocks have not reached their peaks due to a weakening business cycle, internal difficulties within the company, or an industry that is not benefiting in the current context.

Nguyen Minh Hanh believes that in the second half of the year, when the market tends to be more speculative, growth stocks are often preferred over those with poor performance or weak prospects. Therefore, while opportunities remain abundant, investors need to carefully select companies with strong profit growth, a clear investment story, and sectors that benefit from macroeconomic trends and cash flow.

"Stocks that haven't reached their peak can still offer opportunities, but not all of them. Investors should rely on fundamental analysis and the specific prospects of each company to determine a reasonable entry point, rather than relying on general market index expectations," the expert emphasized.

Tat Dat