MBV Bank has designed its app not only for basic needs like money transfers, savings deposits, and bill payments, but also as a personalized financial platform. The app boasts a minimalist interface, user-friendly for all ages, and provides an intuitive, easy-to-navigate experience, demonstrating a user-centric design philosophy from the outset.

|

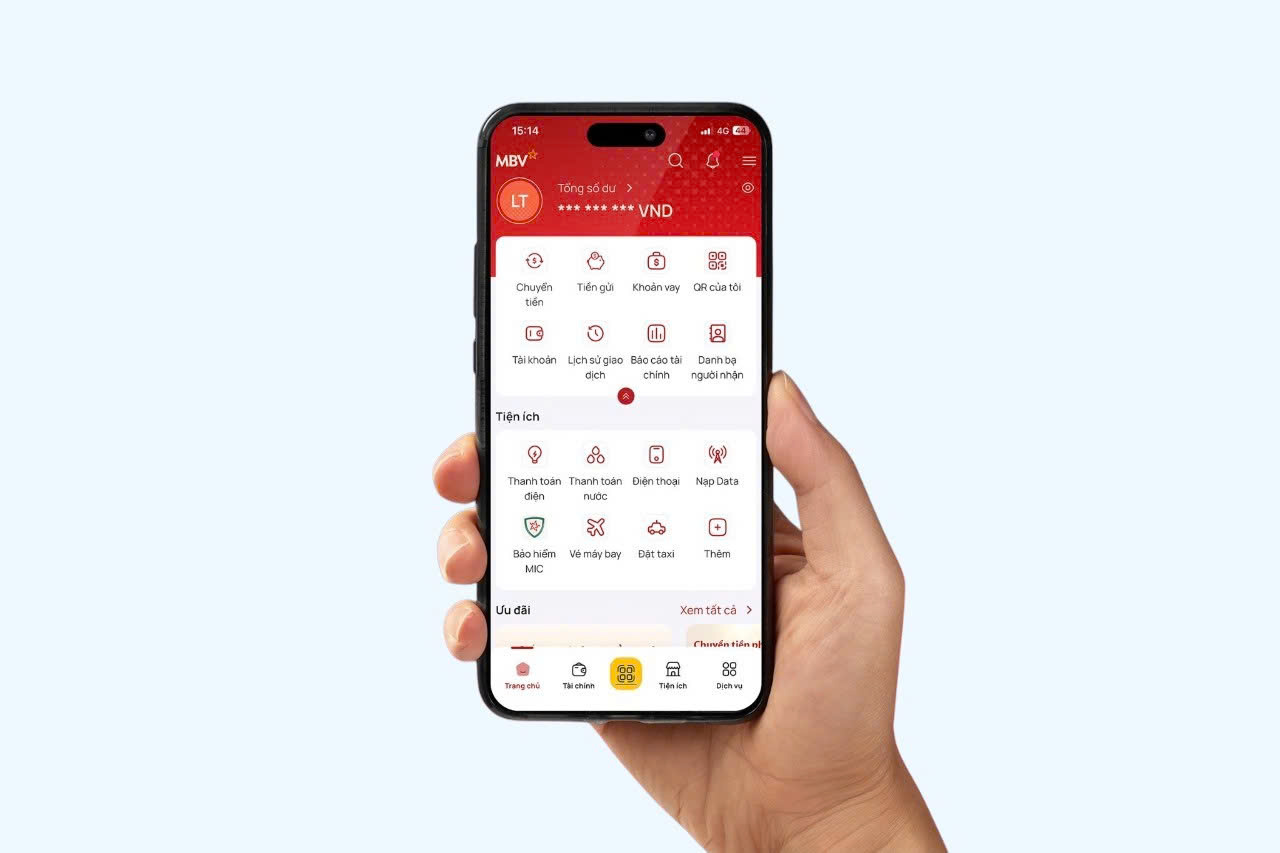

App interface. Photo: MBV |

Features like goal-oriented savings and automatic cash flow categorization based on spending behavior are built on actual user feedback. MBV Bank is defined as a "personalized financial assistant," empowering customers to manage their finances more effectively and proactively.

MBV Bank has partnered with Epay Services JSC (a cashless payment gateway provider) and Digi Invest JSC (Digi - a savings and investment platform) to offer a comprehensive ecosystem of utilities. Through Epay, the MBV Bank app integrates modern digital payment solutions such as QR code scanning, POS, and highly secure international cards, enabling fast and safe transactions.

With Digi, the bank allows users to register, trade open-ended fund certificates, and manage their investment portfolios online. Customers within the Digi network can also access MBV Bank’s traditional banking products, services, and digital utilities.

A bank representative stated these strategic partnerships enhance the user experience and reflect the bank's focus on building a modern, multi-utility bank. The app also meets both financial and investment needs.

The app offers several incentives during its initial launch phase. New account holders receive a premium account number worth 300 million VND and an additional account matching their phone number until 31/12.

Additionally, MBV Bank is giving away tote bags (1/9-31/12 or while supplies last) and a MIC insurance package with coverage up to 150 million VND.

|

The MBV Bank app offers a range of features tailored to customers' actual behavior. Photo: MBV |

According to a bank representative, the MBV Bank app goes beyond personal finance utilities like savings, payments, and expense management. It reflects the bank's long-term strategic direction. Entering today's digital transformation race, the bank views app development not just as a technology project but as a transformation in organization and operation.

In the digital age, developing a banking app is crucial for competing for customer experience. Many banks outsource app development to shorten implementation time. However, this approach risks creating products lacking customization, dependent on the provider, and slow to respond to market needs.

To maintain control over improvements, MBV Bank developed its app entirely in-house. The bank challenged itself to create a smooth, user-friendly app reflecting users' lives, needs, and habits.

At MBV Bank, the entire technology, product, operations, and marketing teams united to develop the new platform. Each employee became a link in the innovation chain, acting as both a tester and an "auditor" for the user experience, detecting bugs and suggesting improvements early on. The bank established a well-trained internal team of engineers working alongside business departments to develop the product from the ground up.

The philosophy of "understanding the customer from within" was applied throughout, turning the technology project into a testament to the user-centric strategy.

By listening to real feedback and continuously improving, MBV Bank affirms its goal of redefining digital transformation, a bank representative said. "The MBV Bank app is not just a transaction tool, but a platform inspiring a future of personalized, convenient, and sustainable personal finance," the representative added.

Hoang Dan