This statement follows the Ministry's proposal to levy a 20% tax on the difference between the purchase and sale prices of real estate for each transaction, as outlined in the draft of the revised Personal Income Tax Law.

The Ministry acknowledges that implementing this 20% tax on capital gains requires a suitable roadmap. This is to ensure consistency with the development of related policies (land, housing) and the readiness of databases and IT infrastructure for land and real estate registration and transfer.

"This will provide tax authorities with sufficient information and legal basis related to real estate transactions to collect the correct amount of tax," the Ministry stated.

|

Eastern Ho Chi Minh City real estate with apartment, townhouse, and land projects, 2/2025. Photo: Quynh Tran |

Experts agree that effective implementation of the 20% capital gains tax hinges on a complete IT infrastructure and land database. For instance, the government needs a transparent real estate market data system, integrating administrative procedures related to pricing and transactions (notarization, taxes, etc.) on an electronic platform. Stronger penalties are also needed to address cases of misreported transaction values.

Income from real estate transfers is a significant source of personal income tax revenue. Since 2015, following amendments to the Personal Income Tax Law, a uniform rate of 2% on the transfer price of real estate has been applied.

The Ministry explains that the 20% tax on profit proposal was developed after receiving feedback emphasizing the need for regulations that reflect the true nature of economic transactions.

Compared to the current 2% tax on the transfer price, the Ministry calculates that the 20% tax on income will result in a similar tax level. In cases with smaller price differences, no profit, or losses, the 20% tax on income would be more beneficial for individuals.

Experts believe that taxing real estate profits clearly aims to regulate speculation and "flipping," factors contributing to recent price surges.

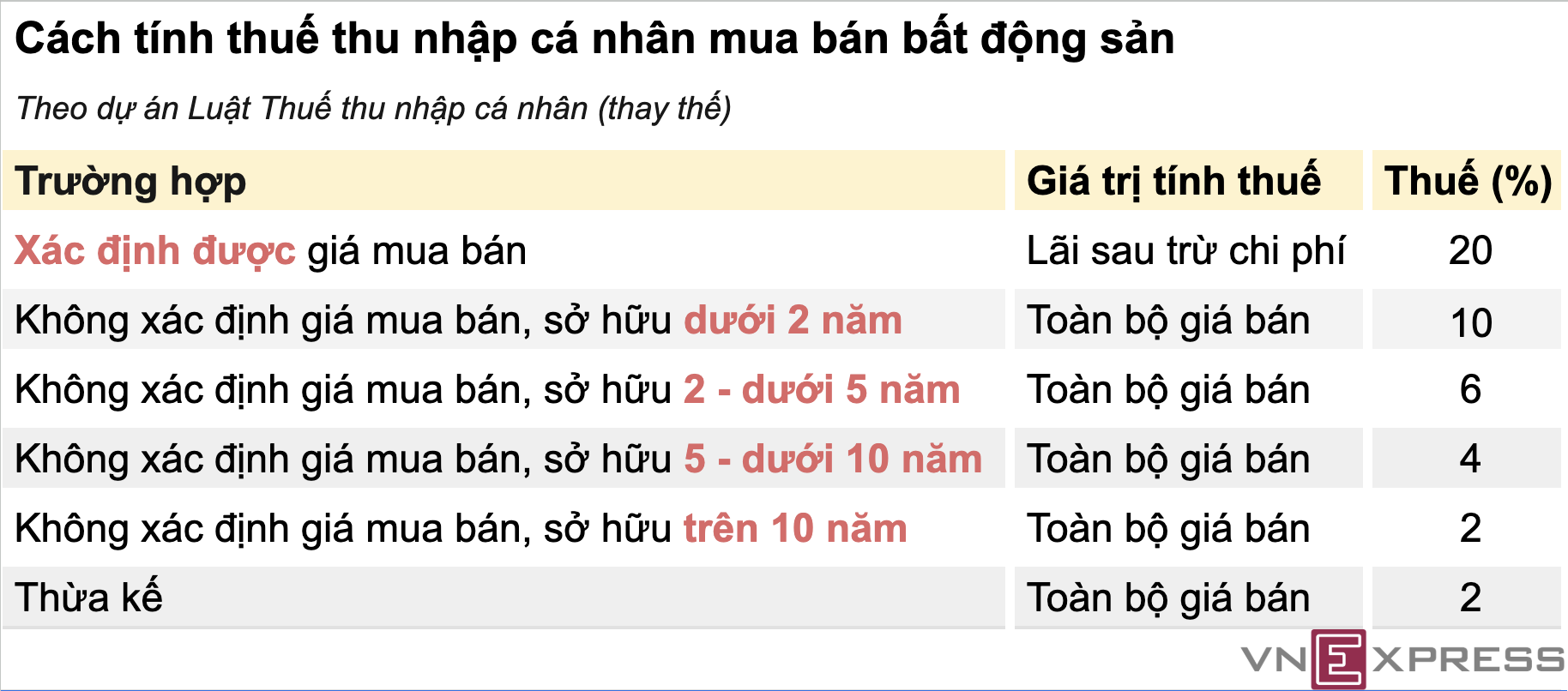

In addition to the 20% profit tax, the draft law also proposes a tax rate based on the holding period to curb speculation. If the purchase price and related costs cannot be determined, the tax will be based on the selling price and ownership duration, with rates ranging from 2% to 10%.

|

Personal income tax calculation methods for real estate transactions in the Ministry of Finance's draft Personal Income Tax Law. Illustration: Anh Tu |

According to the Ministry of Finance, other countries use personal income tax tools to increase the cost and reduce the appeal of real estate speculation. Some countries apply taxes to profits from transactions based on the frequency and duration of real estate resales.

The Ministry is currently seeking feedback on the draft law from ministries, localities, organizations, and individuals. They will continue to consult with countries with similar conditions to develop suitable proposals for Vietnam before submitting them to higher authorities for decision.

Phuong Dung