A VIB representative stated that the "Most Innovative AI Application in Digital Banking 2025" award is a testament to the bank's customer-centric vision. VIB has invested significantly in core technologies, big data, cloud infrastructure, and especially generative AI.

As users increasingly expect convenience, intelligence, and proactivity, MyVIB has emerged as a personalized, user-friendly, and reliable digital financial platform.

"This technology award demonstrates our commitment to always putting customers first, making every financial experience efficient and inspiring," the VIB representative said.

|

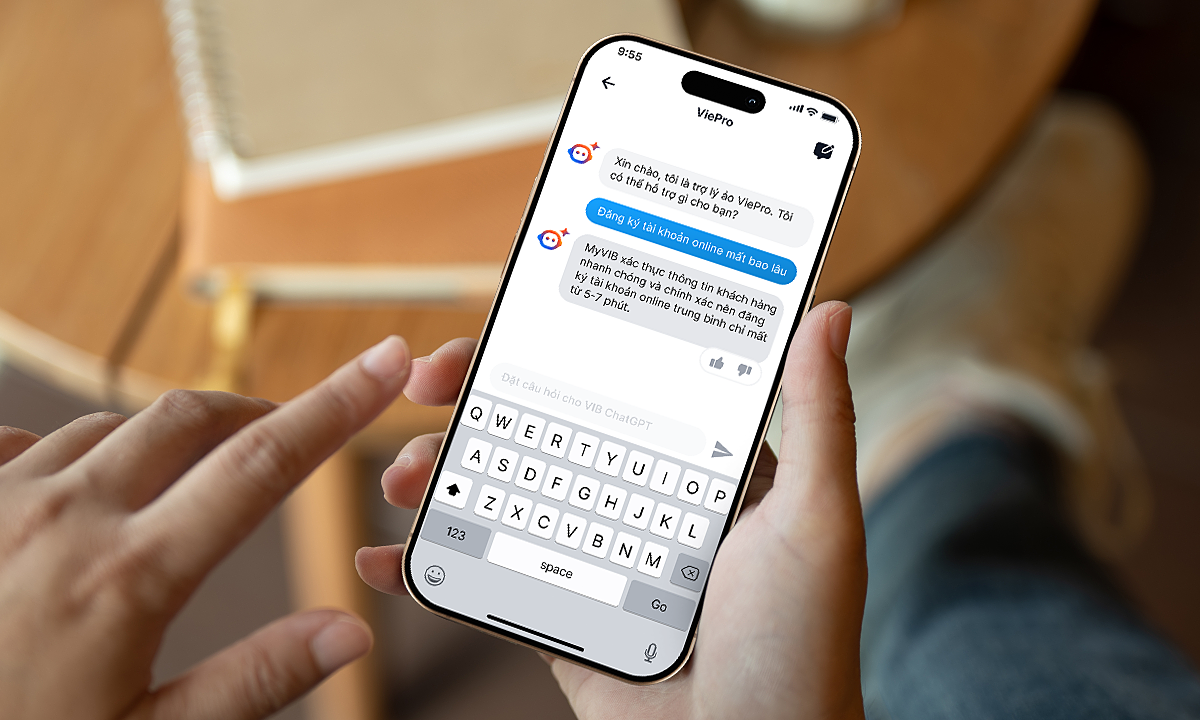

The bank uses AI to support customers. Photo: VIB |

The bank uses AI to support customers. Photo: VIB

Central to VIB's technological innovation journey is the implementation of the virtual assistant, ViePro. The bank provides this 24/7 virtual assistant to millions of customers. ViePro can respond accurately and instantly in Vietnamese to a wide range of topics related to banking products and services. This virtual assistant is built on Amazon Web Services (AWS), a leading global cloud computing platform.

By integrating the Claude 3 Haiku language model through Amazon Bedrock, VIB can customize data stored on AWS to develop applications that align with its business goals, such as personalized financial services.

The bank also uses Amazon SageMaker, a fully managed machine learning service, to enhance operational efficiency and provide personalized recommendations. Suggestions such as spending limits or promotional programs are tailored to each customer.

According to the VIB representative, these platforms will further develop ViePro into an intelligent financial advisor. This advisor will help customers manage their personal finances more effectively with services such as: calculating loan eligibility and managing expenses based on customer profiles.

The representative added that MyVIB is not merely a mobile banking application, but a personalized digital financial ecosystem where all financial needs are met, adapting to each customer's behavior. This is the result of the methodical technology strategy that the bank has consistently pursued for many years. VIB is also among the first organizations in Vietnam to comprehensively implement cloud computing, leverage big data, and develop AI models to personalize the customer experience.

Based on this technology, MyVIB offers a range of intelligent features that help users actively and efficiently manage their finances every day. Customers can track their cash flow through intuitive reports, make transfers, and conduct super-fast payments 24/7, securely and seamlessly. MyVIB also offers utilities such as voice transaction notifications, automatic reminders for bills, and flexible support for various modern payment methods.

The app integrates a variety of essential services: investment, insurance, tuition payment, flight and hotel booking, movie tickets, and stock trading. All operations are simplified, allowing users to proactively handle their daily financial needs within a single application.

|

Users enjoy many benefits on MyVIB. Photo: VIB |

Users enjoy many benefits on MyVIB. Photo: VIB

Another highlight is personalization. Users can customize the interface, set spending limits, and arrange functions according to their habits and needs. This experience is both convenient and demonstrates understanding, where the bank accompanies each step of the customer's financial journey.

Through MyVIB, users can also experience the Super Interest Rate account, a product that helps idle cash earn daily interest with rates up to 4.3% per year. The entire process, from tracking returns to transactions, is transparent, easy to use, and secure, with just a few taps on the app.

From now until the end of July, MyVIB users have the chance to win an iPhone 16 Pro Max when paying bills from two different services each month, such as electricity, water, or internet. This is part of a campaign to promote beneficial spending habits and the use of smart digital banking.

The bank representative stated that when the bank addresses the most needs in each person's financial life, every transaction becomes easy, reliable, and meaningful. "That is the journey MyVIB is steadfastly pursuing," the representative said.

This award not only recognizes the bank’s technological advancements but also demonstrates VIB's aspiration to build a modern and accessible digital bank where AI optimizes the experience, understands, and connects with each customer.

Hoang Dan

Readers can experience the most innovative AI-powered digital banking of 2025 here.