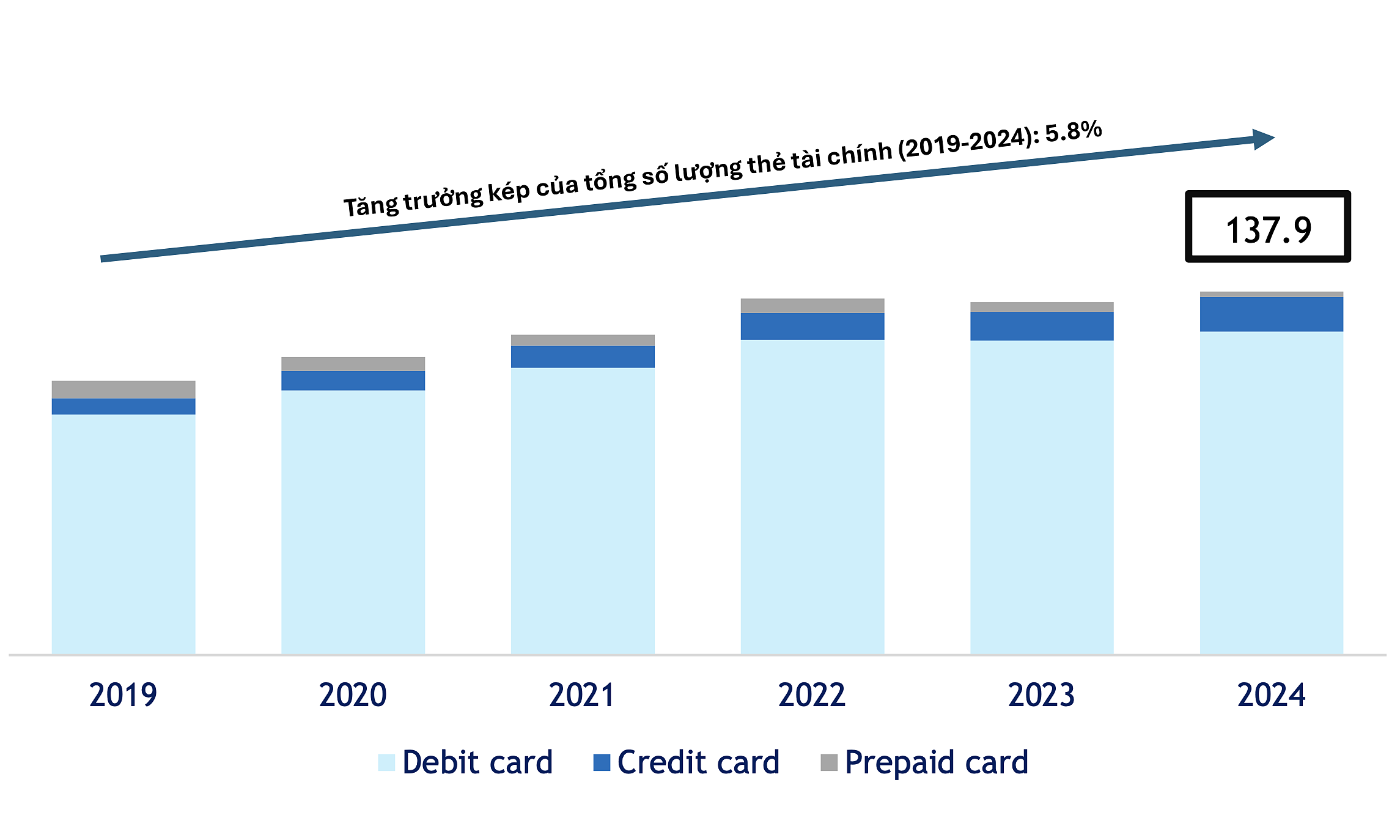

A recent report by FiinGroup shows that the total number of financial cards in circulation in Vietnam, including credit cards, debit cards, and prepaid cards, reached nearly 138 million by the end of last year. The compound annual growth rate (CAGR) from 2019 to 2024 was 5.8%.

This data was compiled from 39 commercial banks that are members of the Vietnam Banks Association (VNBA) and 4 financial companies (FinCos) issuing credit cards: FE Credit, Home Credit, JACCs, and VietCredit.

|

Financial card market structure by type of card in circulation (unit: million cards). Graphics: FiinGroup |

Financial card market structure by type of card in circulation (unit: million cards). Graphics: FiinGroup

Debit cards continue to dominate with nearly 89% of the market share, equivalent to about 122.7 million cards. However, growth has slowed, with a CAGR of 6.1% per year from 2019 to 2024, indicating that the period of rapid expansion has passed.

Meanwhile, FiinGroup assesses that credit cards have made a breakthrough with a CAGR of 19.1% per year, increasing their market share to over 8%, equivalent to more than 11 million cards. This reflects the increasing demand for flexible spending, promotional offers, and easier access to credit for young people.

Conversely, prepaid cards have almost disappeared from the market with an average annual decline of 21.2%. The reason is that the need for small top-ups and payments has been replaced by e-wallets and banking apps.

According to Pham Trung Thanh, head of the report analysis team at FiinGroup's Market Research and Consulting Department, the total number of cards continues to grow, with debit cards remaining the market's foundation. However, the new growth driver comes from credit cards, which directly benefit from increased consumption and the demand for flexible spending. In parallel, buy now, pay later (BNPL) services have also emerged as a supplementary product, contributing to the expansion of consumer credit channels, especially in the context of strong retail and e-commerce development.

The differentiation between the two groups became even more pronounced in 2024. Credit cards saw a 19% increase in quantity thanks to online marketing campaigns, cashback offers, and increasingly flexible issuance conditions. In contrast, debit cards only saw a slight increase of 2.9%, reflecting their shrinking role, mainly serving withdrawals and e-wallet top-ups rather than direct payments.

"This development puts credit cards at the center of the market, while debit cards face fierce competition from electronic payment solutions and the spreading BNPL trend among young people," added Thanh.

|

Some credit cards on the market. Photo: Tat Dat |

Some credit cards on the market. Photo: Tat Dat

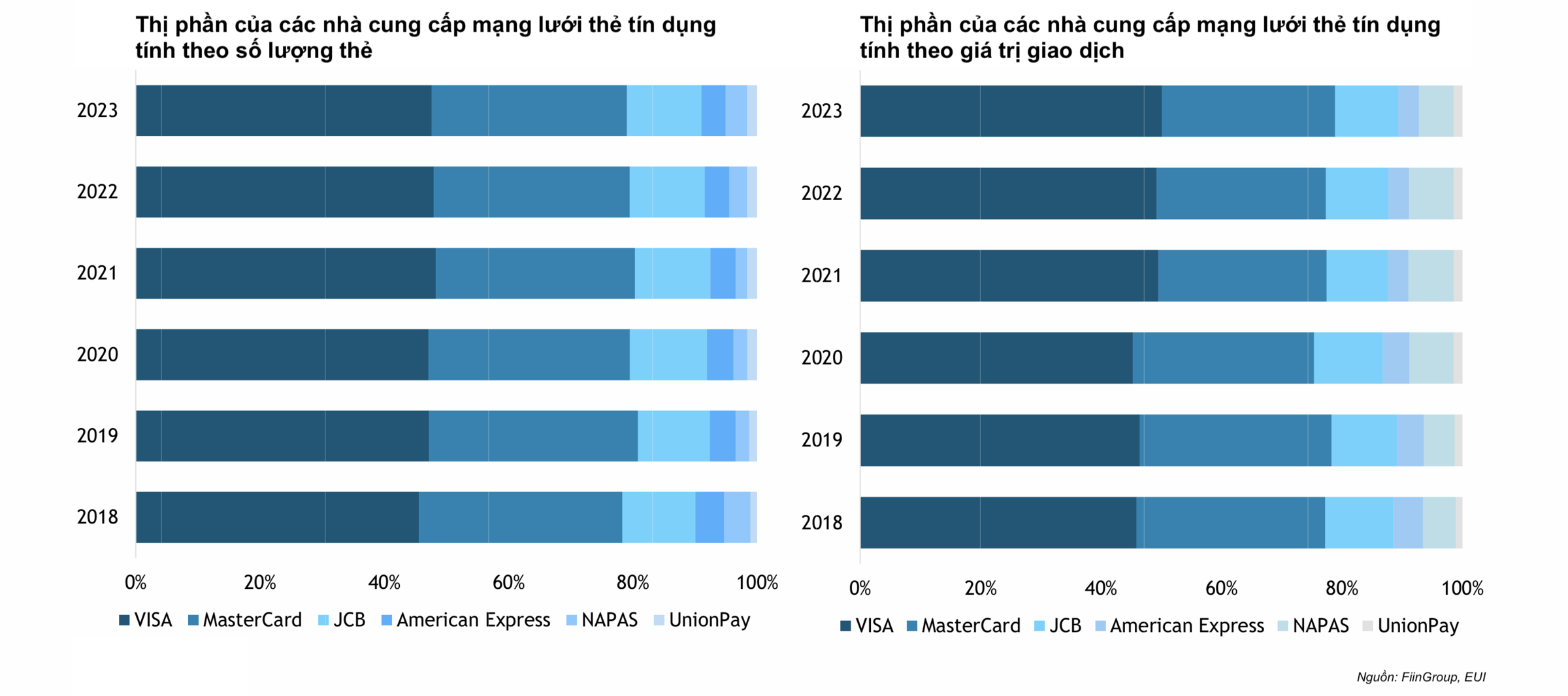

FiinGroup's report also states that the card market in Vietnam is witnessing increasingly fierce competition between international and domestic networks.

Visa (USA) currently dominates with over 65% market share thanks to its e-wallet integration capabilities and dominance in e-commerce. However, competitive pressure from domestic rivals and fee sensitivity are challenging Visa to maintain its advantage.

MasterCard (USA) holds nearly 25% of the market, leveraging promotional programs and extensive partnerships with banks, but still needs to find ways to increase coverage in provinces and cities outside major urban areas – where Visa has already established a strong foothold.

In the smaller group, JCB (Japan), with 6.8% market share, is taking advantage of competitive fees and an expanding acceptance network, but lacks appeal in the high-end segment.

UnionPay (China) holds 2.3%, benefiting from cross-border transactions with China and the tourism recovery, but faces limitations in acceptance outside city centers.

American Express (USA) accounts for less than 1% and remains loyal to the high-end customer segment, but high fees and a limited network hinder its growth potential.

|

International payment networks hold the majority of the credit card market share. Graphics: FiinGroup |

International payment networks hold the majority of the credit card market share. Graphics: FiinGroup

Meanwhile, the domestic card group and smaller networks are almost negligible, mainly hampered by scale and technological investment requirements. In 2023, for every 10 credit card transactions, about 8 were made using Visa and MasterCard. The domestic network NAPAS holds a very small share in this area.

However, Pham Trung Thanh believes that with a young population, constantly improving income, and the boom in e-commerce, the Vietnamese market still has much room for growth. In the context of rapidly changing consumer behavior and digital payments, domestic credit cards, with low fees and increasingly competitive features, are emerging as a "potential piece" that could challenge the dominance of international brands.

Tat Dat