Nvidia is deploying its substantial cash reserves through a series of strategic investments and share buybacks, with a major focus on the burgeoning artificial intelligence (AI) sector. This week, the company announced plans to spend 2 billion USD to acquire a stake in chip design firm Synopsys. This follows previous announcements this year, including plans to buy 1 billion USD in Nokia shares, invest 5 billion USD in Intel, and 10 billion USD in Anthropic. These four deals alone total 18 billion USD, excluding smaller venture capital investments.

The chipmaker’s investment strategy extends further, with a significant 100 billion USD commitment to acquire a stake in OpenAI over the next three years. This commitment, initially announced in 9/2024, is still pending a formal agreement between the two parties, as confirmed by Nvidia Chief Financial Officer Colette Kress at a technology conference on 2/12/2024.

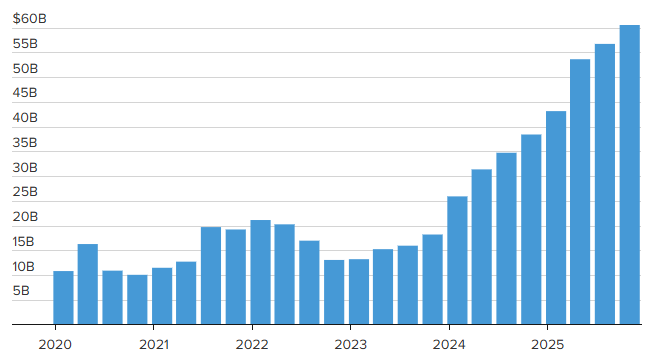

Nvidia possesses ample resources to fund these ventures. By the end of 10/2024, the company held 60,6 billion USD in cash and short-term investments. This figure marks a sharp increase from 13,3 billion USD in 1/2023, a period immediately following OpenAI's launch of ChatGPT. This event proved to be a turning point for Nvidia, which quickly solidified its position as the dominant player in the global AI chip industry.

|

Nvidia's cash and short-term investments from 2020-2025 (Unit: billion USD). *Chart: CNBC, Nvidia* |

As the world's largest company by market capitalization, currently valued at 4,460 billion USD, Nvidia's balance sheet is robust. The question for investors, however, is how the company plans to utilize its massive cash reserves. When asked about this at last month's earnings event, Nvidia CEO Jensen Huang stated, "No company has grown at this scale."

Beyond direct investments, Nvidia is also engaging in significant share buybacks. A survey by data firm FactSet indicates that analysts predict the company's free cash flow will reach 96,85 billion USD this year and 576 billion USD over the next three years. This projection has led some to expect Nvidia to allocate more capital to share repurchases. Ben Reitzes, an analyst at Melius Research, noted that the chipmaker has "plenty of cash" for such initiatives.

In 8/2024, Nvidia's board of directors increased its share buyback authorization by 60 billion USD. The company spent 37 billion USD on share repurchases and dividends in the first three quarters of the year. Huang affirmed this ongoing strategy, stating, "We continue to buy back shares."

Colette Kress highlighted another critical priority for the company: ensuring sufficient cash flow to facilitate the timely delivery of its next-generation products. Nvidia's major suppliers, including equipment manufacturers like Foxconn and Dell, may require the company to provide working capital to manage inventory and expand production capacity.

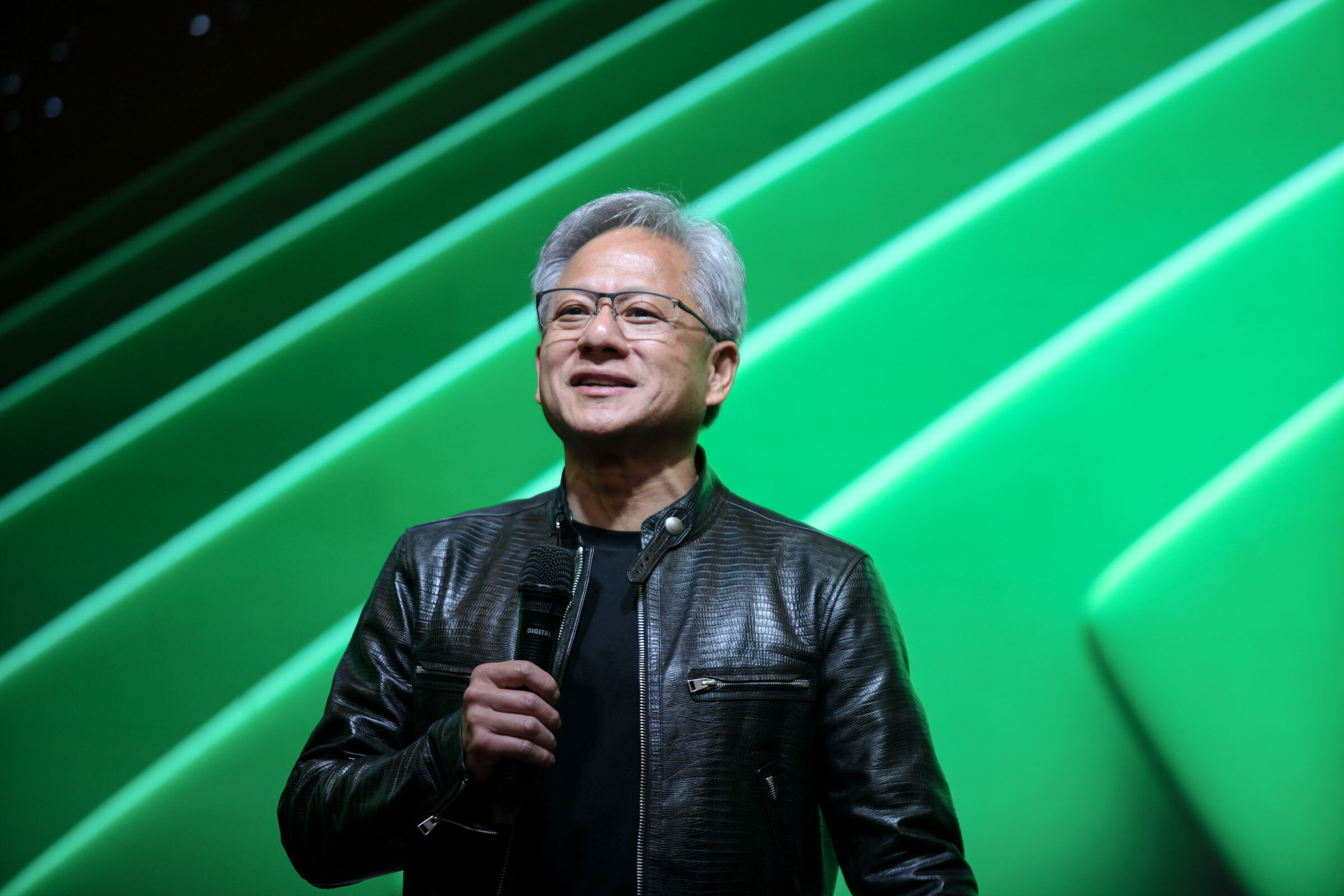

|

Nvidia CEO Jensen Huang at Computex 2024 in Taiwan in 6/2024. *Photo: Khuong Nha* |

Huang emphasized the critical nature of these recent strategic investments. He explained that the growth of companies like OpenAI directly fuels demand for AI technologies and, consequently, Nvidia chips. While Nvidia states it does not mandate invested companies to use its products, these companies invariably do.

"The investments we make are to expand the reach of Cuda, the ecosystem," Huang elaborated, referring to the company's proprietary AI software platform.

In an 10/2024 filing, Nvidia disclosed that it had invested 8,2 billion USD in private companies, viewing these investments as analogous to acquisitions.

Nvidia's largest merger and acquisition (M&A) deal to date was the 7 billion USD purchase of Mellanox in 2020. This acquisition proved foundational for the company's current AI product offerings, which include standalone chips and entire server racks with an estimated price of 3 million USD.

However, Nvidia encountered regulatory obstacles in its attempt to acquire Arm for 40 billion USD in 2020. The company canceled the deal after US and UK authorities raised concerns about competition in the chip industry. While Nvidia has acquired several smaller companies over the past few years to expand its engineering team, it has not completed any billion-dollar deals since the Arm agreement collapsed.

"Large-scale M&A deals are difficult to consider. I also hope such a deal emerges, but it's not easy," Kress stated, acknowledging the challenges of significant acquisitions.Ha Thu (according to CNBC, Reuters)