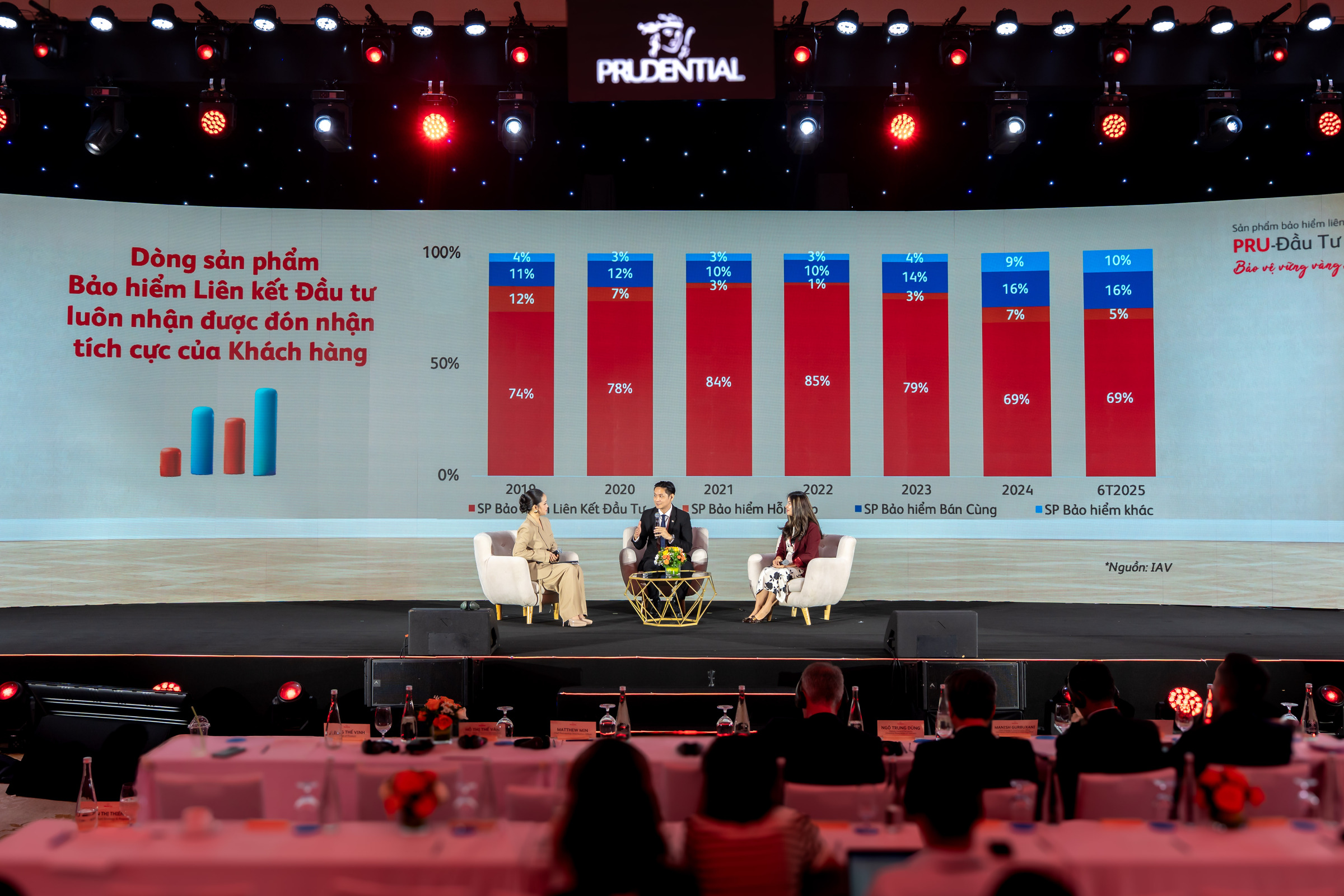

The insurance solution is designed to meet three needs with four core values. In addition to providing peace of mind in the present, the product also serves as a financial legacy for the next generation. According to Prudential Vietnam, "Pru - Dau tu vung tien" is their flagship product this year, meeting new regulations and focusing on the practical needs of customers.

|

A company representative introduces the new product at the launch event on 24/9. Photo: Prudential |

A company representative introduces the new product at the launch event on 24/9. Photo: Prudential

For investments, customers can choose a portfolio that suits their risk appetite through 7 Prulink Funds managed by Eastspring Investments. Eastspring Investments is one of the largest asset management companies in the Vietnamese market, with a team of experienced professionals and a rigorous risk control process. According to the company's report, during the period from 2020 to 2024, despite market fluctuations, unit-linked funds still recorded cumulative growth ranging from 28.2% to 66.2%.

For asset accumulation needs, the product applies a dual bonus mechanism starting from the 10th policy year. The growth bonus can reach up to 300% of the first year's annual basic premium, helping customers increase their investment potential.

Focusing on protection needs, customers are entitled to insurance benefits of up to 110% of the sum assured, plus the contract's account value. Participants can also proactively increase the sum assured at important milestones in their lives without requiring further health assessments.

The product allows the policyholder to transfer the entire accumulated value by assigning the policy to a new insured person, without reapplying the mandatory premium payment period or initial fees. The policyholder can exercise the right to transfer the accumulated value once the current insured reaches the age of 60 or from the 20th policy anniversary, whichever comes later.

|

Mr. Kevin Kwon, CEO of Prudential Vietnam. Photo: Prudential |

Mr. Kevin Kwon, CEO of Prudential Vietnam. Photo: Prudential

Prudential Vietnam expects "Pru - Dau tu vung tien" to be a solution combining optimal protection benefits and a long-term investment strategy, suitable for the modern, transparent, and diverse needs of middle-class Vietnamese customers.

A company representative said the new product provides an additional financial solution to help increase assets and protect families from risks. A key feature of the insurance package is the ability to transfer the accumulated value of the policy to the next generation.

"With 'Pru - Dau tu vung tien', we want to bring customers not only protection and peace of mind in the present, but also a 'sustainable financial legacy' for future generations to continue and develop," the representative said.

According to World Bank statistics, Vietnam's middle class has grown significantly over the past decade and is expected to account for more than 50% of the population by 2035. In parallel, rising incomes are helping them focus not only on basic needs, but also on maintaining their quality of life and preserving and growing their assets over the long term. Goals such as their children's future or peace of mind in retirement become key drivers in financial decisions.

Hoang Dan

Participants should carefully read all the rules and terms of the "Pru - Dau tu vung tien" unit-linked insurance product to fully understand the product, fees, exclusion clauses, as well as their rights and obligations upon participation. Entering into a unit-linked insurance contract is a long-term commitment. Policyholders should carefully consider before canceling the policy in the early stages, as fees can be high during this period.

Investment returns from the insurance policy are not guaranteed. The policyholder will enjoy all investment results and bear all risks arising from the chosen investment fund, corresponding to the premiums allocated to the fund.

Depending on the fund's performance, the buyer may receive profits or incur losses from the investment. Past investment performance is for reference only and does not guarantee future results. The illustrative interest rates of unit-linked funds are not fixed and may change depending on actual investment results.