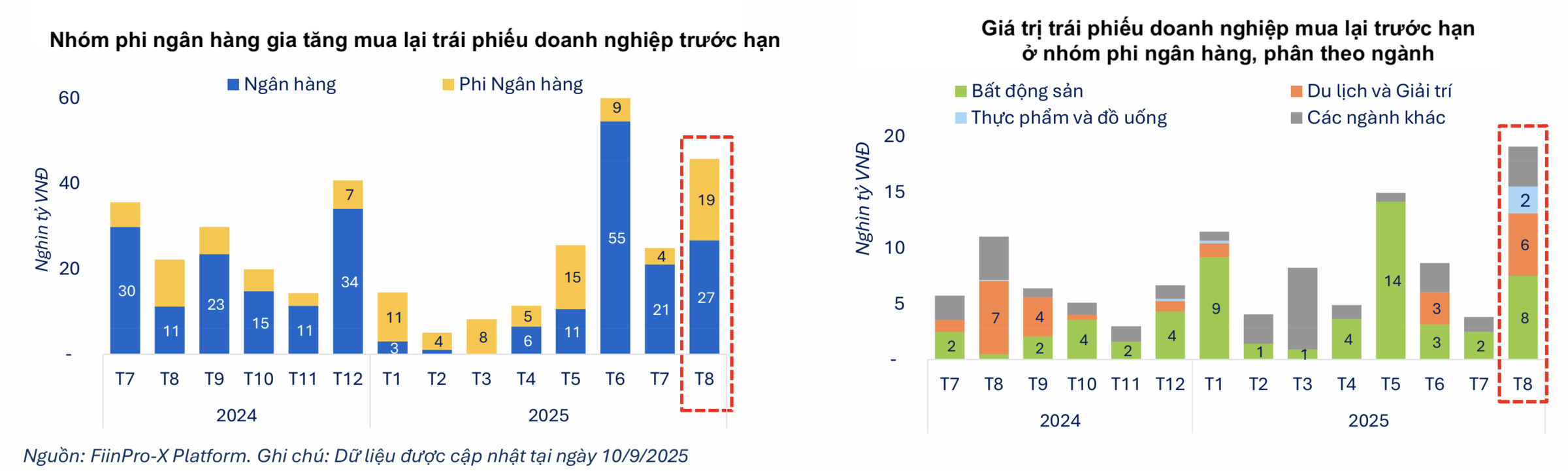

A recent report by FiinGroup shows that in August, the value of corporate bonds repurchased ahead of schedule reached 45,800 billion VND, up 84% compared to the previous month and double the figure from August 2024. This marks the second-highest monthly value this year, only behind June.

In previous peak periods, banks led the wave of early bond repurchases. In June, they accounted for 86% of the total value. However, in August, non-banking institutions saw a surge, repurchasing approximately 19,000 billion VND worth of bonds, nearly 5 times the amount in July and the highest level so far this year.

Real estate companies accounted for 7,500 billion VND of this, three times the amount in July. Notable repurchases came from Phu Long (2,000 billion VND), Luxury Living (1,600 billion VND), and Hoang Truong (1,400 billion VND).

In the first 8 months of the year, real estate companies have repurchased over 42,500 billion VND in bonds, a 47% increase compared to the same period last year. Novaland leads with 6,700 billion VND. The tourism and entertainment sector also saw significant repurchases totaling nearly 6,600 billion VND, primarily from Ba Na Hills Cable Car (3,100 billion VND) and Hung Thinh Quy Nhon (2,500 billion VND).

|

Real estate businesses are actively buying back bonds early. Graphics: FiinGroup |

Real estate businesses are actively buying back bonds early. Graphics: FiinGroup

While banks repurchase bonds early to manage their balance sheets and ensure capital safety, a VnExpress survey suggests that many real estate companies are doing so not necessarily because their financial health has recovered.

Some companies choose to issue new bonds to repay old debts to reduce interest burdens and late payment penalties. This allows them to extend repayment deadlines, converting short-term liabilities into longer-term obligations. If they can issue new bonds at lower interest rates than their existing debt, they can significantly reduce interest expenses.

Besides proactive repurchases, many companies are forced into early buybacks. Some are obligated to do so because the value of the collateral has fallen below the level stipulated in the bond agreements. Others face mandatory repurchases due to multiple missed interest payments. For this group, such moves can strain cash flow, particularly given the still-fragile financial state of many companies, potentially impacting their ability to execute and deliver projects in the future.

|

Staff counting money at a bank's transaction office in Hanoi. Photo: Giang Huy |

Staff counting money at a bank's transaction office in Hanoi. Photo: Giang Huy

FiinGroup’s report also indicates that bond repayment pressure will ease considerably in the final months of the year. Data updated to 16/9 shows that companies have paid a total of 166,900 billion VND in principal and interest on bonds since the beginning of the year, equivalent to 64% of the cash flow due for all of 2025. In October, the expected cash flow due is only about 21,700 billion VND, much lower than in previous peak months.

For real estate, about 6,800 billion VND worth of bonds are due in October, a 22% decrease compared to September. Some companies with large bond maturities in October include Vinhomes (3,500 billion VND), Phu My Hung (1,900 billion VND), and The Ky Real Estate (650 billion VND).

Over the last 4 months of the year, the principal due for the real estate sector is about 30,000 billion VND. In the first half of 2026, these companies are projected to need another 57,700 billion VND to repay bond debts. These figures suggest that while financial pressure has eased, it remains a burden for real estate businesses.

Tat Dat