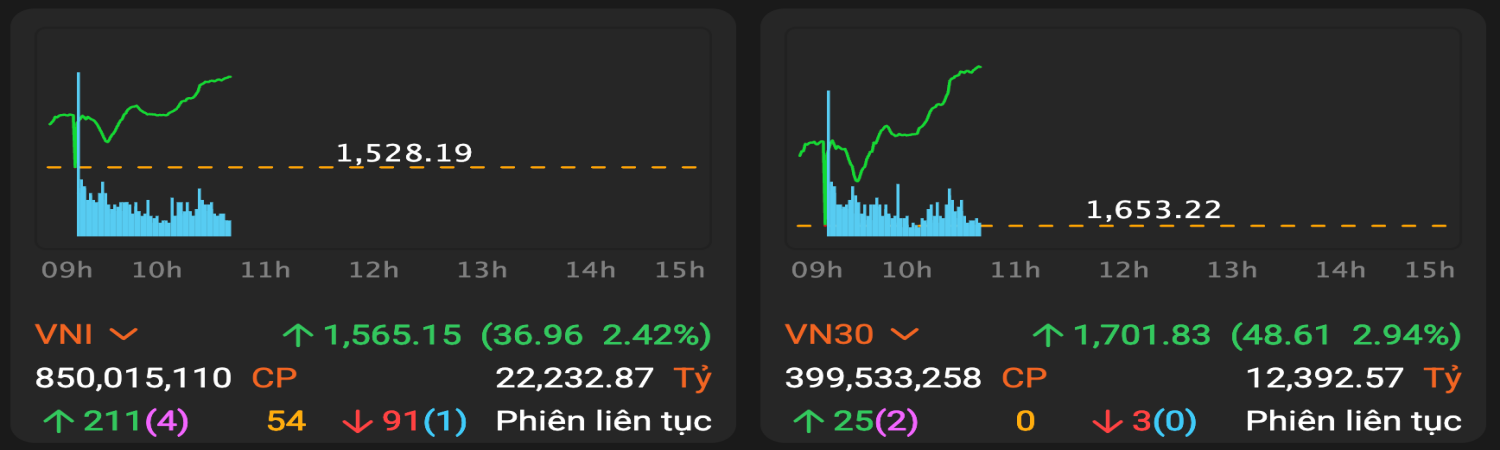

Driven by enthusiastic individual investors, the VN-Index opened strong and continued to climb. At 10:40 (a.m.), the index surpassed 1,565 points, the peak reached just a week ago. The VN30, representing large-cap stocks, also hit a record high, surging nearly 48 points to 1,701.

Thirty minutes later, the Ho Chi Minh City Stock Exchange's benchmark index jumped to 1,570 points, while the VN30 neared 1,712. This surge defied the predictions of many securities companies.

Prior to today's session, most analysts anticipated a continued uptrend for the VN-Index, but expected it to fluctuate around 1,550-1,560 points, followed by periods of volatility.

|

VN-Index and VN30 charts at 10:40 a.m. on 5/8 as they surpassed previous records. Screenshot |

VN-Index and VN30 charts at 10:40 a.m. on 5/8 as they surpassed previous records. Screenshot

Vingroup stocks led the market this morning. VIC hit its ceiling price of 118,900 VND, contributing nearly 7 points to the VN-Index. VHM was the second-largest positive contributor, rising 5.3% to 97,100 VND. VRE and VPL also traded higher, but with smaller gains.

Banking stocks also played a significant role in the market's ascent. MBB and TPB both hit their ceiling prices, with no sellers. Leading stocks like VCB, BID, and CTG rose between 1.8% and 3.3%.

Positive momentum was evident in other sectors such as real estate, securities, and airlines. As a result, the Ho Chi Minh City Stock Exchange saw over 221 stocks advance, double the number of declining stocks. In the large-cap basket, 27 stocks traded above their reference prices, with only BCM and SAB bucking the trend.

Nearly 1.2 billion shares were traded, equivalent to 32,270 billion VND. Four of the six stocks with trillion-VND liquidity in the morning session were banks: TCB, MBB, TPB, and SHB. The other two in the top ranking were HPG and SSI.

Amidst the domestic investors' enthusiasm, foreign investors were net sellers. This group invested approximately 2,500 billion VND but withdrew around 2,900 billion VND.

According to some securities companies, while the VN-Index is continuing its upward trajectory, the number of advancing stocks is not as high as during the previous peak. Therefore, this might not be the ideal time for new short-term investments.

"Despite the market's positive signals, investors should remain cautious, balancing holding strong positions and selectively seeking new opportunities," advised analysts from Vietcombank Securities.

Phuong Dong