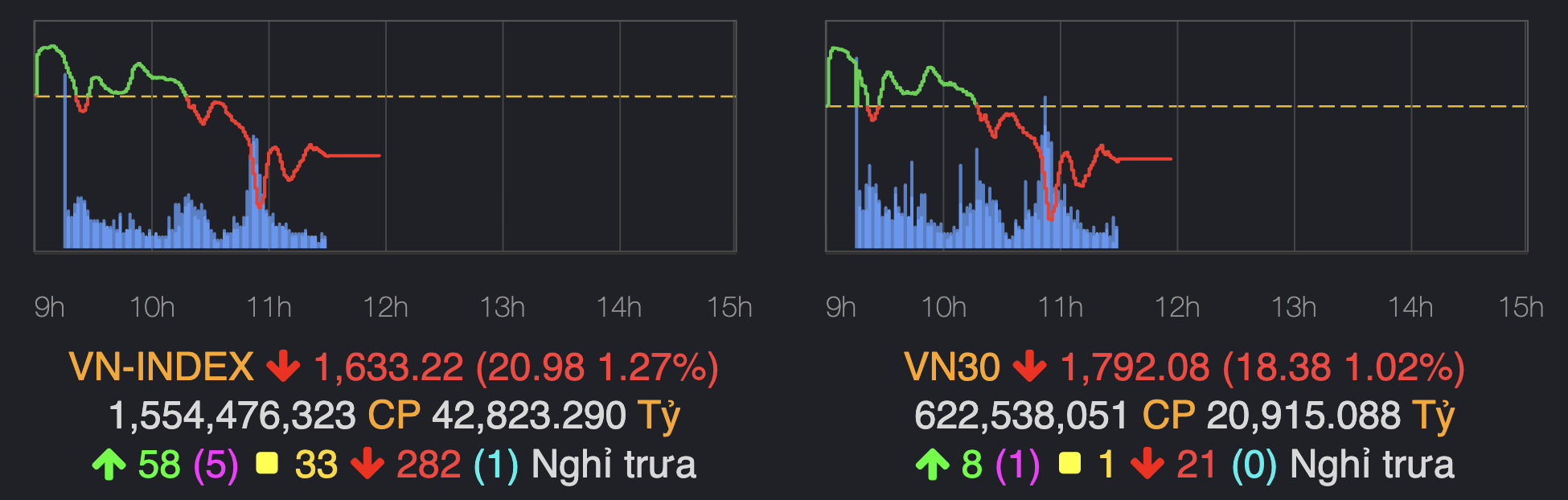

The Ho Chi Minh City Stock Exchange opened higher this morning, at one point gaining over 10 points to surpass 1,665. However, the early enthusiasm was short-lived as widespread profit-taking emerged. Selling pressure engulfed the market, pushing the VN-Index down nearly 40 points before recovering slightly to close the morning session with a 21-point loss at 1,633.

The surge in selling propelled trading volume to 1.55 billion shares, equivalent to over 42,800 billion VND. This matched the entire day's trading value from the beginning of the week.

|

VN-Index and VN30 at the end of the morning session on 20/8. Screenshot. |

Trading volume in the VN30 basket reached 20,900 billion VND this morning. SHB led with over 2,000 billion VND, followed by eight other stocks with trading values exceeding 1,000 billion VND, including HPG, VPB, MBB, SSI, and TCB.

Over 280 stocks on the Ho Chi Minh City Stock Exchange closed the morning session lower, five times the number of gainers. The decline was widespread among large-cap stocks, with 21 falling compared to only eight rising.

Securities stocks faced the heaviest selling pressure, with most falling over 3%. Blue-chip stocks like SSI, VIX, VND, HCM, and VCI lost between 3.5% and 5%.

Steel stocks followed a similar pattern, with all components trading lower. HPG dropped 2.5%, while HSG and NKG fell 4.1% and 4.7% respectively.

Bank stocks showed significant divergence. Recently surging stocks like EIB, TPB, ACB, MBB, and SHB all corrected by over 3%. Large-cap stocks such as VCB, BID, STB, and VPB lost between 0.5% and 2%. VIB bucked the trend, hitting its ceiling at 21,900 VND, while OCB also briefly touched its ceiling at 13,650 VND.

In the real estate sector, small-cap stocks like HDC, CII, HDG, and PDR experienced heavy selling, leading to corrections of 6% or more. Mid-cap stocks such as NLG and KDH declined by 3% to 5%. Vingroup stocks acted as a support for the sector, remaining in positive territory with gains ranging from 0.2% to 2.7%.

Foreign investors continued their selling streak this morning, with 3,760 billion VND in purchases against 4,600 billion VND in sales, resulting in a net withdrawal of approximately 900 billion VND. This marks the 10th consecutive session of heavy selling by foreign investors.

According to Yuanta Securities, despite today's correction, the short-term trend remains upward. However, given the increasing short-term risks, investors should limit new purchases and prioritize reducing margin leverage.

Phuong Dong